Taxation of Investment Income for Nonresident Alien F-1/J-1 International Students

These are my notes on the tax treatment of investment income for Nonresident Alien F-1/J-1 students and scholars. They are meant as a personal reference, and are not very polished. I decided to publish it for advanced tax-filers (i.e. Nonresident Alien international students with substantial investment activity) who are seeking additional sources from the IRS Publications.

For a more approachable guide on how to declare investment income, please see the Nonresident Alien with U.S.-Source Income tax guide.

Introduction

Investment income consists of dividends, interest, and capital gains. As a nonresident alien, the taxation of investment income is defined entirely in IRS Publication 519. In order to determine the tax treatment of investment income, three considerations have to be made:

- Where is the investment income sourced?

- Is the investment income considered effectively connected income?

- How is the investment income taxed?

Determining the tax treatment of investment income

This section will present a treatment of the above questions, from the perspective of an international student or scholar who is a Nonresident Alien. Resident Aliens are subject to the same tax rules as U.S. citizens, hence this article does not apply to them.

Where is the investment income sourced?

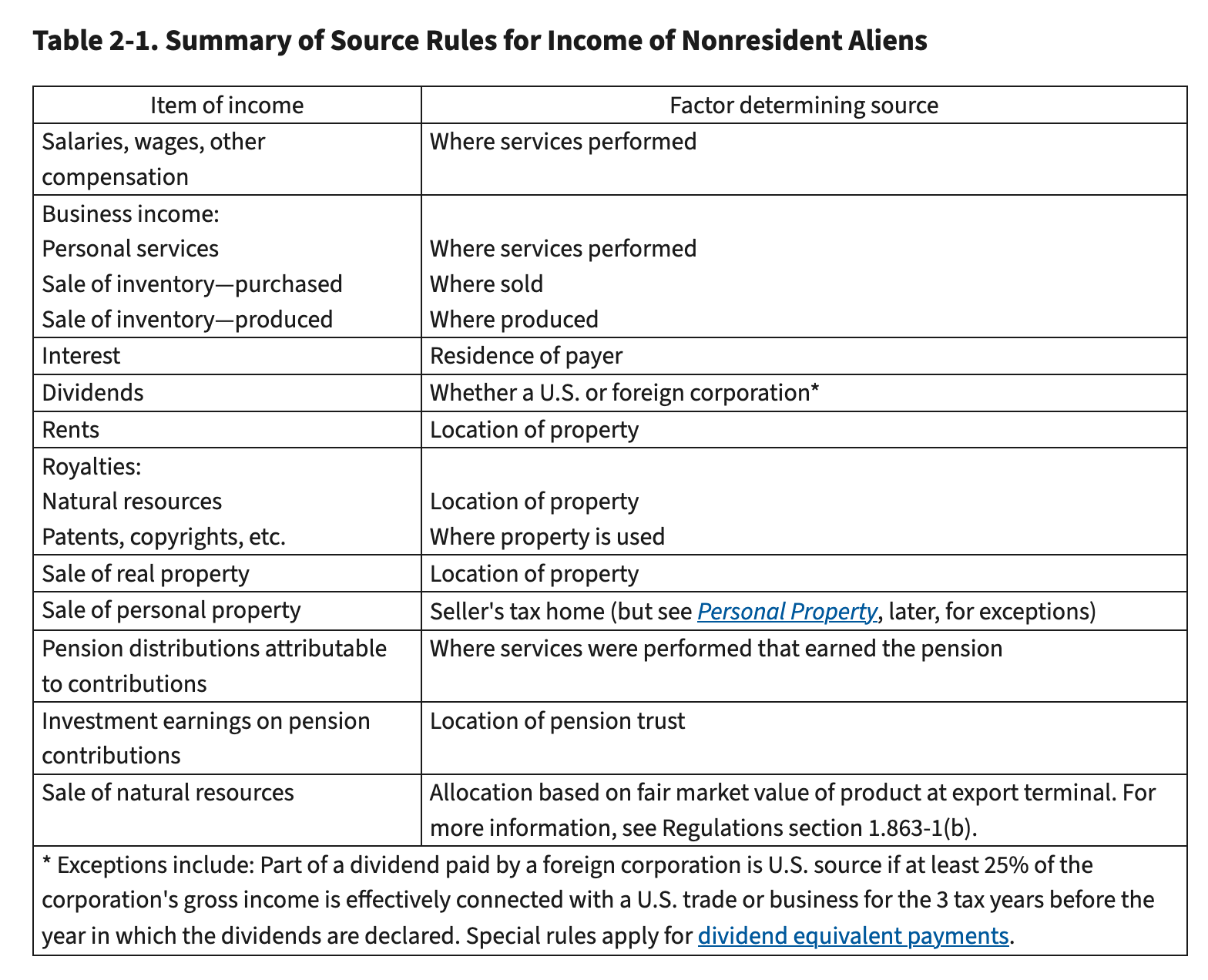

Nonresident aliens are only taxed on U.S. source income. Hence, the first step in determining tax treatment of investment, is to find it's source. The authoritative treatment of income sourcing rules for Nonresident Aliens is found in IRS Publication 519, where:

In essence, IRS Publication 519 states:

- Interest payments are U.S. source, if paid by a U.S. payer (i.e. corporation).

- Dividends are U.S. source, if paid by a U.S. corporation.

However, the treatment for capital gains is more complicated. IRS Publication 519 does not define "U.S. source capital gains." However the IRS article, The taxation of capital gains of nonresident students, scholars and employees of foreign governments, provides additional clarification. Quoting the aforementioned source, with annotations:

Gain or loss from the sale or exchange of personal property generally has its source in the United States if the nonresident has a tax home in the United States. The key factor in determining if an individual is a U.S. resident for purposes of the sourcing of capital gains is whether the individual’s "tax home" has shifted to the United States. If a nonresident does not have a tax home in the United States, then the nonresident’s U.S. source capital gains would be treated as foreign-source and thus nontaxable.

In general, under the "tax home" rules, a person who is away (or who intends to be away) from his tax home for longer than 1 year has shifted tax homes to his new location upon his arrival in that new location. See Chapter 1 of Publication 463, Travel, Entertainment, Gift, and Car Expenses.

Thus, under this rule, most foreign students and scholars and most nonresident employees of foreign governments and of international organizations have shifted tax homes to the United States on the day of their arrival in the United States - unless the particular program or employment which brings them to the United States clearly terminates in less than one year and they have no intention to remain in the United States after the termination of such program or employment.

Thus, the IRS Guidance has the following implications on the income sourcing of capital gains income:

- The source of capital gains income depends solely on the tax home of the individual who obtains the gains.

- The tax home shifts to the United States upon two criteria:

- If the individual is away in the United States for a period of longer than 1 year, or

- If the individual intends to be away in the United States for a period of longer than 1 year.

- Thus, international students and scholars attending programs of study that are longer than one year, are considered to have a tax home in the United States from the day of their arrival in the United States, irrespective of their actual duration of stay.

- Therefore, all capital gains income are considered U.S.-sourced for the majority of international students.

Hence, in summary. In order to determine the source of investment income:

- Interest payments are U.S. source, if paid by a U.S. payer (i.e. corporation).

- Dividends are U.S. source, if paid by a U.S. corporation.

- Capital gains are U.S. source, if the international student is in the United States on a program that lasts longer than one year.

Is the investment income considered effectively connected income?

Once the investment income is determined to be U.S.-source, it is subject to U.S. taxes, as per IRS Publication 519. The income of Nonresident Aliens is taxed differently depending on if the income is "effectively connected."

- Effectively Connected Income (EIC): Taxed at personal income tax levels.

- Not Effectively Connected (NEC) Income: Taxed at NEC-rates.

To quote IRS Publication 519, whether investment income is considered effectively connected income for nonresident aliens is determined by two tests:

- The Asset Use Test: "Under this test, if an item of income is from assets (property) used in, or held for use in, the trade or business in the United States, it is considered effectively connected."

- The Business-Activities Test: "Under this test, if the conduct of the U.S. trade or business was a material factor in producing the income, the income is considered effectively connected."

Therefore, the investment income of international students and scholars (F-1 or J-1 visas) are not considered effectively connected income. Hence, investment income is considered Not Effectively Connected Income.

How is the investment income taxed?

Here, IRS Publication 519, section on The 30% Tax, and the section on Sales or Exchanges of Capital Assets, both of which cover the taxation of NEC Income, becomes authoritative.

Interest and Dividend Income

The IRS classifies both dividend and interest income as Fixed or Determinable Income, and applies a 30% tax rate.

Capital Gains Income

However, the treatment of capital gains is slightly more complicated. The taxation of NEC capital gains income is subject to the 183-day rule for capital gains. As per IRS Publication 519:

183-day rule.

If you were in the United States for 183 days or more during the tax year, your net gain from sales or exchanges of capital assets is taxed at a 30% (or lower treaty) rate. For purposes of the 30% (or lower treaty) rate, net gain is the excess of your capital gains from U.S. sources over your capital losses from U.S. sources. This rule applies even if any of the transactions occurred while you were not in the United States.

...

If you were in the United States for less than 183 days during the tax year, capital gains (other than gains listed earlier) are tax exempt unless they are effectively connected with a trade or business in the United States during your tax year.

Taxation of NEC Investment Income

Hence in summary, for investment income:

- Interest: taxed at a flat 30% tax rate, unless lowered by treaty benefit.

- Dividends: taxed at a flat 30% tax rate, unless lowered by treaty benefit.

- Capital gains:

- Taxed at a flat 30% tax rate, if the international student is present in the U.S. for 183 days or more.

- Tax-exempt, if the international student is present for less than 183 days.

This determination is supported by the conclusion of IRS article, The taxation of capital gains of nonresident students, scholars and employees of foreign governments:

Conclusion

Nonresident students and scholars and nonresident employees of foreign governments and international organizations who, at the time of their arrival in the United States, intend to reside in the United States for longer than 1 year are subject to the 30 percent taxation on their capital gains during any tax year (usually calendar year) in which they are present in the United States for 183 days or more, unless a tax treaty provides for a lesser rate of taxation.

Conclusion

For the overwhelming majority of international students in the United States, investment income in the form of dividends, interest, and capital gains are considered Not Effectively Connected (NEC) income, and are taxed at a 30% tax rate, unless there exists a lower rate per tax treaty. Such investment income must be declared on Form 1040-NR Schedule NEC, and any tax treaty benefits declared on Form 1040-OI.