Start Here: How to File Taxes as an International Student or Scholar

Are you an international student? A visiting researcher or professor? Or perhaps, a PhD student who is well on the their way to completing their studies? Whether you're a Freshman undergrad on your first F-1 visa, or a Postdoc Researcher on a H-1B, you'll need to file your taxes. It is very hard to find high-quality tax guidance online for international students, scholars, and researchers. And our tax situation can be quite different from that of regular U.S. citizens, so a lot of the regular advice doesn't apply for us. I know this first hand, because I am an international student myself. And I decided to create this free guide for all other international students, so that we may have a source of high-quality information.

Introduction

My goal with these guides is to empower you with the information to file your own federal tax returns. Although tax preparation in the United States has a reputation as being terribly difficult, it doesn't have to be. You shouldn't have to pay someone hundreds of dollars to prepare your taxes. And furthermore, most international students are eligible for special tax benefits under international tax treaties. By learning how to file your own tax returns, you'll get to claim these benefits – that your country has negotiated for you on your behalf.

Most international students (F-1, J-1 or M-1 visas) or researchers (J-1, Q-1 visas) are completely exempt from Social Security and Medicare Tax (i.e. FICA taxes). For 2024, the FICA tax rate was 7.65%. If this tax was erroneously withheld on your paycheck, then you can contact your employer for a refund.

I didn't know this when I was an undergrad, so across four years I paid thousands of dollars of FICA taxes, even though I didn't have to. I hope that this guide will help others avoid that pitfall.

Throughout this guide, I will cite relevant sections of the IRS website in order to point you to the correct information. Whenever there is any doubt, or any ambiguity, please refer back to the IRS Publications.

Important Disclaimers

I am not a Certified Public Accountant, or Tax Attorney. I am not qualified to file tax returns on your behalf, and all the content provided in this guide is for informational purposes only. I believe everyone can do their taxes with some patience and research, but if you believe you need professional tax guidance, then you should consult a certified professional. The best way to get tax help is by contacting your University's Tax office, or International Students Office.

This guide is completely independent—no sponsors, no ads, no affiliate links. If you search 'How do I file a 1040-NR as a nonresident alien?' online, most results are just thinly veiled ads from tax software companies or firms offering vague, low-quality advice. That’s not the case here. This guide exists purely to help international students navigate their taxes without any hidden agenda.

My guide covers both simple and complex tax situations

Did you earn a lot of money trading stocks and crypto? Oh no! Investment income is considered "Not Effectively Connected" (NEC) income by the IRS, and is taxed at a punitive rate of 30% for nonresident aliens (i.e. most international students) by default. Unless, of course – your country has a tax treaty with the U.S. that provides a lower rate. My guide does not shy away from complicated tax situations like these, and I will show you how to properly file capital gains tax (on your Form 1040-NR Schedule NEC) and declare a treaty benefit.

I also cover how nonresident aliens can deduct tax-deferred IRA and HSA contributions—topics that are often poorly documented online. If your situation is more complex, this guide will help you navigate it.

But if you don’t have investments, tax-deferred accounts, or anything complicated—don’t worry. I’ve got you covered, too. This guide walks you through filing a simple tax return step by step, so you can do it yourself without paying for expensive tax prep software. Are you ready? Let's get started!

Do you already know that you're a Nonresident Alien? Feel free to skip ahead to the individual guides, if you're just here to get your taxes done.

Guide for Nonresident Alien with U.S.-Source Income

Guide for Nonresident Alien with No U.S.-Source Income

Guide for Resident Aliens

Are you filing taxes on your own for the first time? Then stick around for some important context and details.

Tax Residency

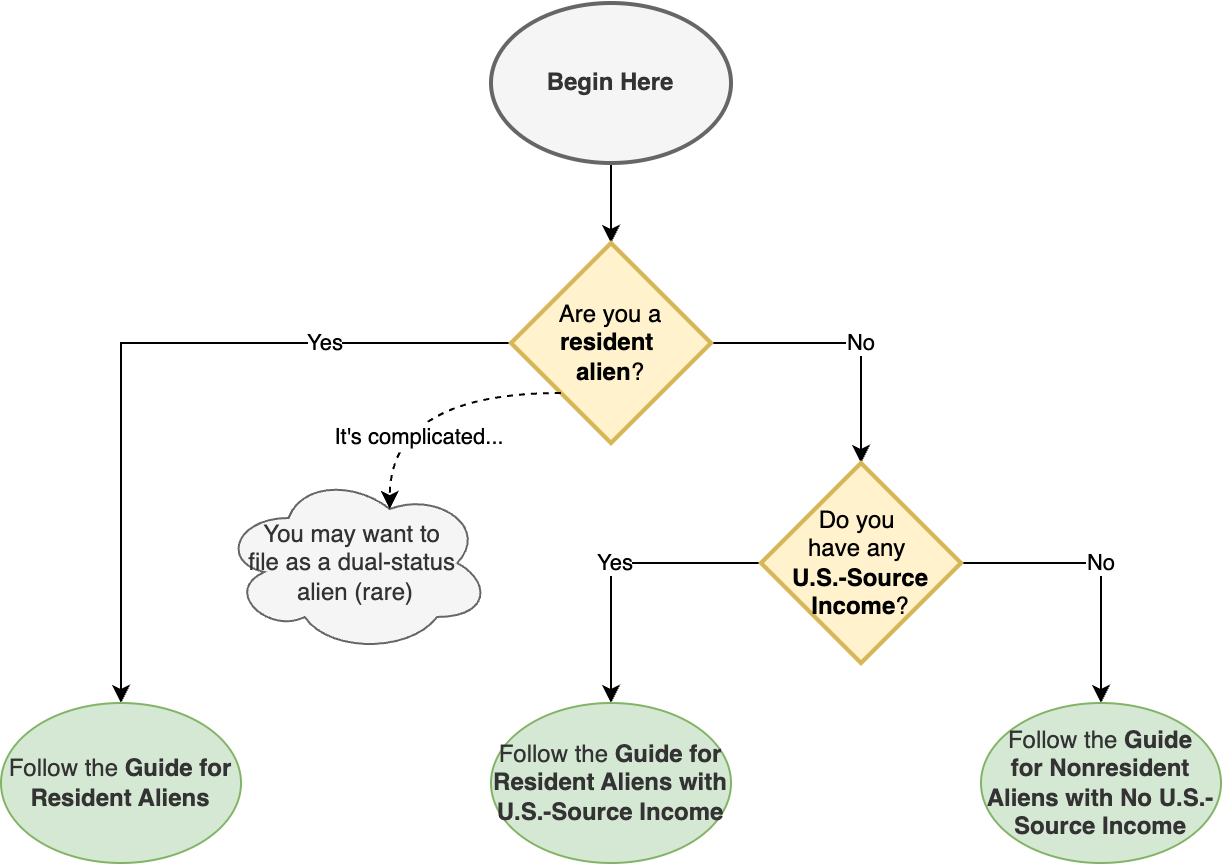

Your tax obligations in the U.S. depend on whether the IRS considers you a resident alien or a nonresident alien— thse are technical terms that have nothing to do with your visa status but are strictly for tax purposes only.

- Resident aliens are taxed similarly to U.S. citizens and must file the same tax forms.

- Nonresident aliens follow a different set of rules, file different tax forms, and typically don’t qualify for many deductions or tax credits available to U.S. citizens.

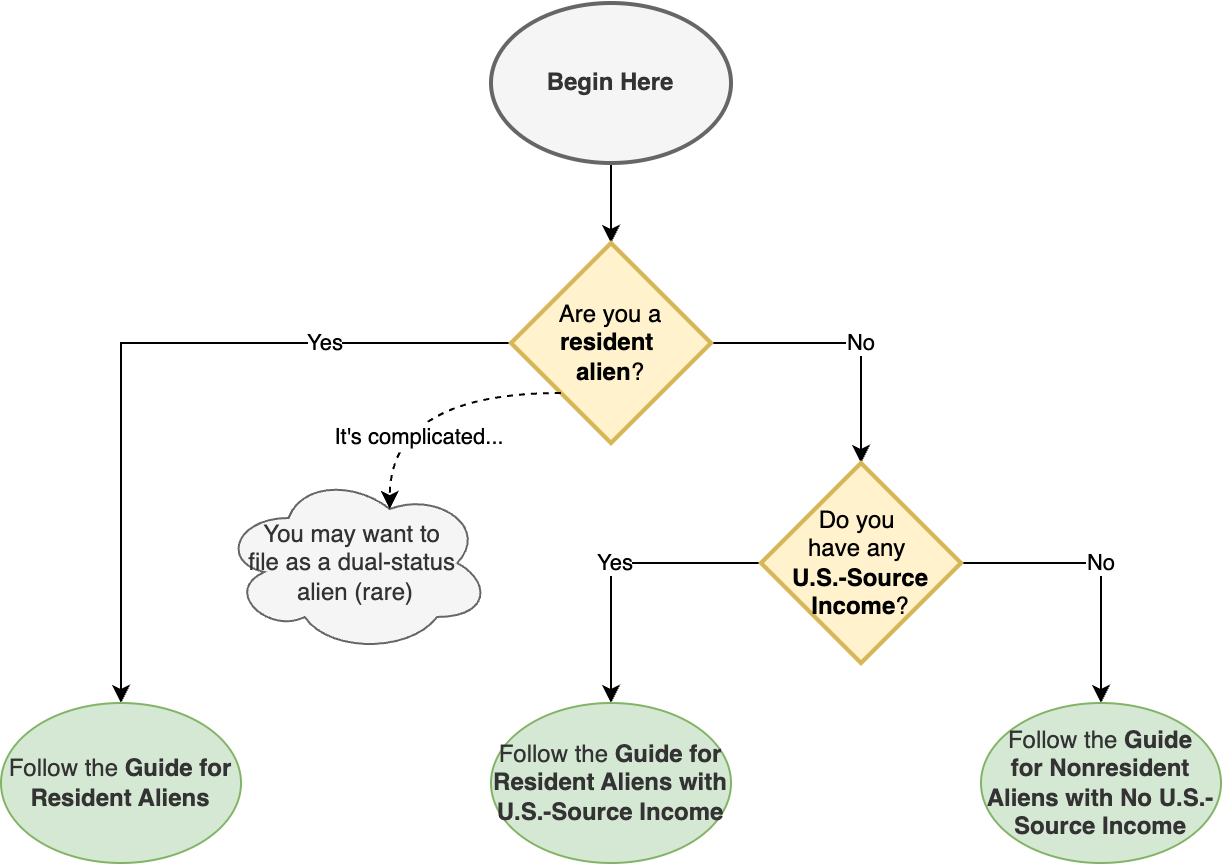

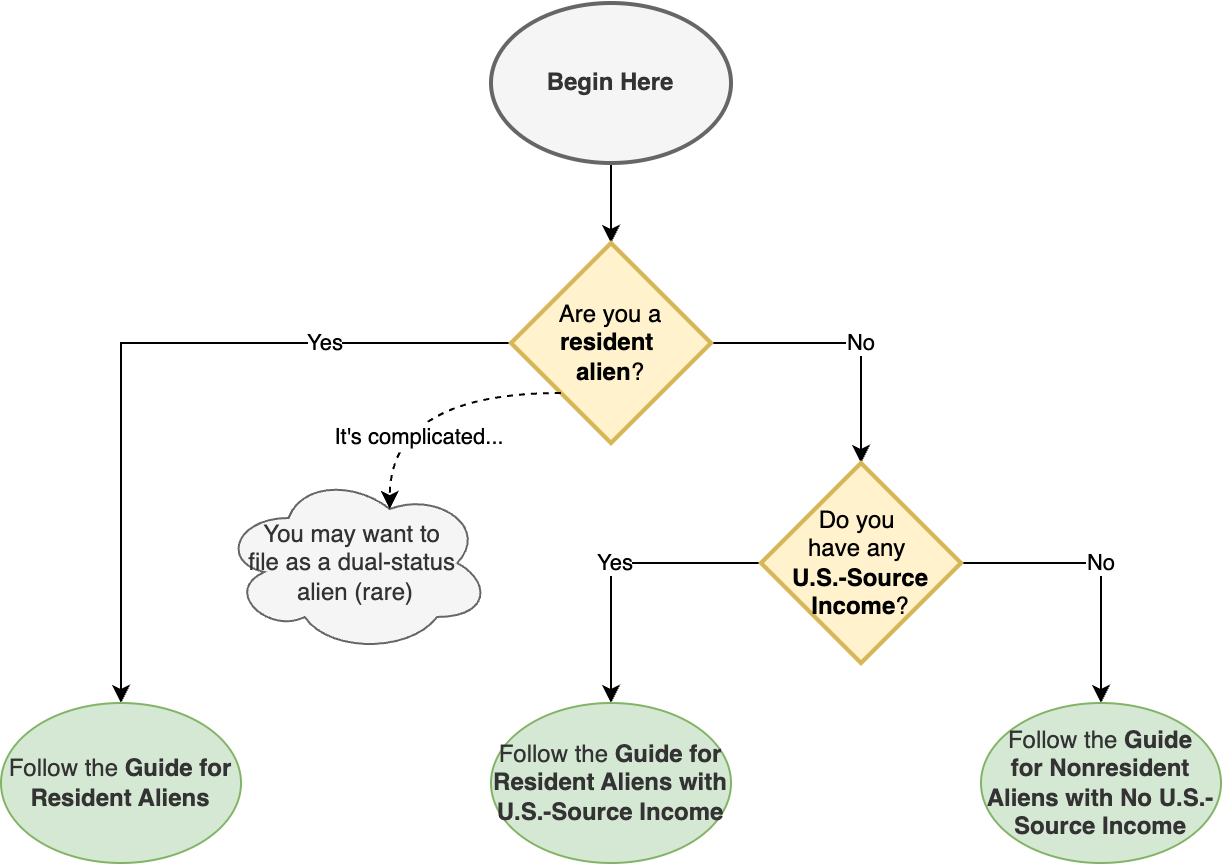

Because these two classifications come with vastly different tax treatments, the first step in this guide is to help you determine which category you fall into. If you are a resident alien, you will proceed on to the Guide for Resident Aliens page.

The majority of international students and visiting scholars are Nonresident Aliens. For example, if you are an undergraduate student on an F-1 visa and this is your first time in the U.S, then you are almost certainly a nonresident alien.

If you’re a Nonresident Alien, the next thing is to determine is whether you have any U.S.-source income.

- No U.S.-source income? Great! Your tax situation is straightforward. You’ll only need to file one form, and you can follow the Guide for Nonresident Aliens with No U.S.-Source Income.

- Earned U.S.-source income? If you have an on-campus job, a work-study position, or receive payments as a Teaching Assistant, Research Assistant, or through what the IRS calls "compensatory fellowship income," then you do have U.S.-source income. In this case, follow the Guide for Nonresident Aliens with U.S.-Source Income to ensure you file correctly.

Do you already know which category you fall into? No worries! Feel free to jump straight to the right guide that applies for you. If you're unsure, don’t worry—keep reading, and I’ll help you figure it out. It might be helpful to keep reading anyways, because the rest of this page offers some important context that is useful to know for everyone.

Determine if you are a Resident Alien or a Nonresident Alien

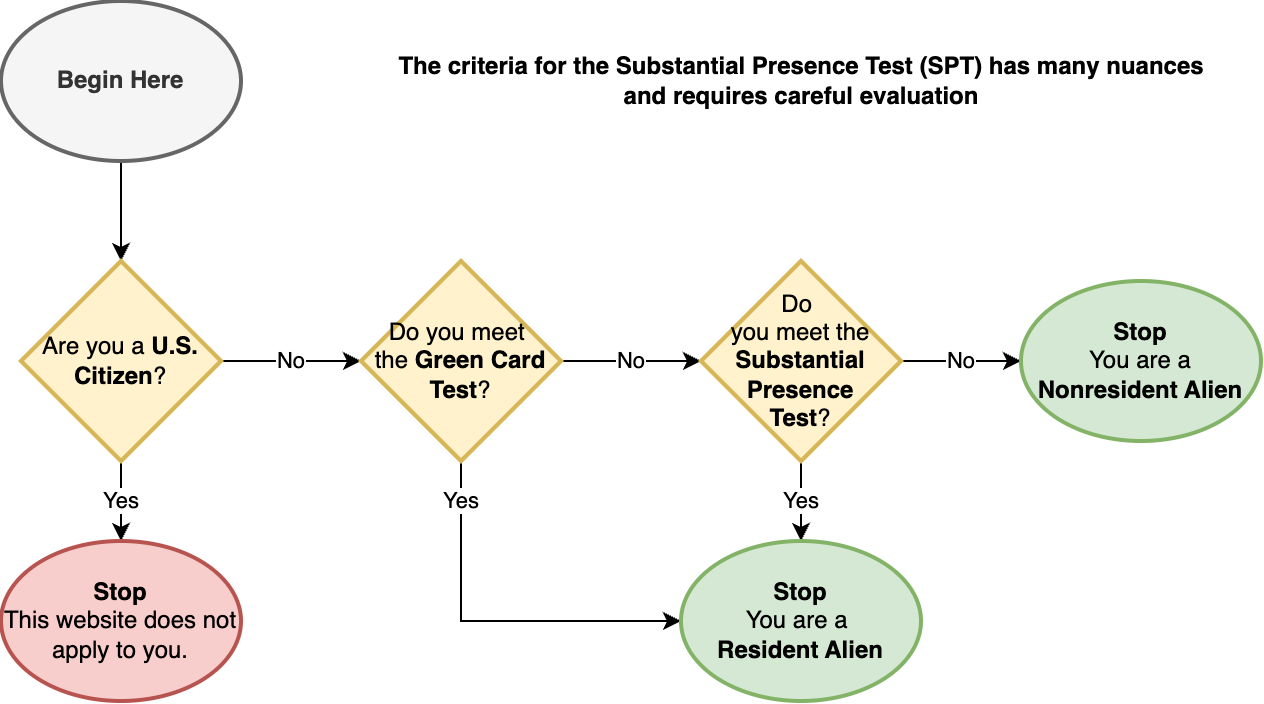

The IRS uses two criterion to determine if a non-U.S. citizen is a Resident Alien. They are their definitions, on the official IRS Publication 519 (2024), U.S. Tax Guide for Aliens:

- The Green Card Test.

- The Substantial Presence Test.

If you meet either one of them, you are considered a Resident Alien. If you do not meet either of them, you are considered a Nonresident Alien.

The Green Card Test

The Green Card Test is relatively straightforward. If you become a Lawful Permanent Resident (LPR, i.e. Green Card holder) at any point within a year, you are considered a Resident Alien for the entirety of that year.

There are a few exceptions to this rule, typically involving individuals who have received deportation orders or have formally renounced their permanent residency status. However, these situations are rare and generally don’t apply to international students, so I won’t cover them here. What’s more relevant for most students is the next criterion: the Substantial Presence Test.

The Substantial Presence Test

For international students this is the most important criterion when it comes to determining your tax residency.

The information presented in this section derived from IRS Publication 519 (2024), U.S. Tax Guide for Aliens, Chapter 1 The Substantial Presence Test. You should open up the chapter in a new tab and follow-along.

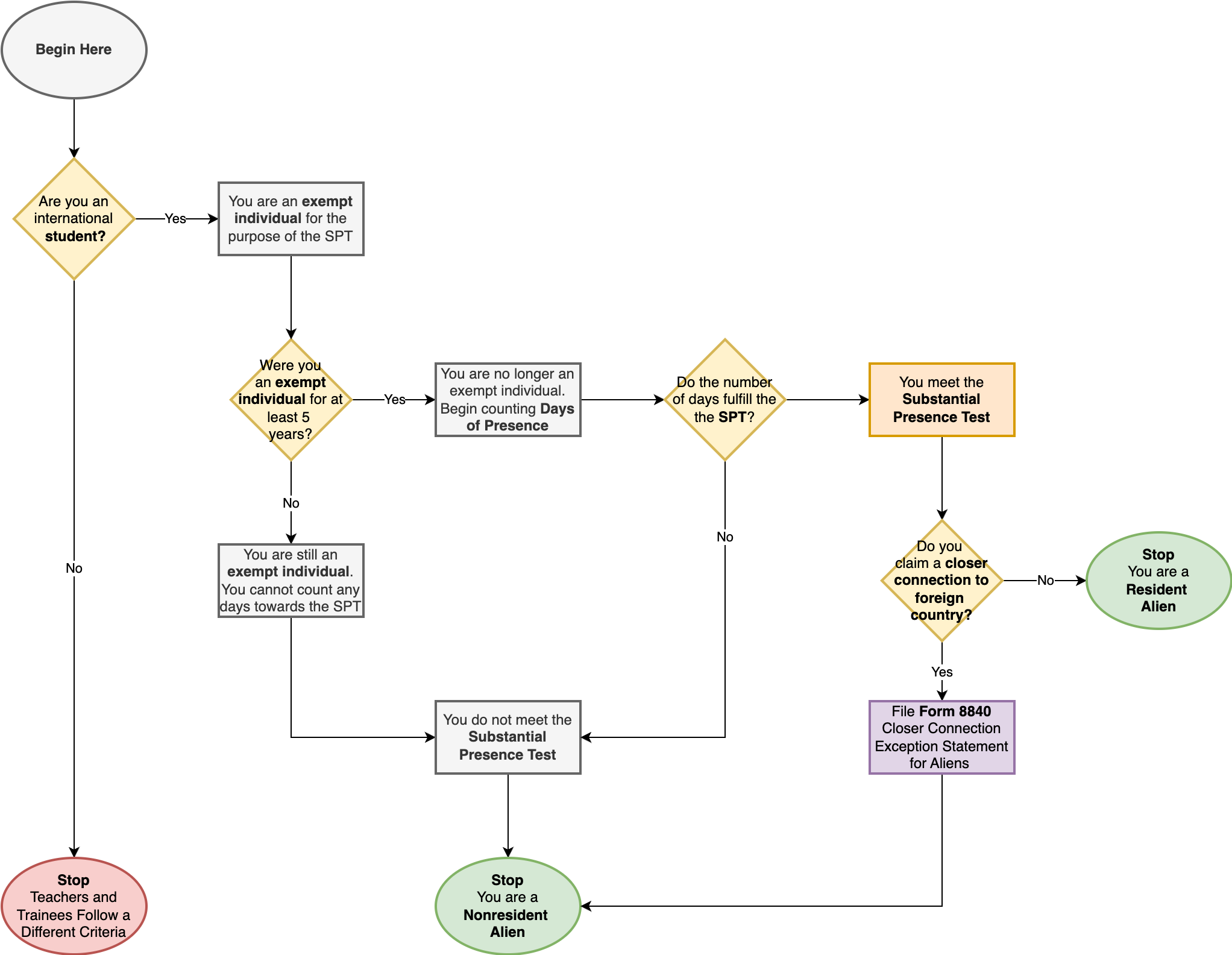

The Substantial Presence Test works by "counting" the number of "days" a foreign national (i.e. an international student) has spent in the United States. The test "adds up" the number of days you spent, and if it exceeds a certain threshold then you are considered a resident alien for tax purposes.

The reason I put "counting," "days," and "adds up" in quotes is because the test is quite nuanced due to the following reasons:

- The method used to count the number of days is not straightforward.

- Days of Presence: The IRS has a specific definition of "Days of Presence," which determines which days count toward the threshold.

- Days that are spent transiting through the U.S. don't count, or days where you are the crew member of an international vessel. These situations don’t come up often for international students, so I won’t go into detail on them here

- Exempt Individuals: Certain individuals are classified as "Exempt Individuals" based on their visa status. If you are an exempt individual, the days you spend in the U.S. do not count toward the threshold at all.

With the above in mind, let's take a look at the language of the test.

Substantial Presence Test

You are a resident for tax purposes if you meet the substantial presence test for calendar year 2024. To meet this test, you must be physically present in the United States on at least:

31 days during 2024; and

183 days during the 3-year period that includes 2024, 2023, and 2022, counting:

All the days you were present in 2024,

1/3 of the days you were present in 2023, and

1/6 of the days you were present in 2022.

As you can see, the IRS uses a kind of "weighted count," where days from past years matter less than more recent ones. But don't start counting your number of days just yet. For the majority of international students, they won't meet the Substantial Presence Test because they are considered an exempt individual:

Exempt individual

Do not count days for which you are an exempt individual. The term “exempt individual” does not refer to someone exempt from U.S. tax, but instead refers to anyone in the following categories.

An individual temporarily present in the United States as a foreign government-related individual under an “A” or “G” visa other than individuals holding “A-3” or “G-5” class visas.

A teacher or trainee temporarily present in the United States under a “J” or “Q” visa who substantially complies with the requirements of the visa.

A student temporarily present in the United States under an “F,” “J,” “M,” or “Q” visa who substantially complies with the requirements of the visa.

A professional athlete temporarily present in the United States to compete in a charitable sports event.

But that’s not all—there’s another important condition to being an exempt individual. If you read further on IRS Publication 519, you’ll see that the IRS limits this exemption for international students to five years. Starting in your sixth year, you’re no longer considered exempt, which means your days in the U.S. will begin counting toward the Substantial Presence Test.

Understanding the Exempt Individual Clause

Students

A student is any individual who is temporarily in the United States on an “F,” “J,” “M,” or “Q” visa and who substantially complies with the requirements of that visa. You are considered to have substantially complied with the visa requirements if you have not engaged in activities that are prohibited by U.S. immigration laws and could result in the loss of your visa status.

Also included are immediate family members of exempt students. See the definition of “immediate family,” earlier, under Foreign government-related individuals.

You will not be an exempt individual as a student in 2024 if you have been exempt as a teacher, trainee, or student for any part of more than 5 calendar years unless you meet both of the following requirements.

You establish that you do not intend to reside permanently in the United States.

You have substantially complied with the requirements of your visa.

What does this mean? Let's walk through an example.

- If you’re a "typical" undergraduate student on an F-1 visa, you are considered an exempt individual for all four years of your degree (from Freshman to Senior year). This means you are a Nonresident Alien for tax purposes.

- If you continue studying and pursue a Master’s degree, you remain an exempt individual in your fifth year, so you are still a Nonresident Alien.

- However, in your sixth year of studies, you are no longer exempt. At this point, you must count your days of presence in the U.S. If you meet the Substantial Presence Test, you will be classified as a Resident Alien for tax purposes.

Finally, keep in mind that the "five-year limit" on exempt individual status is a lifetime total, not necessarily five consecutive years. In the above example, even if you left the U.S. after completing the Bachelor's and returned after a gap year, you must still count in the same way.

The website of the International Student Office at UCLA has a very comprehensive section on the Substantial Presence Test with examples on determining exempt individual status, including examples for J-1 Scholars and people who were F-1 students and then transitioned to J-1 status. Be sure to check out their site if you need additional examples:

https://cru.ucla.edu/alien-exempt-individual-examples

Putting all of this together, we can create the following flowchart to understand the the Substantial Presence Test for international students:

Are you a teacher or trainee under a J or Q visa? The above flowchart and the "five year exempt individual" period does not apply to you. The IRS has a similar, but different exemption period and criteria for teachers and trainees. Please see IRS Publication 519 (2024), U.S. Tax Guide for Aliens, Chapter 1, Subsection Teachers and Trainees for your specific situation.

What this means, for international students

Let's take a step back to look at the big picture.

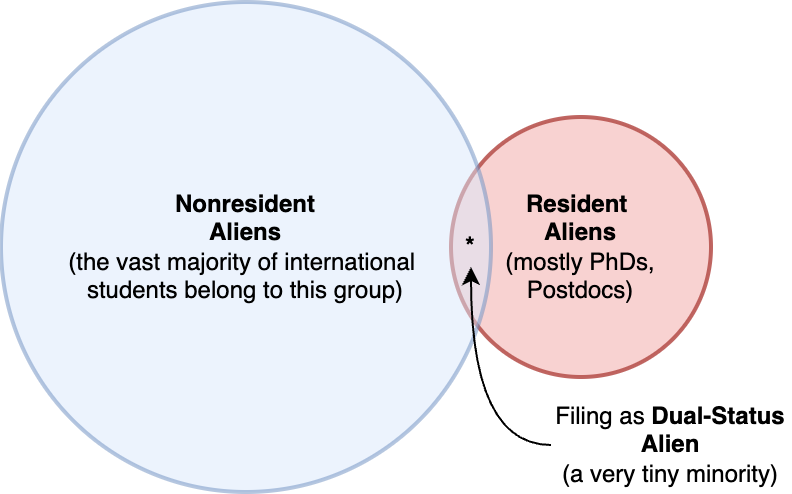

Most international students are considered nonresident aliens. However, those who have been in the U.S. for more than five years—mainly PhD students who also did their undergraduate studies in the U.S., postdocs, and similar cases—may become resident aliens.

If you’ve been in the U.S. for at least five years on an F-1 visa, you should start counting your days of presence beginning in your sixth year to see if you meet the Substantial Presence Test. Otherwise, if you’ve been here for less than five years on an F-1 visa, you are most likely an exempt individual and therefore a nonresident alien.

It’s possible to be both a nonresident alien and a resident alien in the same tax year—this is called Dual-Status Alien. A common example is someone who arrives in the U.S. on an H-1B visa but doesn’t meet the Substantial Presence Test in their first year. They remain a nonresident alien until they accumulate enough days in the following year to become a resident alien.

Normally, they would file as a nonresident alien, but the (rather obscure) First Year Choice provision allows them to file a Dual-Status Tax Return—where they are taxed as a nonresident for part of the year and as a resident for the rest.

This is an advanced tax situation that rarely applies to international students but is more common for H-1B visa holders. I’m working on a guide for it. I almost had to file as a Dual-Status Alien!

U.S.-Source Income

Congratulations! You have already learned more about international student tax filing, than many of your peers. Have you figured out your tax residency status? If you are a Resident Alien, you can proceed to following the Guide for Resident Aliens.

If you are a Nonresident Alien, your next step is to determine whether you have any U.S.-Source Income. If you have an on-campus job, receive work-study aid, work as a TA or RA, or received a Form W-2 Wage and Tax Statement, then you definitely have U.S.-Source Income. In that case, you can skip ahead to the Guide for Nonresident Aliens with U.S.-Source Income.

If you didn’t receive any money, keep reading. Generally speaking, if you “didn’t earn any money,” you only need to file one form. However, the IRS has a specific definition of earning money—it’s called U.S.-Source Income. This definition can be a bit tricky; for instance, some fellowship grants count as U.S.-Source Income, while others do not. If you're unsure whether your income qualifies, this section of the guide will help you figure it out.

If you traded stocks, bonds, or cryptocurrencies, then you almost certainly have U.S.-source income. International students who have any kind of investment income must carefully navigate their tax situation.

Determining U.S.-Source Income

The information presented in this section derived from IRS Publication 519 (2024), U.S. Tax Guide for Aliens, Chapter 2, Section Income. You should open the link in a new tab and follow-along.

As a Nonresident Alien, the IRS only taxes you on income earned in the United States. For example, if you were an F-1 visa student and spent the summer working at a café in Bologna, Italy, that income would not be considered U.S.-Source Income.

Work Study & On-Campus Jobs are U.S.-Income

In general, the IRS determines the source of income based on where the services are performed or where goods are sold. IRS Publication 519, Chapter 2, provides a comprehensive table outlining different income types, but most of these scenarios don’t apply to international students. As an F-1 visa holder, you are typically only allowed to work in an on-campus job, through work-study, or under the Optional Practical Training (OPT) program—making it fairly straightforward to determine if you have U.S.-Source Income.

Scholarships and Fellowships

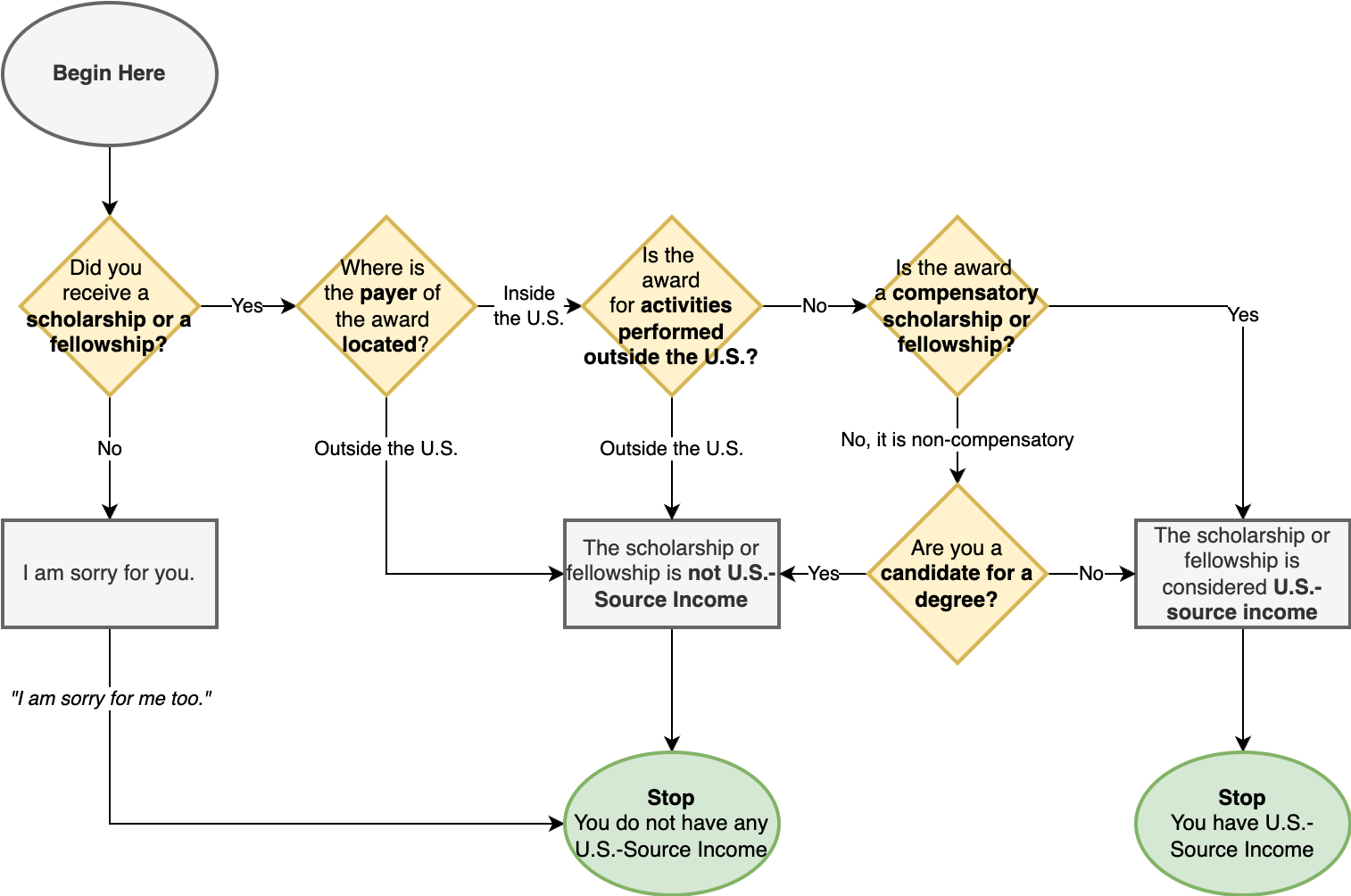

Feeling confused about the tax status of your scholarship? The easiest way to find out is to email your university's tax office or international student office. They will be able to provide you with the definitive answer. If you do so, you can probably skip this entire section – but feel free to continue reading if you're interested in how it works.

The main area of ambiguity for international students, however, is scholarships and fellowships. If you receive what the IRS calls a compensatory fellowship, then it is considered U.S.-Source Income. The rest of this section will focus on clarifying what that means.

Is your scholarship from a foreign source?

The information presented in this section derived from IRS Publication 519 (2024), U.S. Tax Guide for Aliens, Chapter 2, Section Scholarship, Research, and Grant Money. You should open the link in a new tab and follow-along.

First of all, if your scholarship or fellowship is awarded by an institution outside the U.S., then it is not considered U.S.-source income, and not subject to taxes.

If a nonresident alien receives a grant that is not from U.S. sources, it is not subject to U.S. tax. See Scholarships, Grants, Prizes, and Awards in chapter 2 to determine whether your grant is from U.S. sources.

For example, if you a F-1 student and you were awarded a grant by the Turkish Ministry of Education to study in the U.S. for a year, that money is not considered U.S.-source income. Furthermore, it does not matter if the scholarship money is paid to you from someone in the U.S., or from a U.S. bank account. The IRS clearly states that:

For example, payments for research or study in the United States made by the United States, a noncorporate U.S. resident, or a domestic corporation are from U.S. sources. Similar payments from a foreign government or foreign corporation are foreign source payments even though the funds may be disbursed through a U.S. agent.

Is your scholarship for activities outside the US?

Even if your scholarship is awarded by an U.S. institution, it is not considered U.S. source income if it is for activities performed outside the U.S. The IRS states:

Activities to be performed outside the United States.

Scholarships, fellowship grants, targeted grants, and achievement awards received by nonresident aliens for activities performed, or to be performed, outside the United States are not U.S. source income.

This means if you were awarded a grant to spend your summer on an archaeological excavation in India, then that grant itself is not considered U.S.-sourced income.

Is your scholarship awarded specifically in compensation for services performed?

This is the key question. If your scholarship or fellowship is explicitly tied to services you perform—such as working as a Teaching Assistant (TA) or Research Assistant (RA)—then the IRS considers it a compensatory fellowship. This means it qualifies as U.S.-Source Income and is subject to taxation.

Are You a Degree-Seeking Student?

To qualify for a non-compensatory fellowship (which is not considered U.S.-source income), you must be pursuing a degree. This criterion is rarely an issue for most international students since the vast majority are enrolled in degree programs. However, there are exceptions. For example, I spent a year in the U.S. as a post-baccalaureate student on an F-1 visa. During that time, I was classified as an F-1 student, but not a degree candidate—meaning certain grants or fellowships I received could have been treated as U.S.-source income.

Next Steps

Phew! That was a lot of information. By now, you are probably the international tax expert amongst your friend circle. Now, you should be able to determine which guide to follow:

Choosing the Correct Guide

It's time to file your taxes. Remember, as a rule of thumb, the vast majority of international students are nonresident aliens. Each one of these guides will walk you through exactly which forms you have to file. Remember, I cannot tell you what to fill in these forms – but I will help you understand which forms you need.

- Guide for Nonresident Aliens with No U.S.-Source Income.

- Guide for Nonresident Aliens with U.S.-Source Income

- Guide for Resident Aliens

Good luck, and see you on the other side!

Please share collegetaxguide.org with your friends! This guide is a passion project, and I want to help out as many international students as possible. Share this post with your friends, or your campus group-chat!

How to Get Help

Filing taxes as an international student can feel overwhelming, but the good news is you don’t have to figure it out alone—and you definitely don’t need to spend hundreds of dollars on a paid tax preparer. There are free, high-quality resources available to help you.

Contacting your University's Tax Office

Your university or college is the best place to start. Many schools have a dedicated tax office or an international student office that provides tax guidance. They cannot prepare your taxes for you, but they can help answer specific questions, such as:

- “Is my scholarship considered a compensatory fellowship?”

- “Am I a resident or nonresident alien for tax purposes?”

- “Does my country have a tax treaty with the U.S.?”

Indeed, your local university's tax office is probably the best source of tax guidance, because they will be the most familiar with your situation. Furthermore, many large universities have written tax guides and resources specifically for their international students. Indeed, while I was creating the College Tax Guide, I often referred to guidance from the following university tax offices, whenever I wanted a second opinion:

- UCLA Central Resource Office Office

- University of Mary Washington, Center for International Education

- University of Michigan, Finance Office

IRS's Volunteer Income Tax Assistance (VITA) Program

The VITA program is a free tax help service run by IRS-certified volunteers. All volunteers are trained in tax preparation, and some of these volunteers are even actual IRS employees! Some VITA sites specialize in helping nonresident aliens, so you can get expert guidance at no cost. If you literally want someone to help you file your tax return for you, then the VITA program is where you should go.

To find a VITA site near you that helps international students, visit the IRS VITA site locator and check if they support Form 1040-NR (the tax form for nonresidents aliens).

Read the IRS Publications

Finally, if you like to double-check things yourself, the IRS actually has well-written guides. IRS publications can feel dense, but they are authoritative—so if you want the final word on a tax question, this is where to look.

- Publication 519: U.S. Tax Guide for Aliens – The most comprehensive guide on residency status, tax treaties, and filing rules.

- Publication 970: Tax Benefits for Education – Covers how scholarships and fellowships are taxed.

Indeed, all of the information provided in the College Tax Guide are sourced from IRS Publication 519 and Publication 970. I've made sure to link to specific sections, subsections, and chapters, but sometimes you just got to read the whole thing.

A Word of Thanks

If you’ve ever searched “How do I file a Form 1040-NR?”, you’ve probably come across websites from tax firms or software companies that offer vague, low-quality information—only to end with a pitch like, "Taxes are complicated. Hire us!"

The College Tax Guide is not one of those websites.

I firmly believe that with patience and the right information, anyone can prepare their own taxes. And as international students, we should empower each other with knowledge— living away from home is hard enough as it is. So if you found this guide helpful, please share it with your fellow students, researchers, and scholars (whether international or not!)

So instead of a sales pitch, here’s a word of thanks—to you, the international student, researcher, or scholar. Thank you for reading my guide. Thank you for your time and attention.

Taxes can be complicated. But you are capable. You are resourceful. You’ve got this.