Guide for Resident Aliens

Who this Guide is For

Here are some common situations where this guide will apply.

- Are you a PhD student with a F-1 visa, who has already completed 4 year's of undergrad in the U.S, and is on the second year of your PhD?

- Are you a Computer Science graduate who spent 4 years on F-1 status, and is now working in the U.S. via your STEM OTP Status?

- Are you a Postdoc who transitioned from a F-1 visa to a H-1B Visa, and is now working full-time on your H-1B?

Essentially, this tax guide only applies for international students and scholars that are no longer exempt individuals, and now considered resident aliens by the Substantial Presence Test. In the vast majority of cases, this only applies to F-1 visa students that were exempt for five years already, and have met the substantial presence test on their sixth year.

Remember, Resident Aliens are taxed the same way as U.S. Citizens. This means that this tax guide works for Americans too! If you have an American friend, share this guide with them. The tax filing process they follow is exactly the same as yours!

The Reason You Must File

It is the law. Resident aliens follow the same tax laws as U.S. citizens. According to the IRS, the minimum filing threshold is $14,600 dollars for the 2024 tax year, so if you made more than that you must file a Form 1040. But beyond that, it is in our best interest to file a tax return. Because by filing a tax return you will be saving money.

You've spent 5 years in the United States already. You worked your job. You paid your tuition. You were not eligible for any of the credits or deductions that an American citizen enjoys.

But this year, it's different. You're a Resident Alien now. And for the first time, you are eligible for the standard deduction, and to claim an educational tax credit. When you file your taxes, you will be able to claim a substantial tax refund. And this guide will show you how.

How Taxes Work in the United States

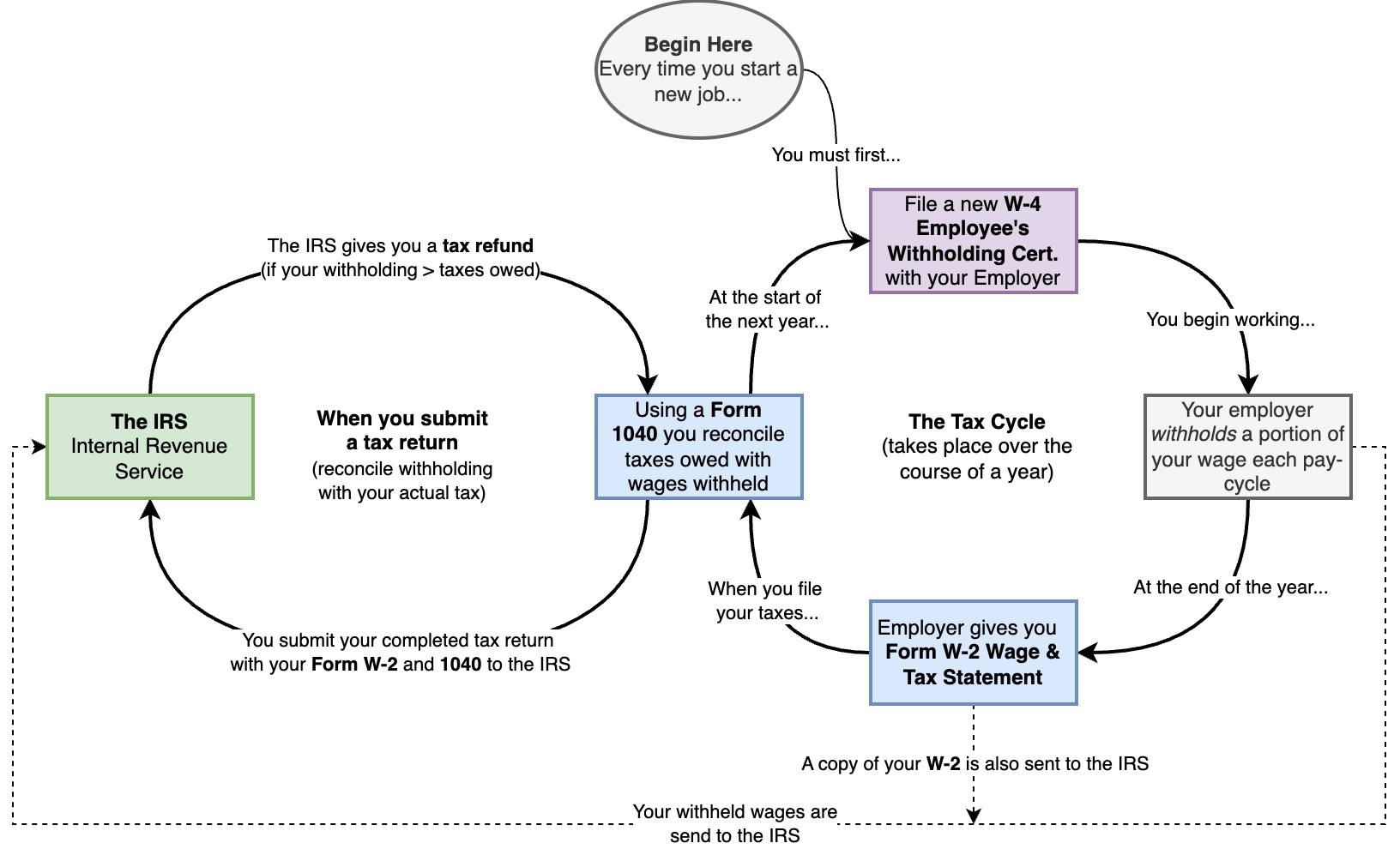

I'll begin with a quick primer on taxes. This section is helpful for the students that just began working. If you know how this works, feel free to skip ahead to the next section.

When you start a job in the U.S., your employer is required to withhold a portion of each paycheck for taxes. To determine how much, they ask you to fill out Form W-4, Employee’s Withholding Certificate. Only after completing this form can you begin working, and with every paycheck, a portion of your earnings is set aside for tax.

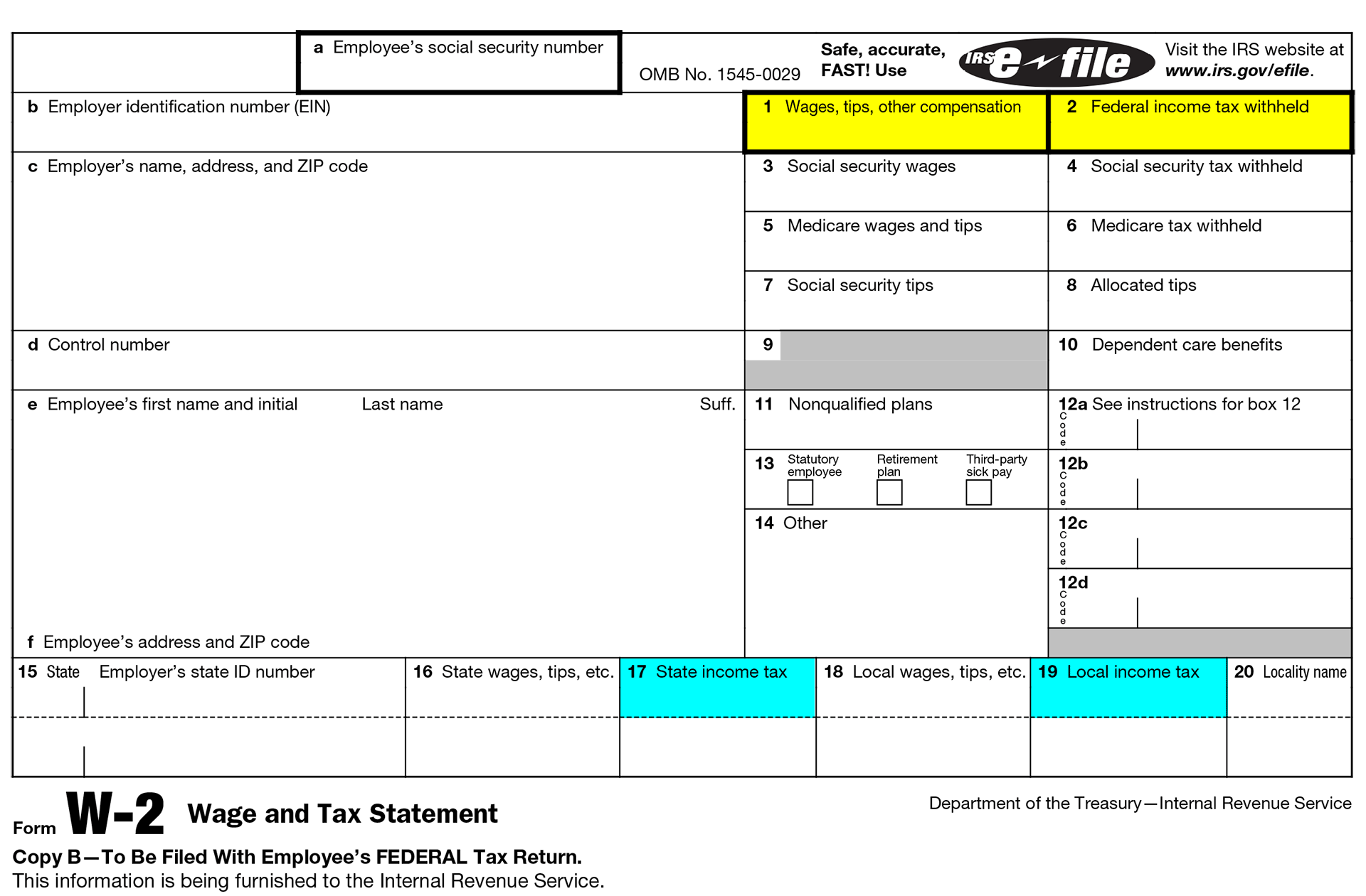

At the end of the year, your employer totals up how much they withheld and how much they paid you. This information is sent to both you and the IRS in a document called Form W-2, Wage and Tax Statement. Now, the ball is in your court. It’s up to you to reconcile the money that was already withheld with the taxes that you actually owe. The only way to do this is by filing a tax return—Form 1040 for resident aliens (and U.S. citizens).

In a perfect world, back at the start of the year you would have filled out Form W-4 knowing exactly how much tax you owed. And your employer would have withheld the correct amount. If that were the case, filing your tax return would show that everything balances out to zero—you neither owe additional taxes nor have overpaid.

Why Filing a Tax Return (Often) Saves You Money

But we don’t live in a perfect world. And if you’re like most international students, you probably had no idea how taxes worked when you first started your on-campus job. As a result, many students end up having too much tax withheld—more than they actually owe. This is especially common if you filled out your W-4 using the rules for nonresident aliens.

Once you become a resident alien for tax purposes, you’re eligible for the standard deduction, which means the first $14,600 of your income isn’t taxed. If too much was withheld from your paycheck, filing a Form 1040 tax return lets you claim a tax refund and get that money back.

On top of that, if you paid tuition, your university will send you a Form 1098-T Tuition Statement. This form shows the amount of qualified educational expenses you paid that year.

As a nonresident alien, you couldn’t do much with a Form 1098-T. But as a resident alien, you may become eligible for the Lifetime Learning Credit (LLC)—a tax credit that can save you up to $2,000 per year. If you qualify for the LLC, you can reduce your tax bill even further!

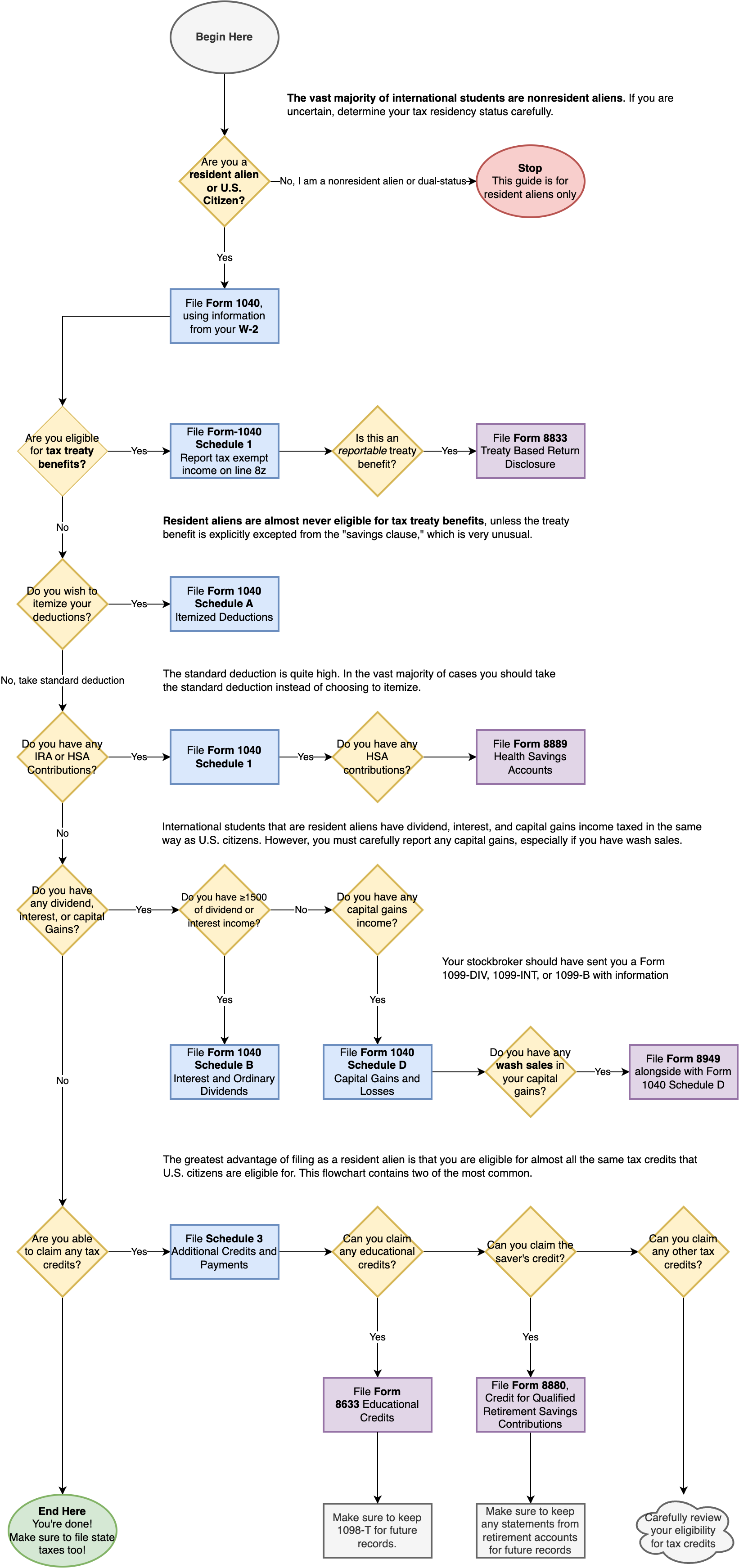

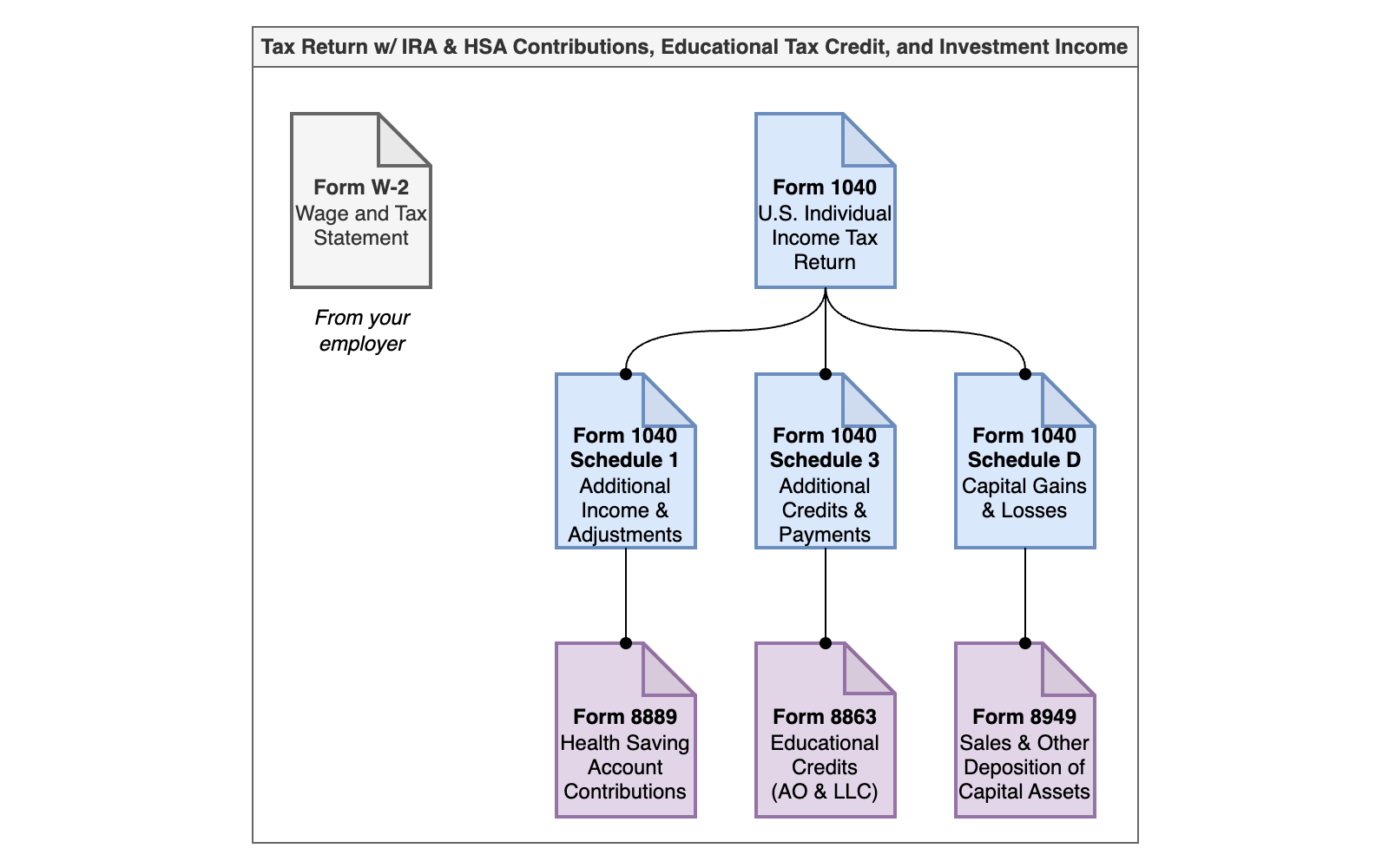

The Flowchart

Alright. Now that you understand why you should file a tax return, let's get the process started. To begin, here's an overview of the steps that you will be taking.

First, take a deep breath. Don't panic. This flowchart might look complicated at first, but not every step will apply to you. Remember: even if the only thing you do claim the standard deduction, you will already be coming out ahead. In this guide, I will be walking you step by step through what you have to do.

The IRS Forms that You Will Need

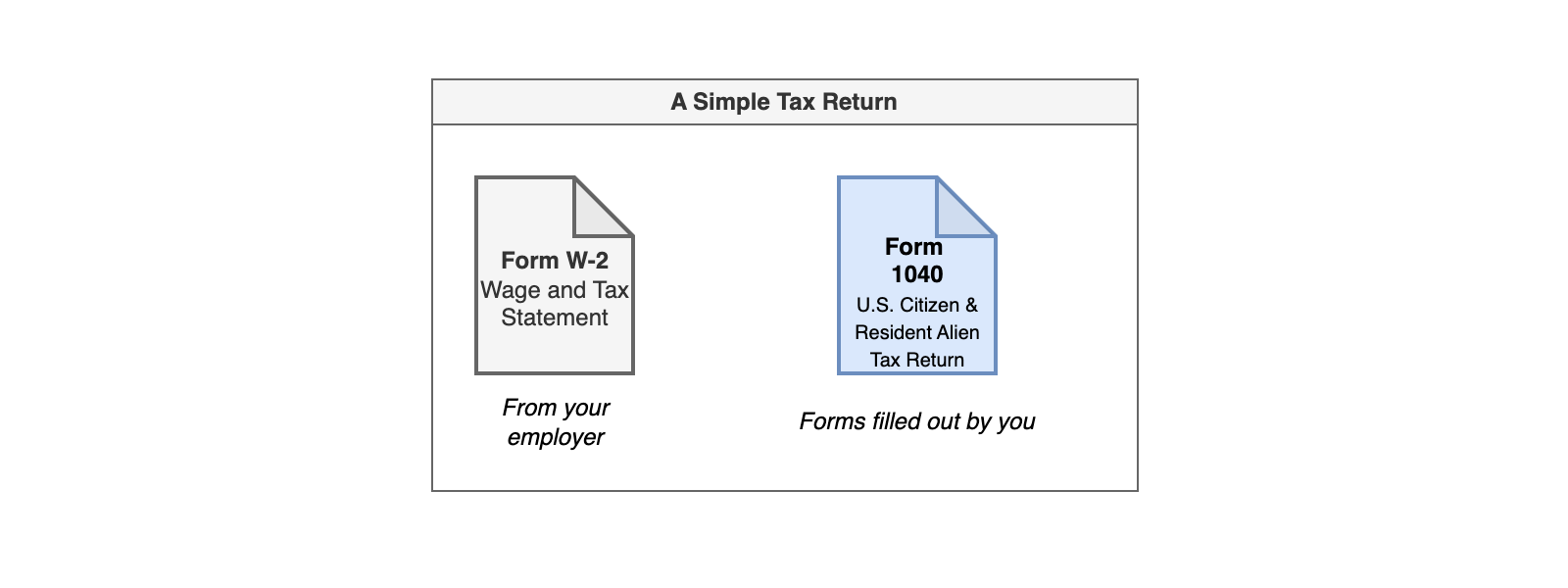

As a resident alien, your tax treatment is (almost) identical to that of any U.S. citizen. You will be filing the same forms as them, and you will begin with only two forms.

- Form W-2 Wage and Tax Statement (you receive this from your employer)

- Form 1040 U.S. Nonresident Alien Income Tax Return

Afterwards, depending on how complex your tax situation is, you might either file some additional Schedules for your Form 1040 (indicated in blue in my flowchart) or some supplementary forms (indicated in purple in my flowchart). Just for example, if you made IRA and HSA contributions, were eligible for an educational tax credit, and had investment income, then your tax return will look like this:

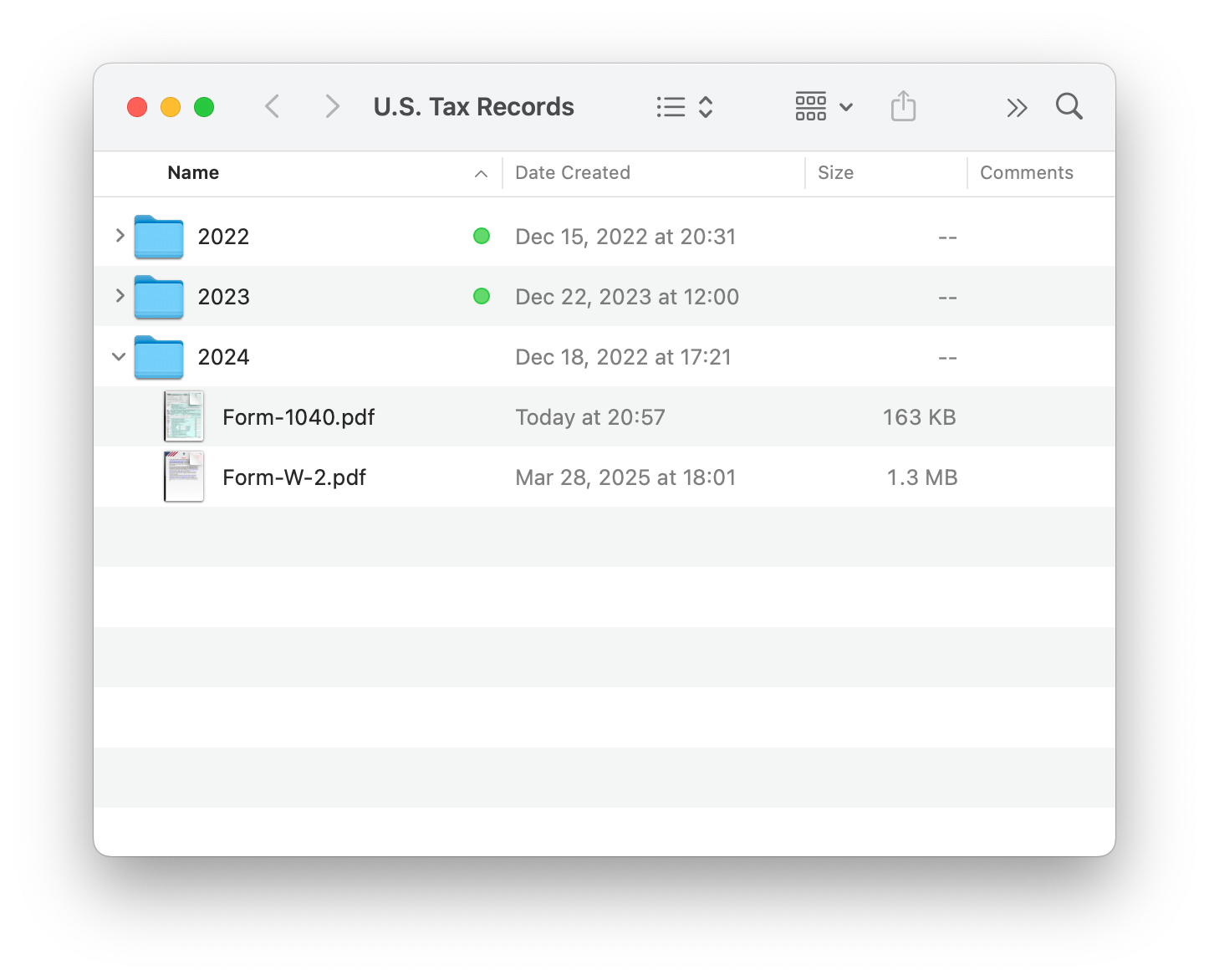

"Not too complicated, right? Things always get clearer with some helpful visuals. Now, let’s get organized. Create a folder to store all your tax forms—it's time to download them and start filling them out!" Pro-tip: always download the PDFs first, and open them from your desktop, not in the browser. Otherwise, you will be so sad if the browser crashes on you. Trust me, I know all too well how it feels.

You'll want to first save your Form W-2 Wage and Tax Statement. You'll receive this from your employer (which is often just your university). Next, navigate to the IRS website and download the PDF copies of Form 1040. I've linked it here below.

Form 1040, U.S. Individual Income Tax Return

Instructions for Form 1040

You want to keep the instructions open in another tab, so that you can refer to it easily for clarification.

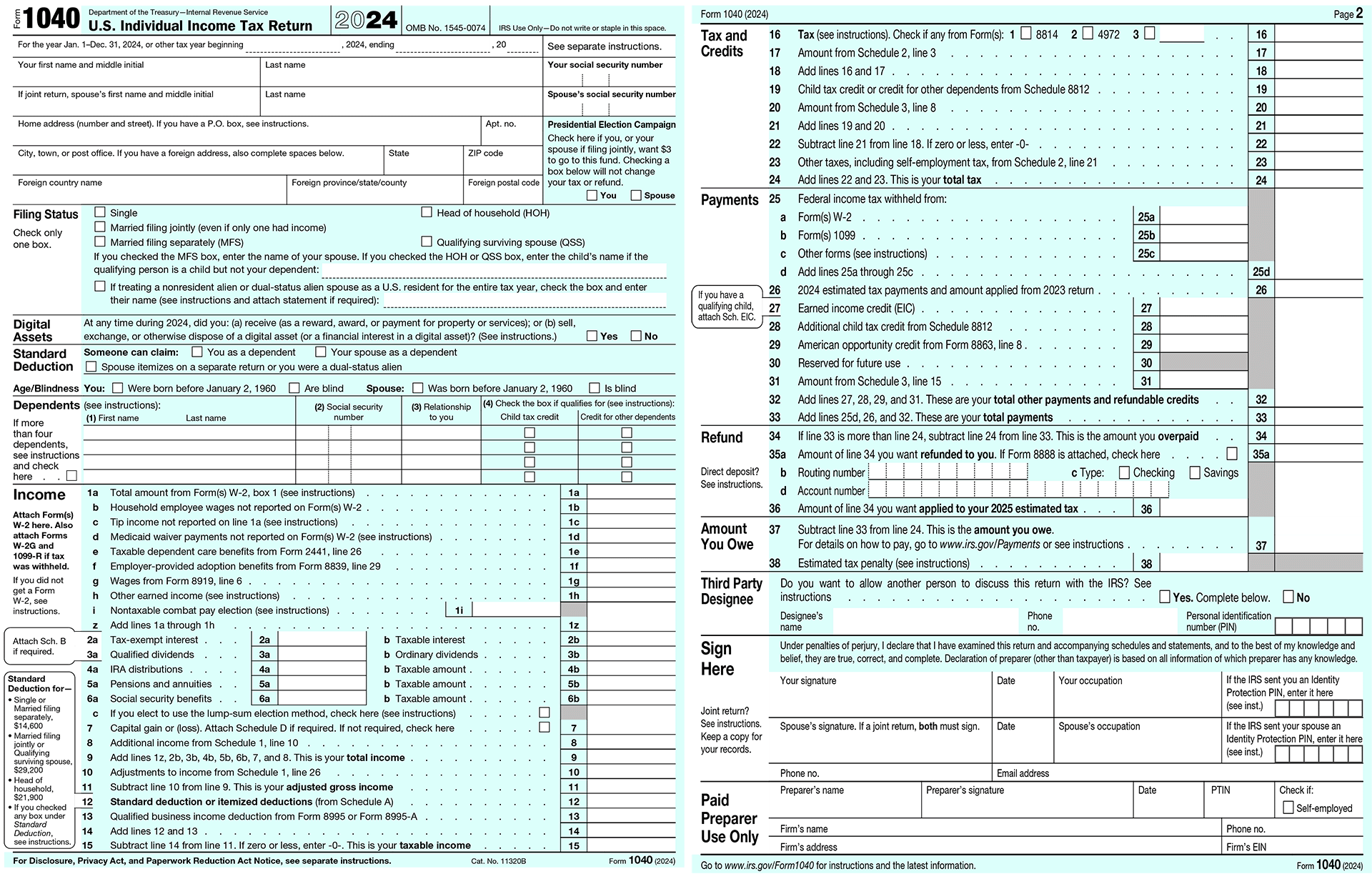

Walk-through of Form 1040

Are you already used to filling out Form 1040s by yourself? Feel free to skip ahead to the sections on handling HSA and IRA Contributions, Declaring Investment Income, or Claiming an Educational Tax Credit. I'm going slowly to help first-time tax filers. I hope you understand!

First, open your Form 1040. It's called the U.S. Individual Income Tax Return, and you can think of this as your "primary document." You'll be filling it in with information from the Form W-2 Wage and Tax Statement that your employer gave you.

Don't panic. Take a deep breath. Remember, a PDF has never hurt an international student before (except for graduate school rejection letters). We'll be going through Form 1040 section by section. The overarching structure of the form is quite straightforward:

- Income: In the first section, you write in the money you earned, and add it all up.

- Taxes and Credits: You take the sum from the previous section and calculate the tax on it. You also subtract the value of any tax credits (like the LLC) from your tax bill.

- Payments: Remember our talk about withholding? Here, you write in the value of your withholding from your Form W-2 Wage and Tax Statement.

- Refund/Amount You Owe: Finally, you take the sum from the Taxes and Credits section, and subtract it from the sum in Payments.

It really is that simple.

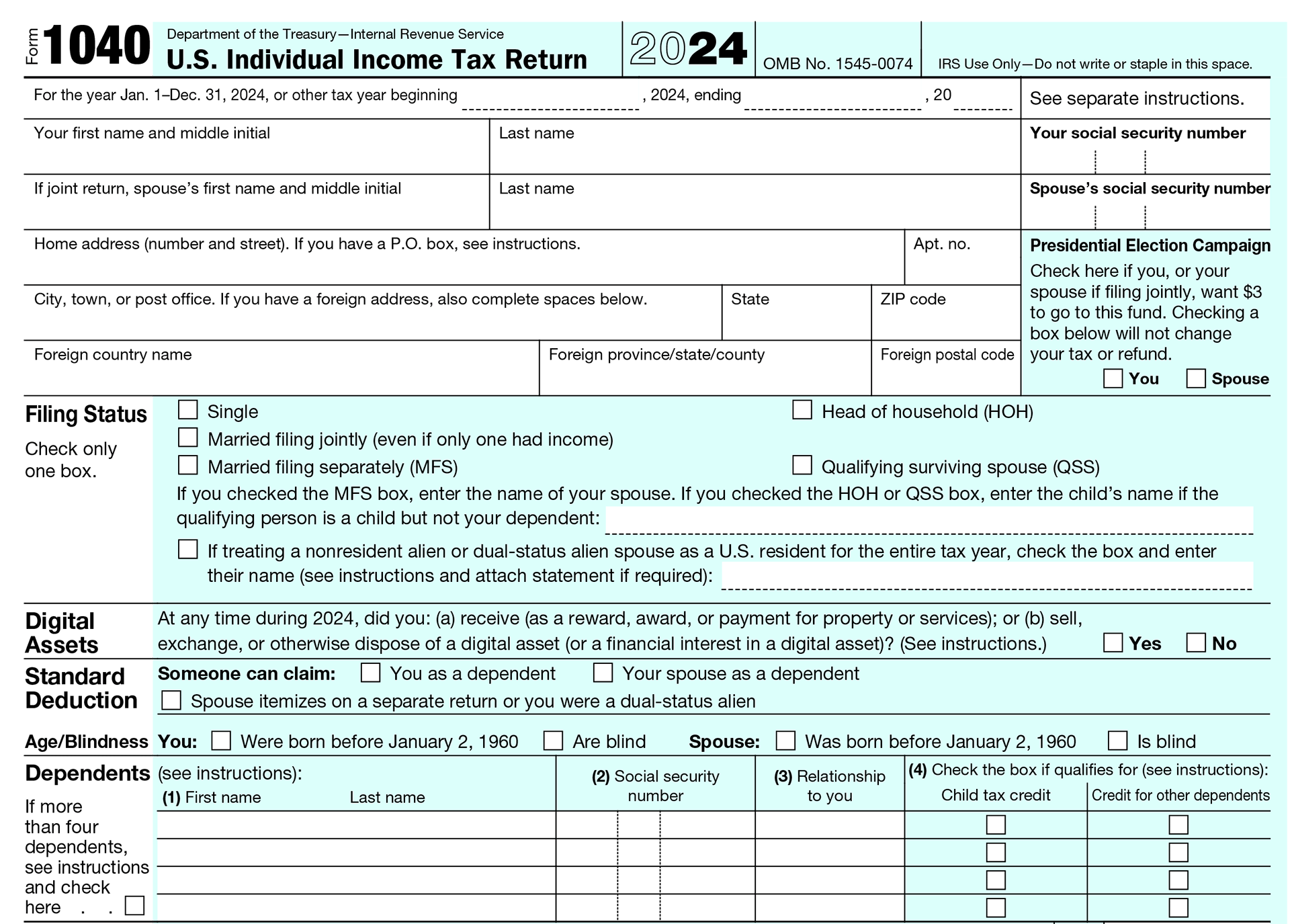

Form 1040: Name, Filing Status, and Dependent Info

Instructions for Form 1040

Every IRS Form comes with a comprehensive set of instructions. These instructions are either available on the IRS Website (linked above), or included with the form itself. Open the instructions in another tab, and keep it handy. This way you can refer to it, if you ever need help.

The first half of Form 1040 is mainly autobiographical. Simply fill it in with your personal information. If you need help, check out the Instructions – they contain line-by-line guidance.

Digital Assets: If you mined, traded, or were paid in crypto

If you have any relationship with crypto, you must read the section on Digital Assets on the Instructions for Form 1040 very carefully. You do not need to check the digital assets box if you simply purchased cryptocurrencies (like with real money), and kept them.

However, if you received crypto as a payment, through mining, or sold crypto in any way, then you must declare it. The way to declare digital assets depends on how you "deposed" of it. According to the IRS, if you "disposed of any digital asset, which you held as a capital asset, through a sale, trade, exchange, payment, or other transfer ... use Form 8949 to calculate your capital gain or loss and report that gain or loss on Schedule D (Form 1040)."

Essentially, the IRS is treating it similarly to capital gains, as if you earned money by trading stocks. If this is the case, you must follow the same instructions for declaring investment income later on in this guide.

However, if you received cryptocurrencies as payment, then you must report it similarly as income (just like how you report income from your Form W-2). Crypto is a bit of a tricky case, so I recommend reading the section on Digital Assets (linked above), as well as the special FAQ On Digital Currencies on the IRS website.

Once you have filled out the first part, we will proceed to the next section: Income. This is the time to get your Form W-2 Wage & Tax Statement ready!

Income

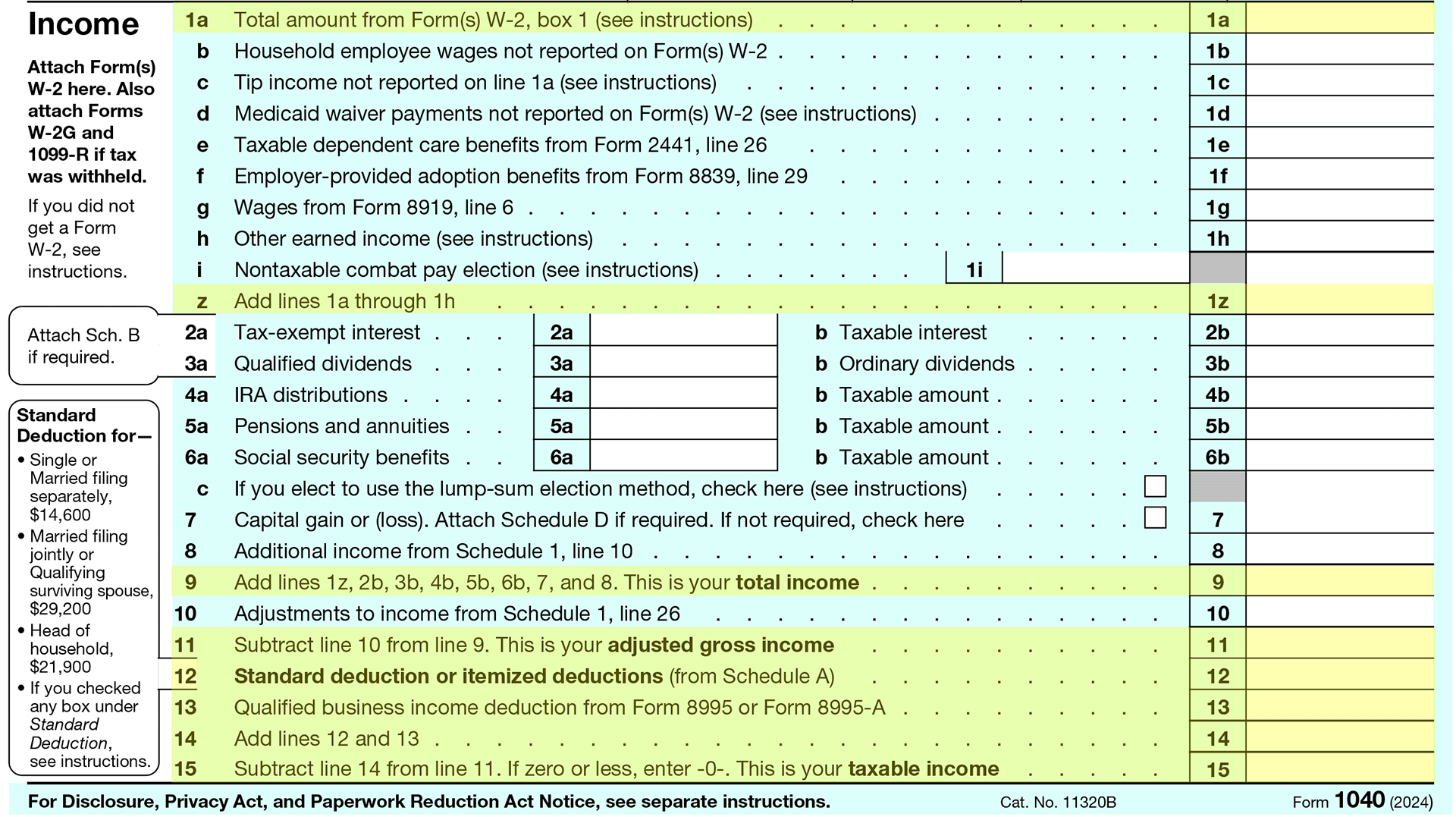

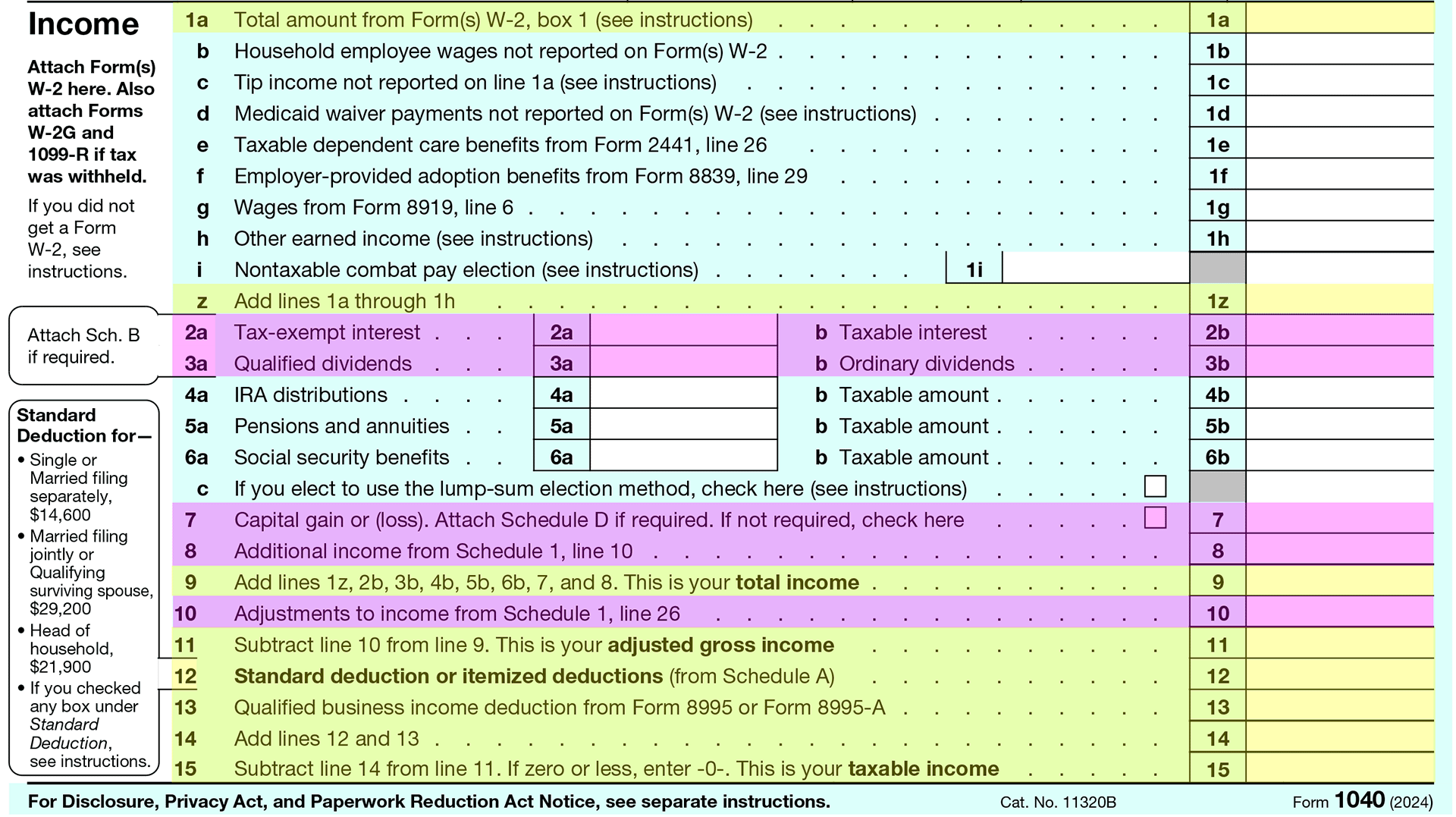

This is the section where we report our income. Don't let it intimidate you: most of the lines simply do not apply to us. I've gone ahead and highlighted in yellow all the lines necessary for a "typical" tax return, as an international student who is a Resident Alien.

Additionally, we will also fill the lines in magenta (purple), if you end up doing any of the following:

- Deduct IRA or HSA contributions: Lines 8 and 10

- Declare investment income (interest and dividends): Lines 2a, 2b, 3a, 3b.

- Declare investment income (capital gains): Line 7

As international students, we are not allowed to work off-campus, so we will not have any sort of income other than what is on our Form W-2.

Enter the amount from Wages, tips, other compensation (line 1 of your Form W-2) into line 1a of Form 1040. That’s it! If you have HSA contributions or investment income, keep on following the guide. We'll fill in those information as well. Now follow the instructions on each line (they tell you to add different sections up), until you arrive at the number on Line 15: that is your Taxable Income.

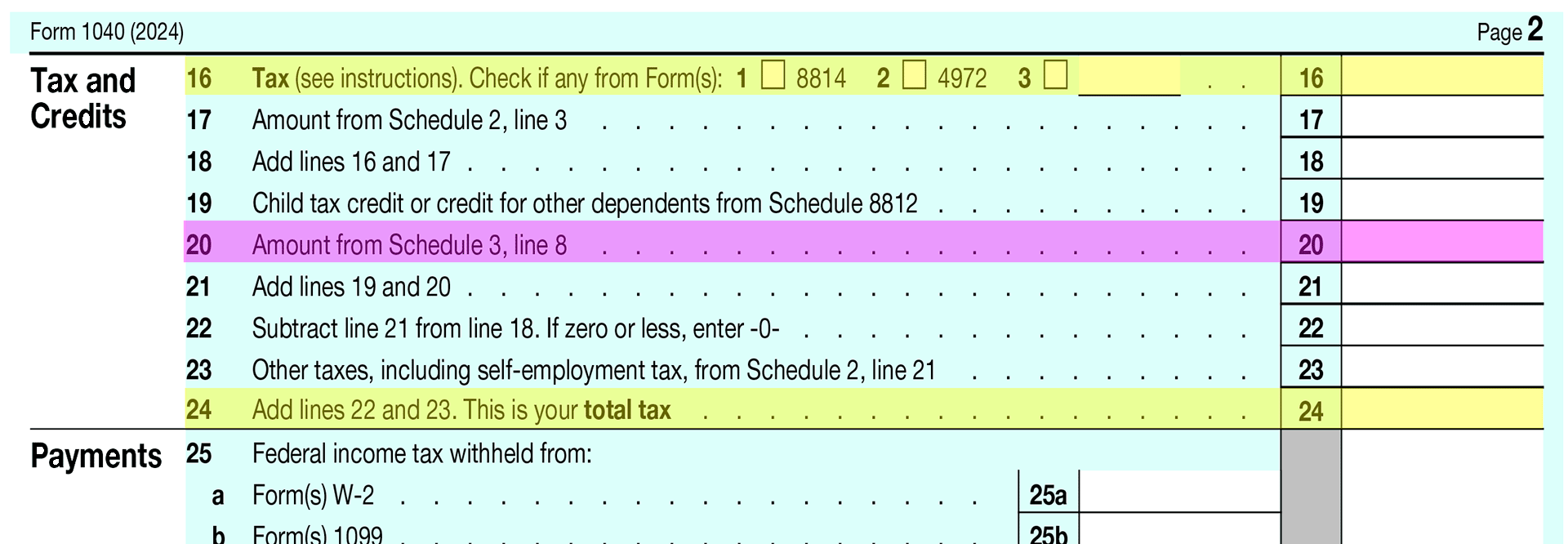

Tax and Credits

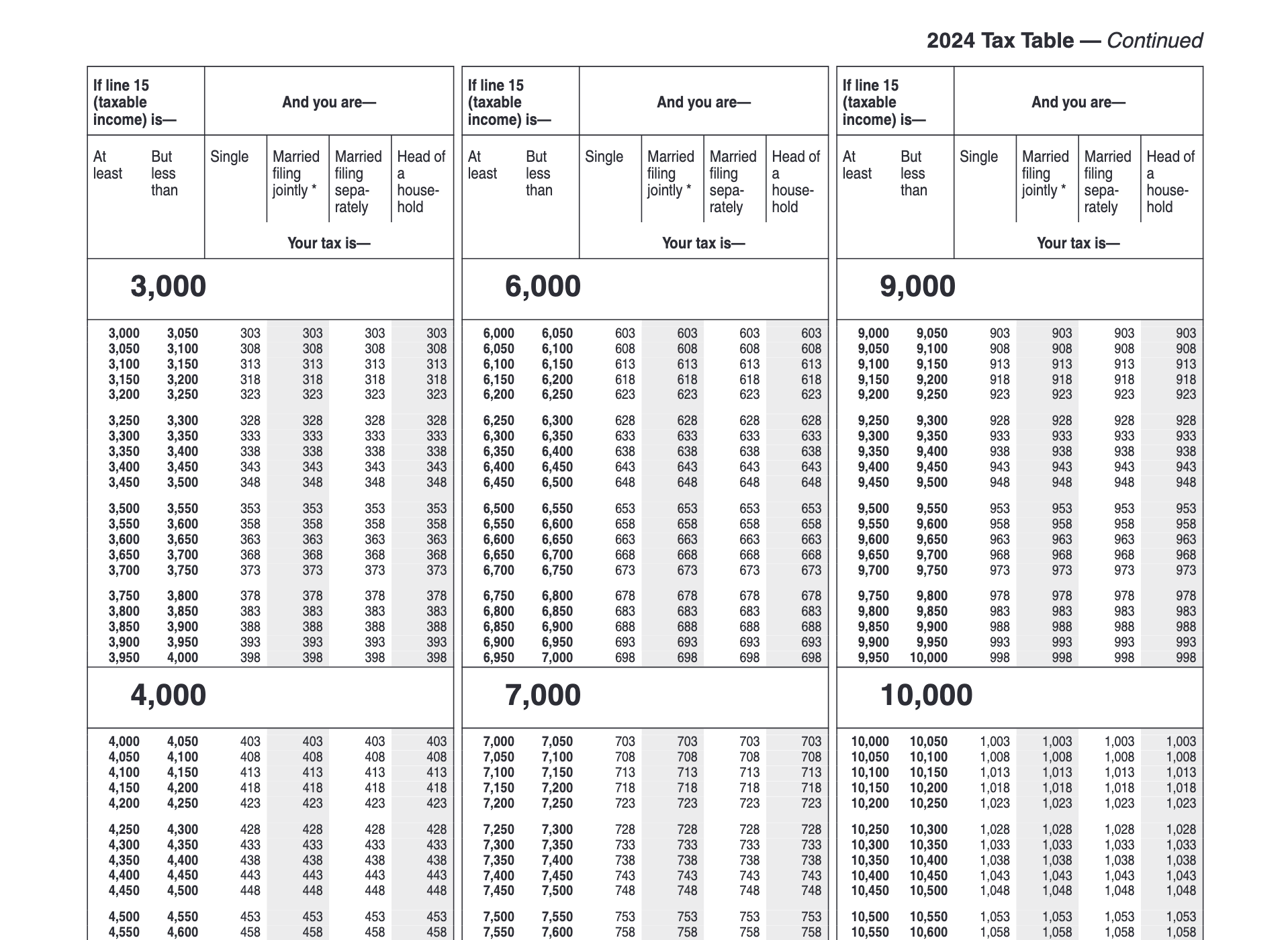

You are almost done! Using the number from Line 15: Taxable Income from the previous section, all we need to do now is to figure out your tax using the instructions for Form 1040. Specifically, look at the instructions for Line 16: Tax. The instructions are a little verbose: but for international students, the only part that applies to international students is the following:

Tax Table or Tax Computation Worksheet.

If your taxable income is less than $100,000, you must use the Tax Table, later in these instructions, to figure your tax. Be sure you use the correct column. If your taxable income is $100,000 or more, use the Tax Computation Worksheet right after the Tax Table.

Basically, you must look up your tax using your taxable income from Line 15. Here is the direct link to the web version Tax Table. Unfortunately, the formatting is quite poor, so the table is very difficult to read. Here's a pro-tip: use the PDF version of the Tax Table instead, the formatting is much more comprehensible.

Instructions for Form 1040, PDF Version

You will want to use this to look up your tax on the tax table, because the formatting on the web version is very difficult to read. The tax table is located on page 64

Once you have found your tax, write it on Line 24. This is your total tax. We will now proceed to the subsequent section where you balance it against the amount withheld from your pay.

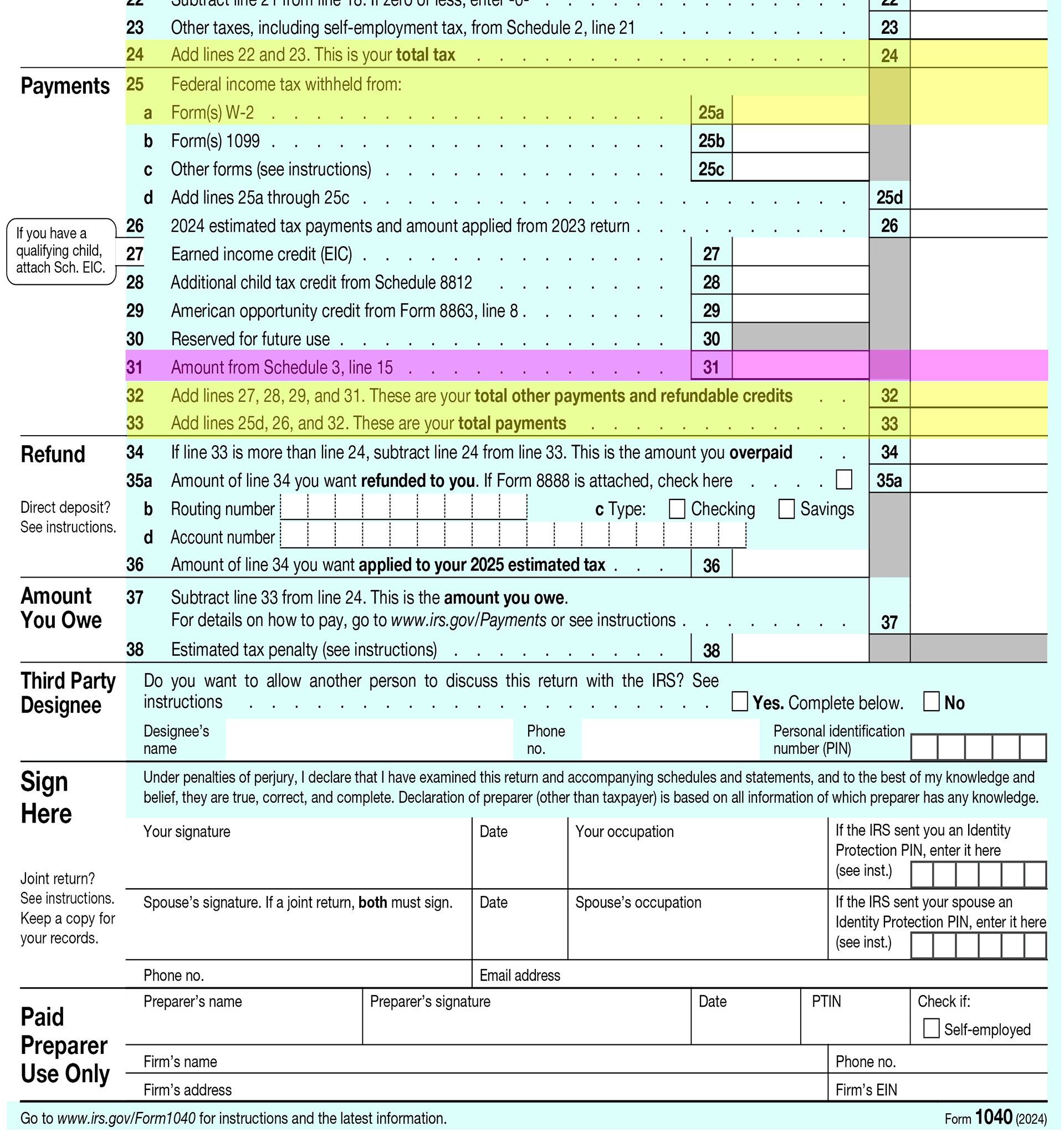

Payments, Refund, and What You Owe

You're almost done. Now fill in the number from your W-2 Federal Income Tax Withheld into Line 25 of Form 1040. Next, follow the instructions on each line, in order to compute the balance between your total tax (line 24) and your withholding (line 25).

Finally, you will find either the amount you owe, or the amount you'll be refunded. Hurrah! You just successfully filled out Form 1040!

Completing the Minimal Tax Return

Congratulations! You just completed the most important part of your tax return, your Form 1040. Now, as long as you do not have any investment income, your tax return is technically complete. Simply submit it along with your W-2 to the IRS, and you will be done.

However, if you had any contributions to IRAs or HSA accounts, you should continue reading this guide. After all, you will need to properly deduct your IRA or HSA contributions, in order to not be taxed on them. Likewise, if you have investment income, or claim an educational tax credit, you'll have to fill out some additional Schedules. Don't worry, the process is very straightforward. And we'll go through it step by step.

Please share collegetaxguide.org with your friends! This guide is a passion project, and I want to help out as many international students as possible. Share this post with your friends, or your campus group-chat!

Additional Schedules and Forms

Do You Have any IRA or HSA Contributions?

The rest of this guide is still under construction. I have already prepared my notes, but I still need to finish creating the diagrams, flowcharts, and writing out the guide. Thank you for your patience!

In the meantime, please feel free to follow the official IRS instructions for each form (the instructions are very comprehensive).

Do You Have Any Investment Income?

The rest of this guide is still under construction. I have already prepared my notes, but I still need to finish creating the diagrams, flowcharts, and writing out the guide. Thank you for your patience!

In the meantime, please feel free to follow the official IRS instructions for each form (the instructions are very comprehensive).

Are You Able To Claim Any Tax Credits?

The rest of this guide is still under construction. I have already prepared my notes, but I still need to finish creating the diagrams, flowcharts, and writing out the guide. Thank you for your patience!

In the meantime, please feel free to follow the official IRS instructions for each form (the instructions are very comprehensive).

How To Send Your Tax Return to the IRS

The rest of this guide is still under construction. I have already prepared my notes, but I still need to finish creating the diagrams, flowcharts, and writing out the guide. Thank you for your patience!

In the meantime, please feel free to follow the official IRS instructions for each form (the instructions are very comprehensive).

E-Filing Via IRS Direct File or IRS Free Fillable Forms

How to Send a Physical Letter in the Mail

A Word of Thanks

If you’ve ever searched “How do I file a Form 1040-NR?”, you’ve probably come across websites from tax firms or software companies that offer vague, low-quality information—only to end with a pitch like, "Taxes are complicated. Hire us!"

The College Tax Guide is not one of those websites.

I firmly believe that with patience and the right information, anyone can prepare their own taxes. And as international students, we should empower each other with knowledge— living away from home is hard enough as it is. So if you found this guide helpful, please share it with your fellow students, researchers, and scholars (whether international or not!)

So instead of a sales pitch, here’s a word of thanks—to you, the international student, researcher, or scholar. Thank you for reading my guide. Thank you for your time and attention.

Taxes can be complicated. But you are capable. You are resourceful. You’ve got this.