Guide for Nonresident Aliens with U.S.-Source Income

Who this Guide is For

Here are some common situations where this guide will apply. If you are at all uncertain, make sure to first read the Start Here Guide to determine if this page applies to you.

- Are you a F-1 Visa student with an on-campus job or work-study income?

- Are paid to be a Teaching Assistant (TA) or Research Assistant (RA)?

- Are you a J-1 Researcher who is being paid a salary by your U.S. institution?

- Are you a H-1B visa holder who did not meet the Substantial Presence Test for the tax year, because you arrived in the middle of the year?

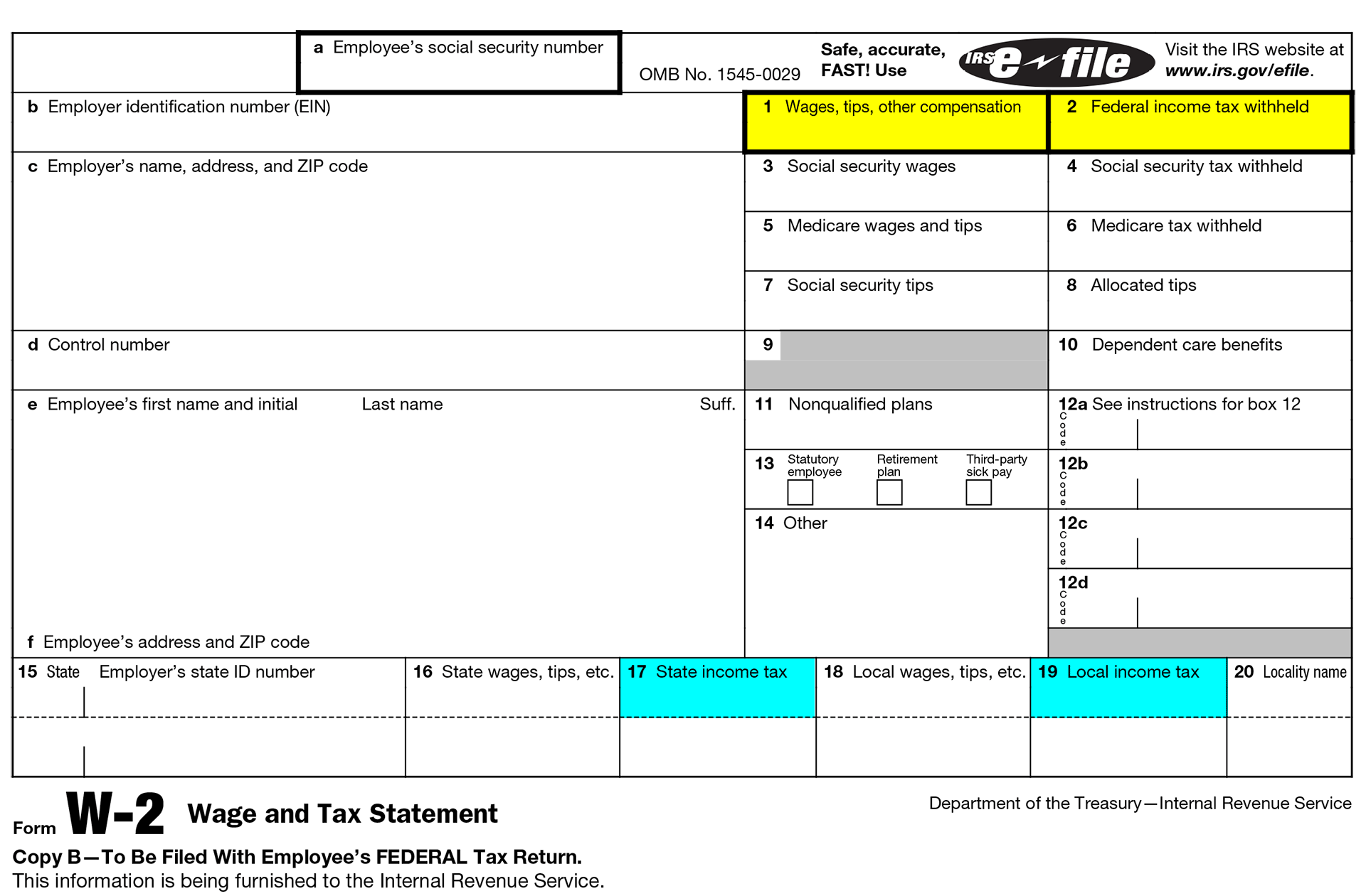

- Have you received a Form W-2 Wage and Tax Statement?

In all of these situations, you are a Nonresident Alien with taxable, U.S.-source income. This guide will walk you through how to file your taxes.

The Reason You Must File

It is the law. If you received any U.S.-Source income, no matter how little, you must file a tax return. According to the IRS, "there is no minimum dollar amount of income that triggers a filing requirement for a nonresident alien, including a foreign student or a foreign scholar." But beyond that, it is in our best interest to file a tax return. Because by filing a tax return you will be saving money. Let me explain why.

How Taxes Work in the United States

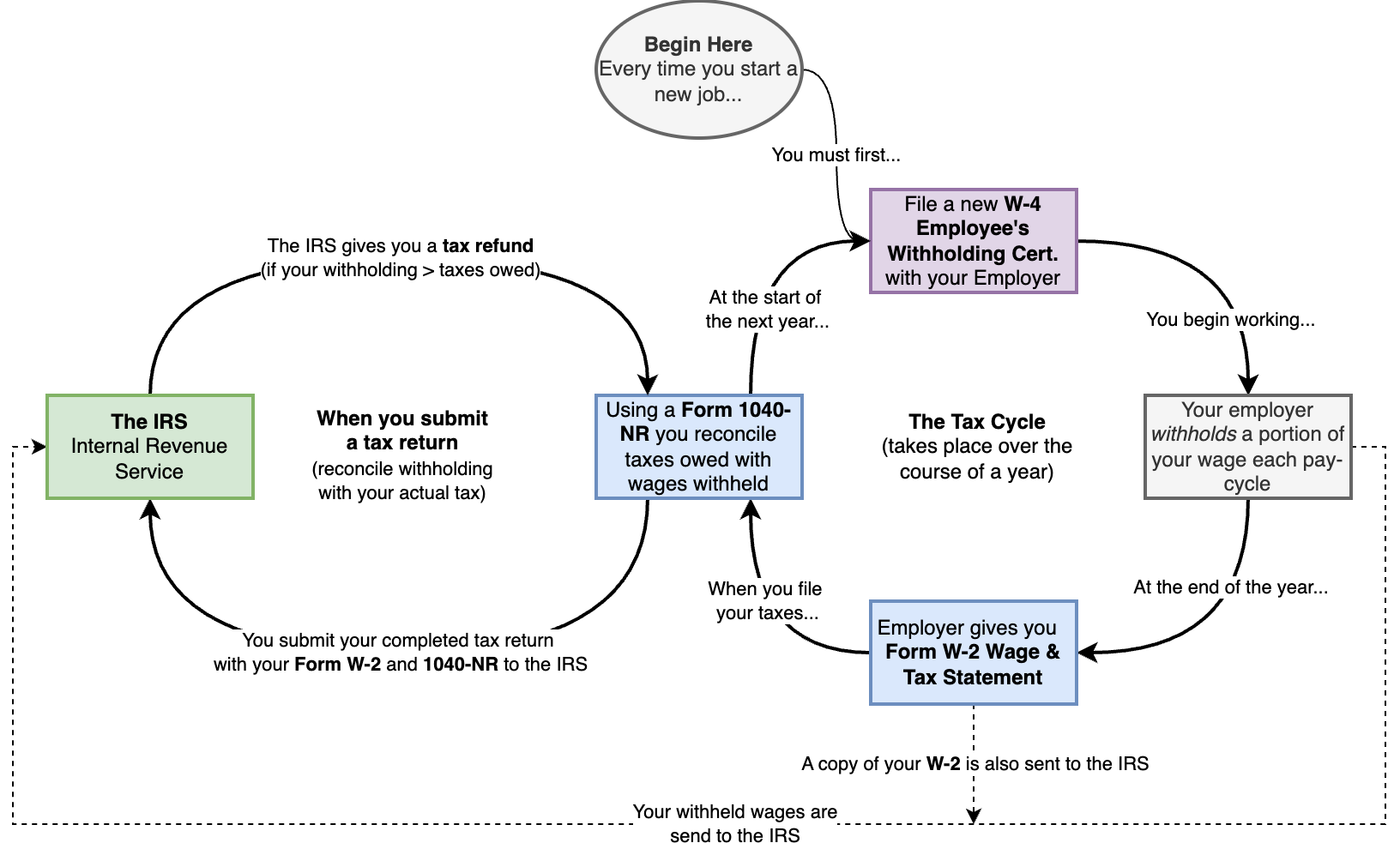

When you start a job in the U.S., your employer is required to withhold a portion of each paycheck for taxes. To determine how much, they ask you to fill out Form W-4, Employee’s Withholding Certificate. Only after completing this form can you begin working, and with every paycheck, a portion of your earnings is set aside for tax.

At the end of the year, your employer totals up how much they withheld and how much they paid you. This information is sent to both you and the IRS in a document called Form W-2, Wage and Tax Statement. Now, the ball is in your court. It’s up to you to reconcile the money that was already withheld with the taxes that you actually owe. The only way to do this is by filing a tax return—Form 1040-NR for most international students.

In a perfect world, back at the start of the year you would have filled out Form W-4 knowing exactly how much tax you owed. And your employer would have withheld the correct amount. If that were the case, filing your tax return would show that everything balances out to zero—you neither owe additional taxes nor have overpaid.

Why Filing a Tax Return (Often) Saves You Money

But we don’t live in a perfect world. And if you’re like most international students, you probably had no idea how taxes worked when you first started your on-campus job. As a result, many students end up having too much tax withheld—more than they actually owe.

This happens especially because most countries have tax treaties with the U.S., where students (and visiting professors and researchers) have reduced tax rates or even full complete exemptions from paying income tax. If you don’t file a tax return, you won’t know if you overpaid—and you won’t get that money back.

According to Article 21 of the 1994 France-American Income Tax Treaty, a French student "who is temporarily present in the other Contracting State for the primary purpose of: (i) studying at a university or other recognized educational institution in that other Contracting State" is completely exempt from income tax for the first 5,000 dollars earned in every year, subject to limitations. Most countries have similar terms in their tax treaties. You'll learn how to claim these treaty benefits later on in this guide!

By filing, you’ll determine your actual tax obligation and, in many cases, get a refund for any excess tax withheld. And thee whole reason I'm writing this guide, is to help you claim every treaty benefit and deduction that you are legally entitled to. Remember, these are tax breaks that the diplomats of our country have negotiated for our benefit. We should make sure that their kind and diligent work does not go to waste!

The Flowchart

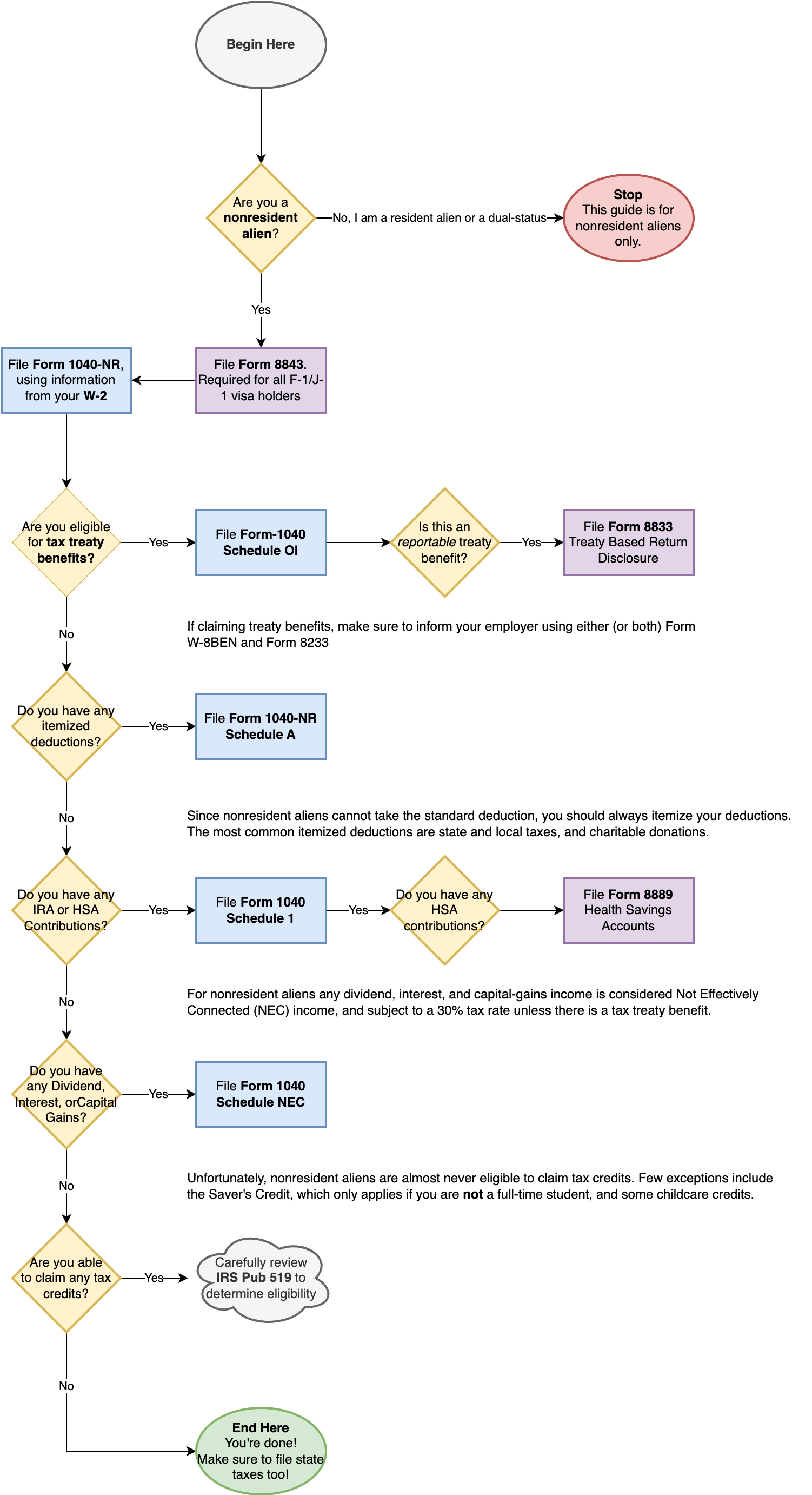

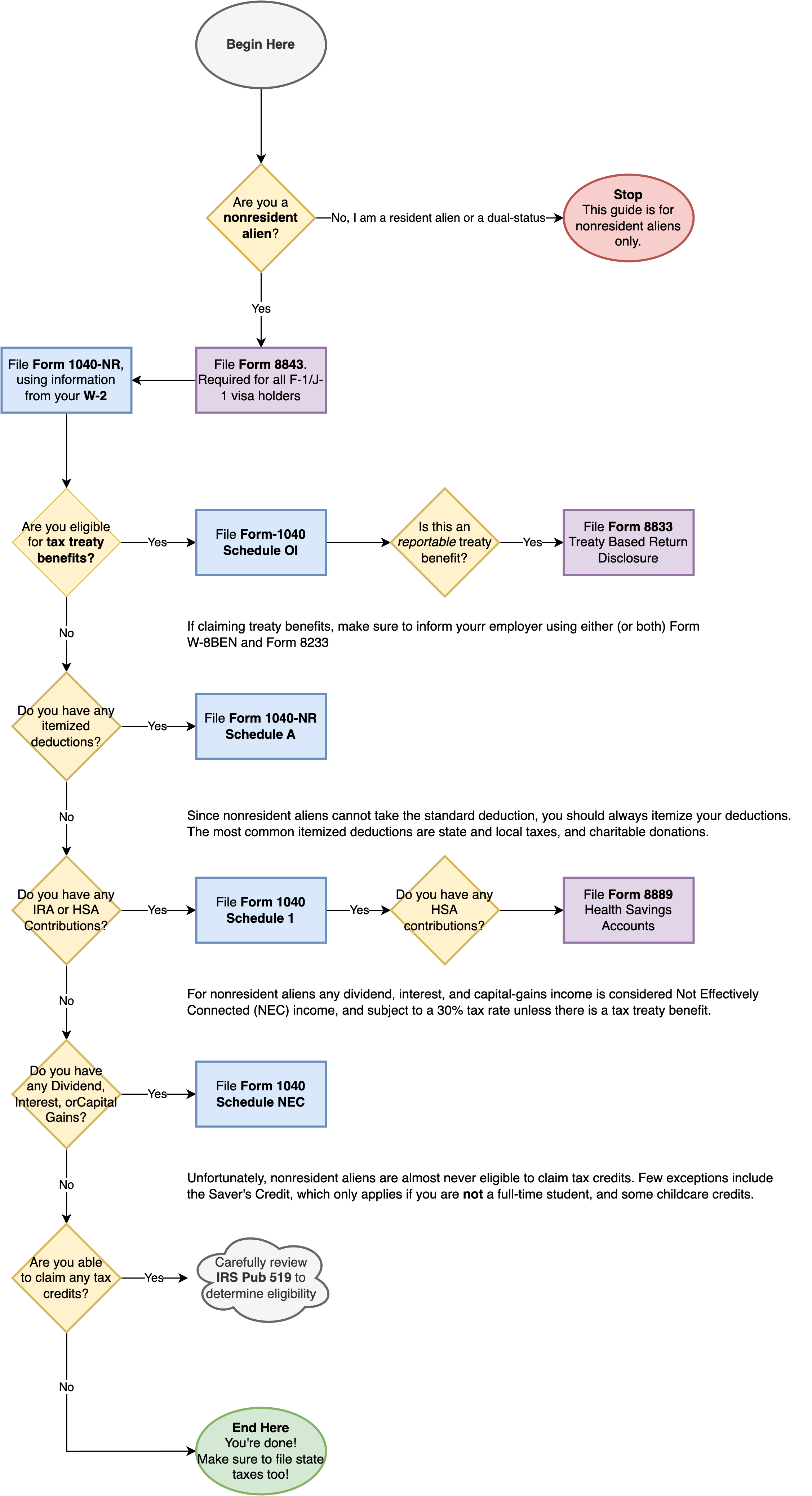

Alright. Now that you understand why you should file a tax return, let's get the process started. To begin, here's an overview of the steps that you will be taking.

First, take a deep breath. Don't panic. This flowchart might look complicated at first, but not every step will apply to you. If you’re not claiming treaty benefits or dealing with a more complex tax situation (like stocks, crypto or investments), then you will only be filling three forms.

The IRS Forms that You Will Need

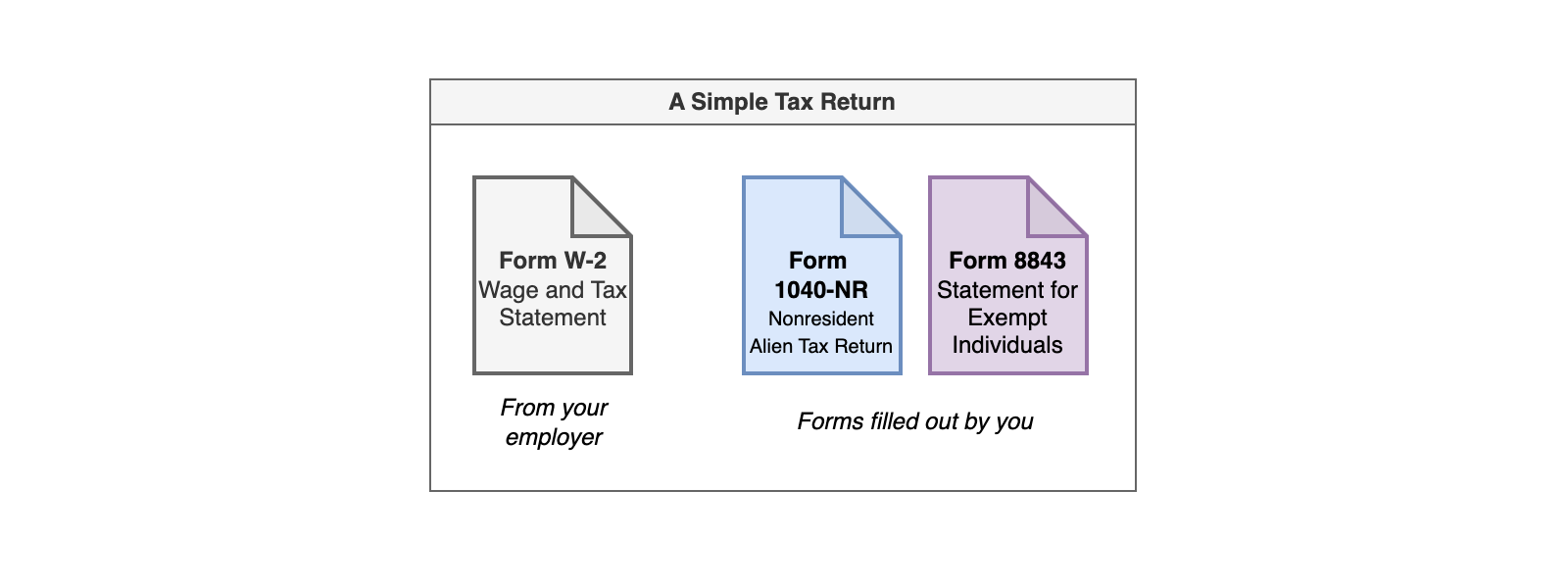

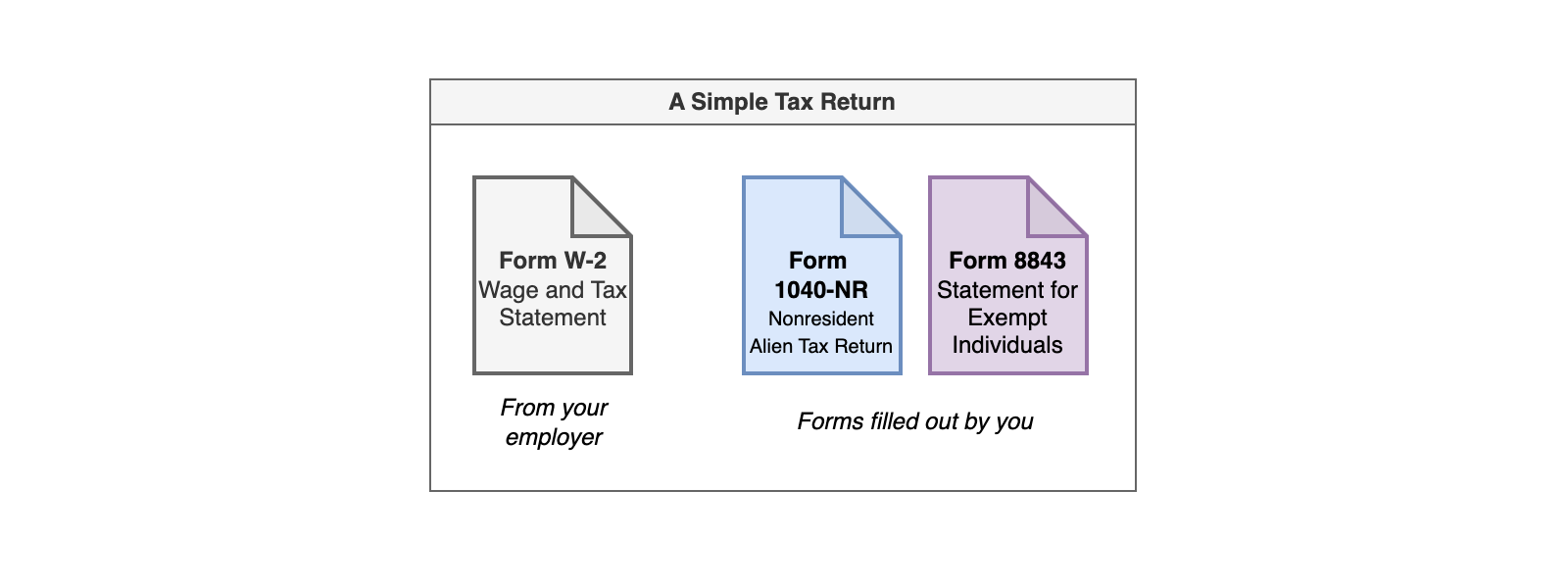

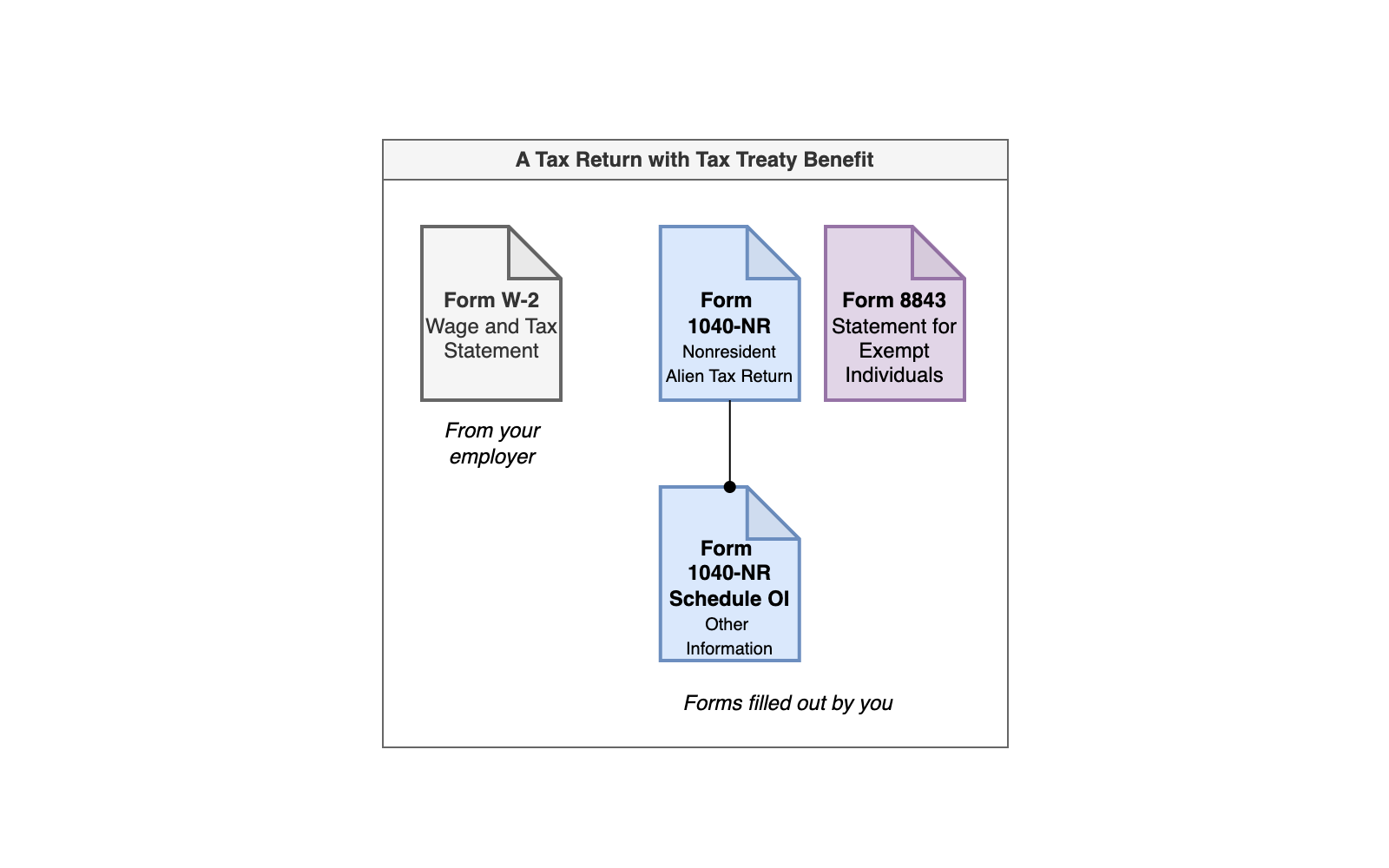

Every Nonresident Alien will have to file three forms for their tax return.

- Form W-2 Wage and Tax Statement (you receive this from your employer)

- Form 1040-NR U.S. Nonresident Alien Income Tax Return

- Form 8843 Statement for Exempt Individuals and Individuals with a Medical Condition

Of these three, Form W-2 is already filled out by your employer and provided to you. You will fill out the Form 1040-NR by copying numbers from your Form W-2, and you will fill out Form 8843 using information from your passport and visa. It's really not too bad at all.

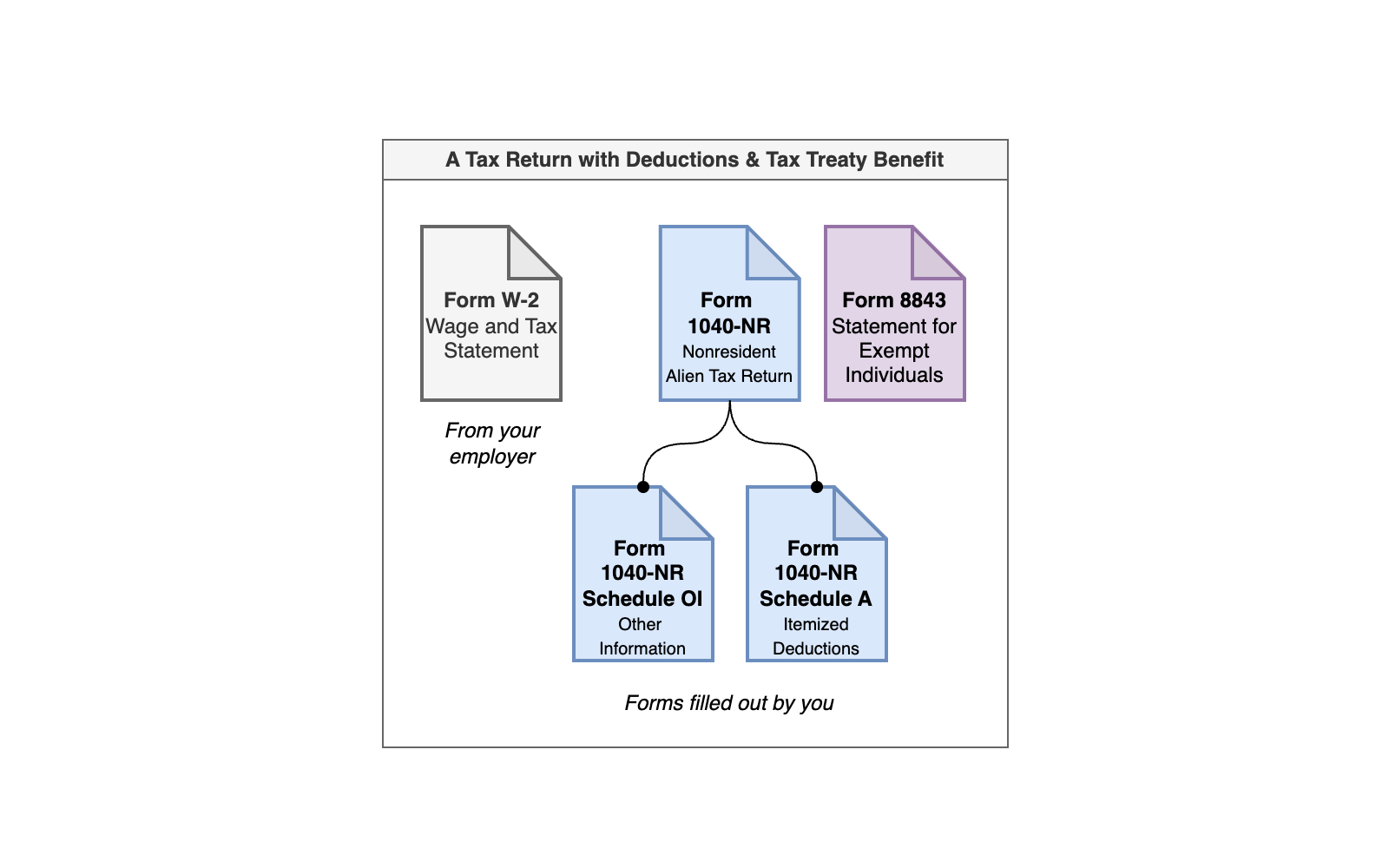

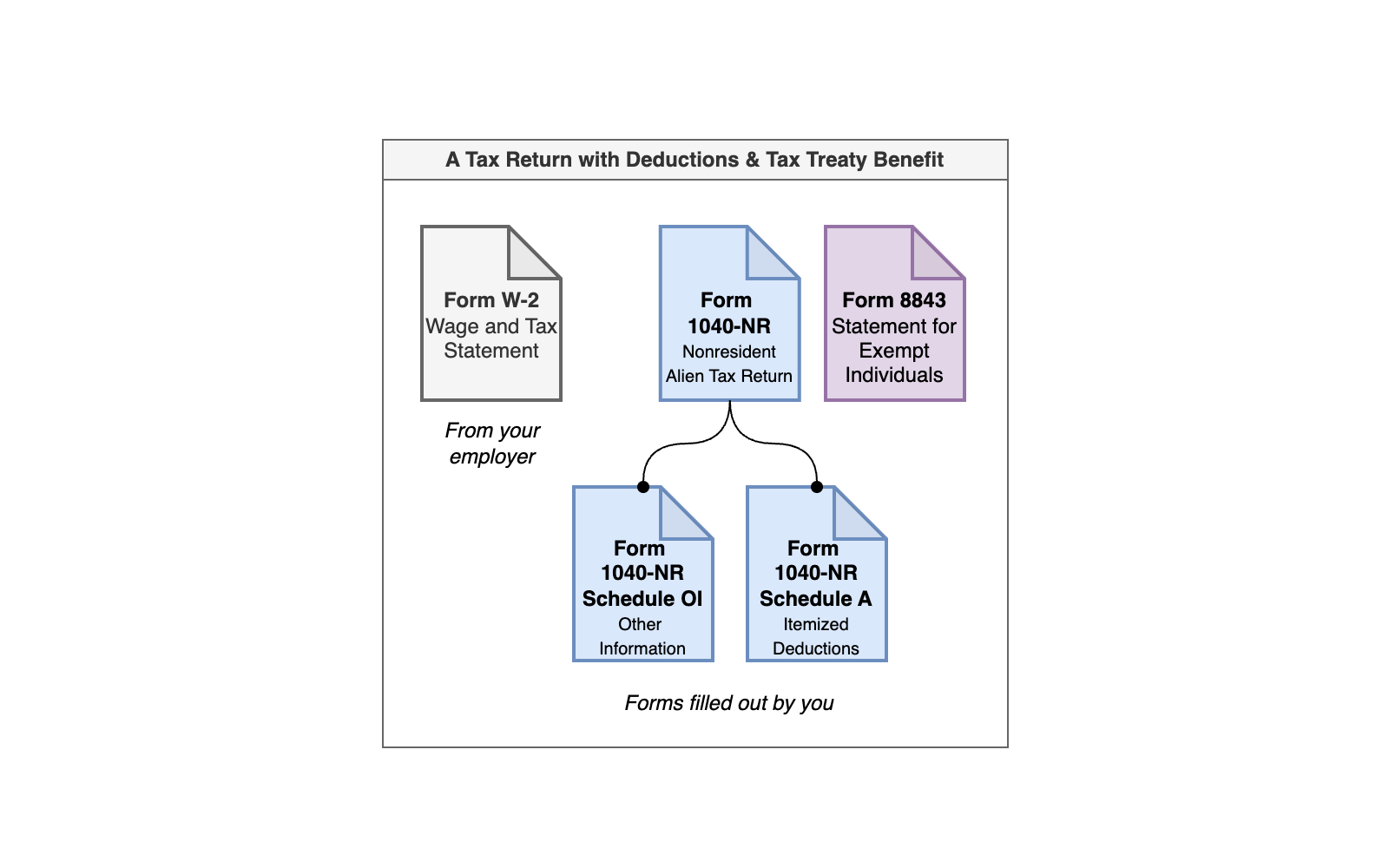

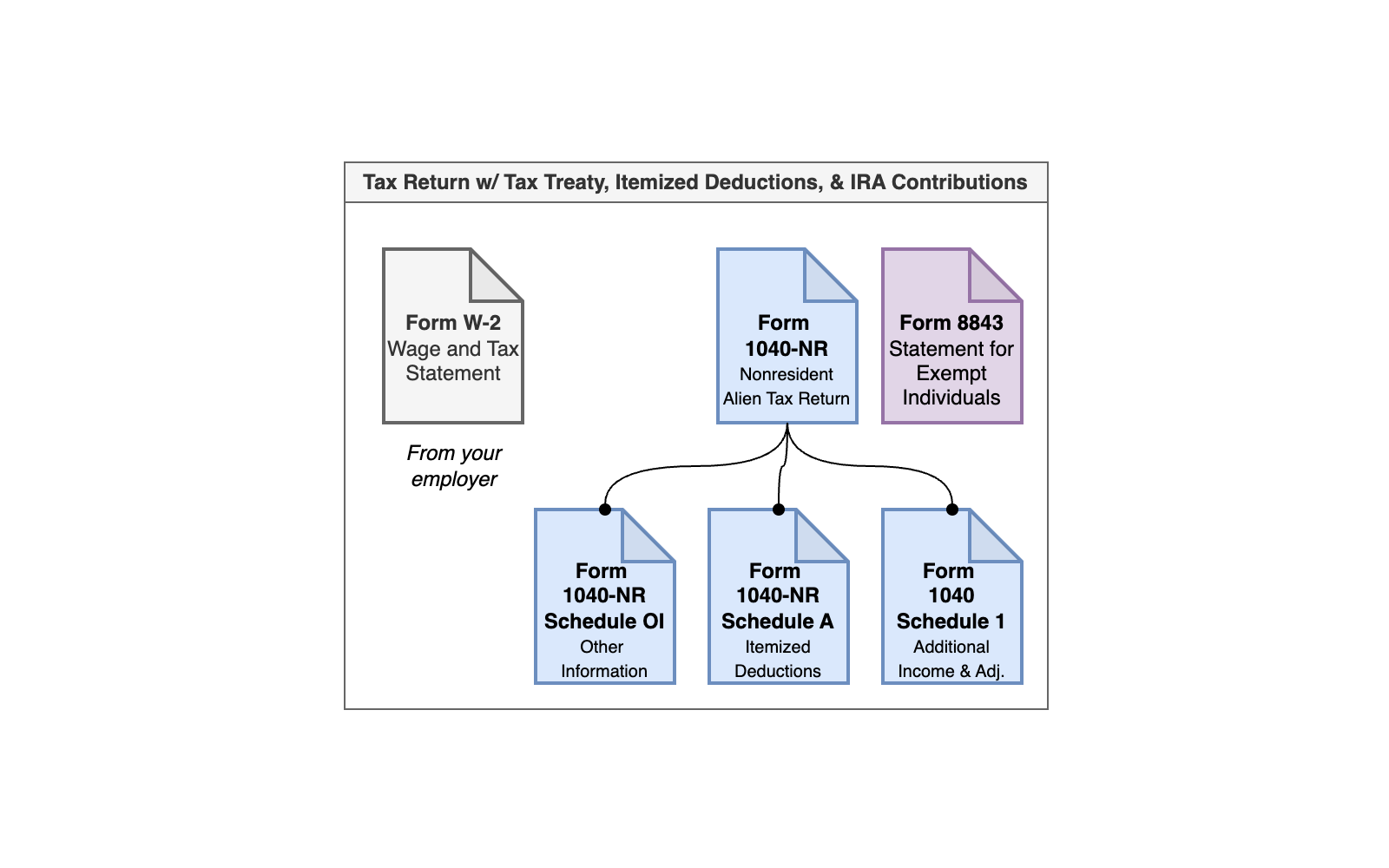

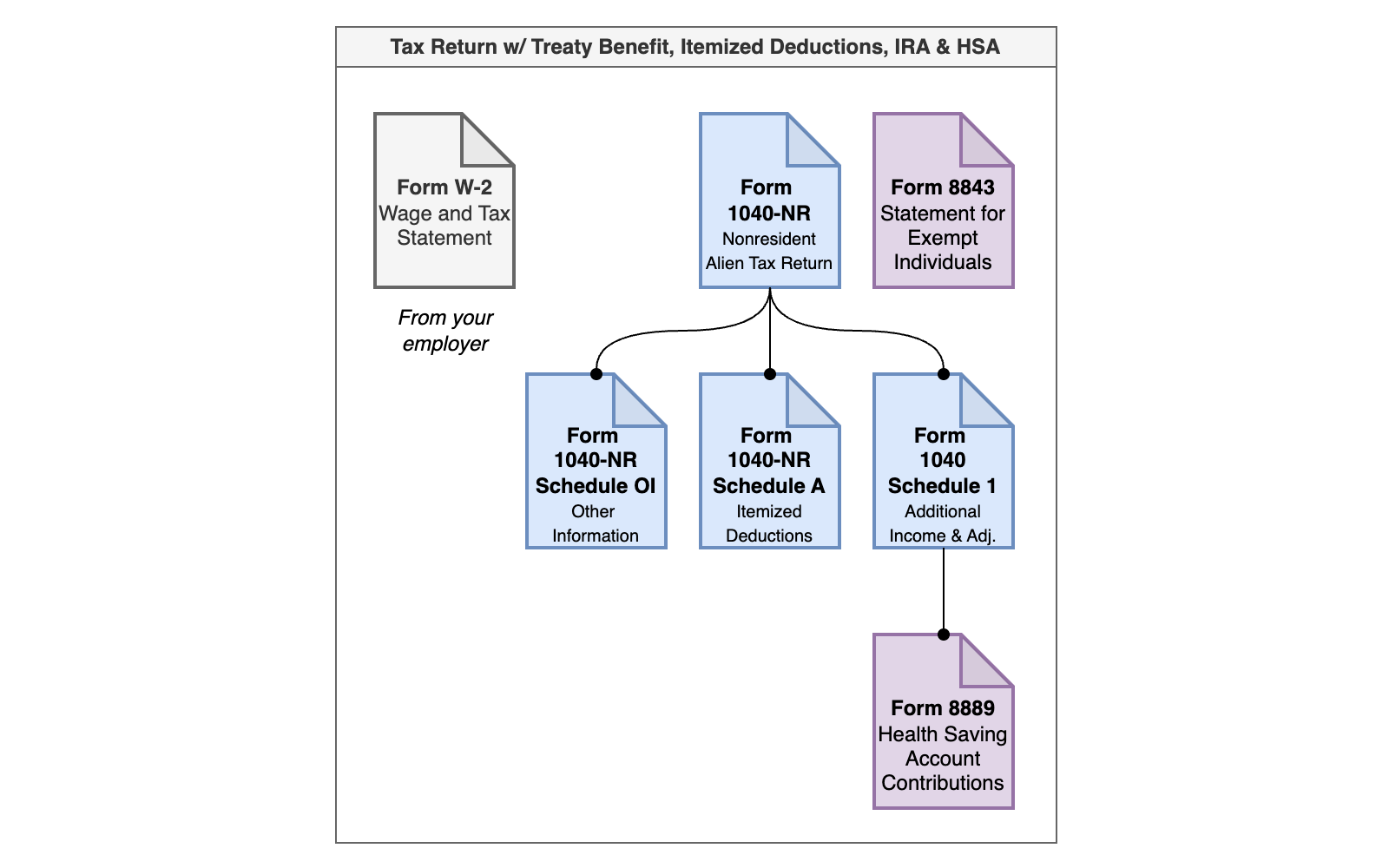

Afterwards, depending on how complex your tax situation is, you might either file some additional Schedules (i.e. appendices) for your Form 1040-NR (indicated in blue in my flowchart) or some supplementary forms (indicated in purple in my flowchart). For example, if you are claiming a tax treaty benefit, and choosing to itemize your deductions (more on that later), your submission will look like this:

"Not too complicated, right? Things always get clearer with some helpful visuals. Now, let’s get organized. Create a folder to store all your tax forms—it's time to download them and start filling them out!" Pro-tip: always download the PDFs first, and open them from your desktop, not in the browser. Otherwise, you will be so sad if the browser crashes on you. Trust me, I know all too well how it feels.

You'll want to first save your Form W-2 Wage and Tax Statement. You'll receive this from your employer (which is often just your university). Next, navigate to the IRS website and download the PDF copies of Form 1040-NR and Form 8843. I've linked them both here below:

Form 1040-NR U.S. Nonresident Alien Income Tax Return

Form 8843 Statement for Exempt Individuals and Individuals with a Medical Condition

Walk-through of Form 1040-NR

Are you already used to filling out Form 1040-NRs by yourself? Feel free to skip ahead to the sections on Claiming Tax Treaty Benefits or Declaring Investment Income, if you're confident with the Form 1040 NR. I'm going slowly to help first-time tax filers. I hope you understand!

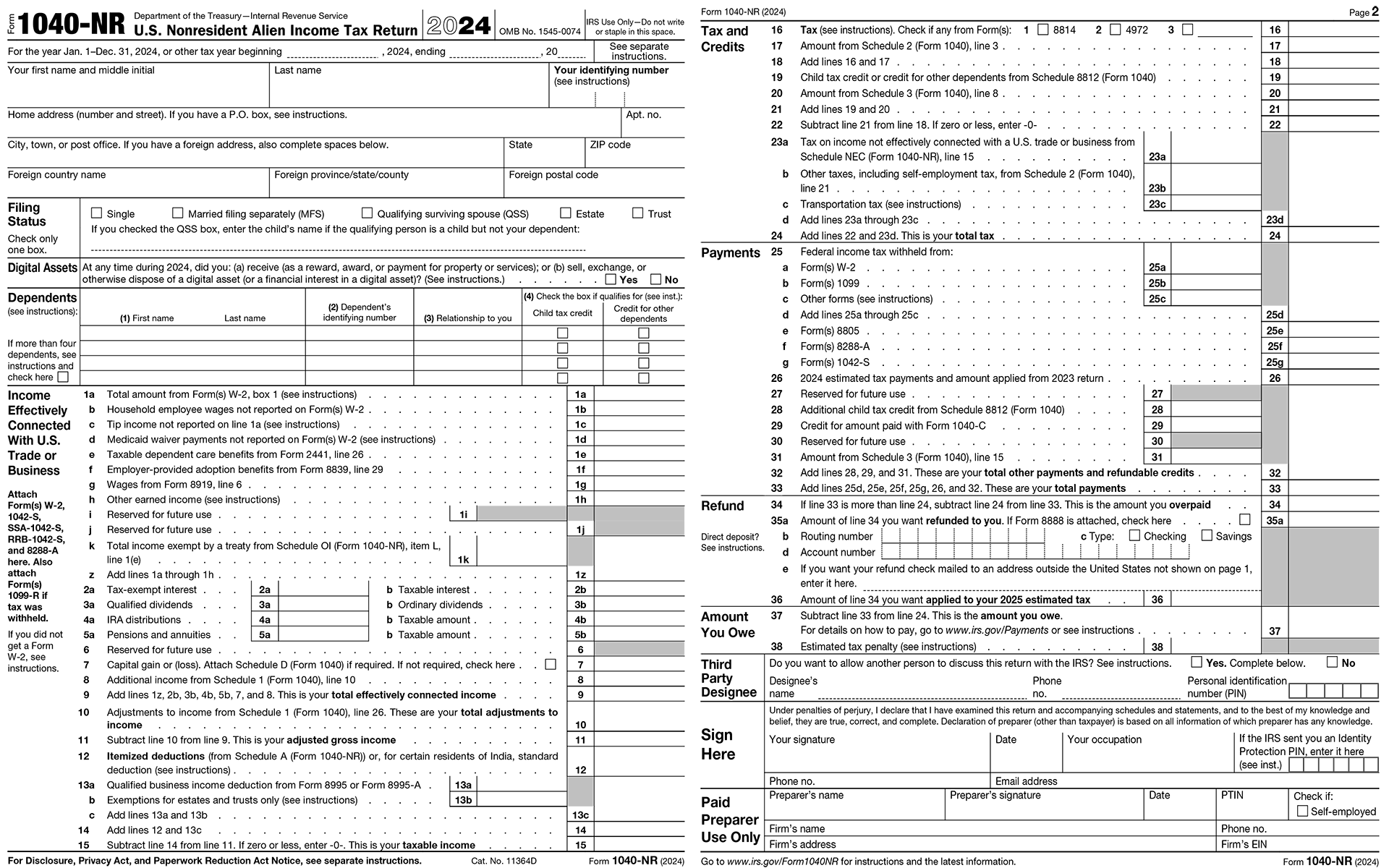

First, open your Form 1040-NR. It's called the U.S. Nonresident Alien Income Tax Return, and you can think of this as your "primary document." You'll be filling it in with information from the Form W-2 Wage and Tax Statement that your employer gave you.

Don't panic. Take a deep breath. Remember, a PDF has never hurt an international student before. We'll be going through Form 1040-NR section by section. The overarching structure of the form is quite straightforward:

- Income Effectively Connected with U.S: In the first section, you write in the money you earned, and add it all up.

- Tax and Credits: You take the sum from the previous section and calculate the tax on it. You also subtract the value of any tax credits from your tax bill.

- Payments: Remember our talk about withholding? Here, you write in the value of your withholding from your Form W-2 Wage and Tax Statement.

- Refund/Amount You Owe: Finally, you take the sum from the Taxes and Credits section, and subtract it from the sum in Payments.

It really is that simple.

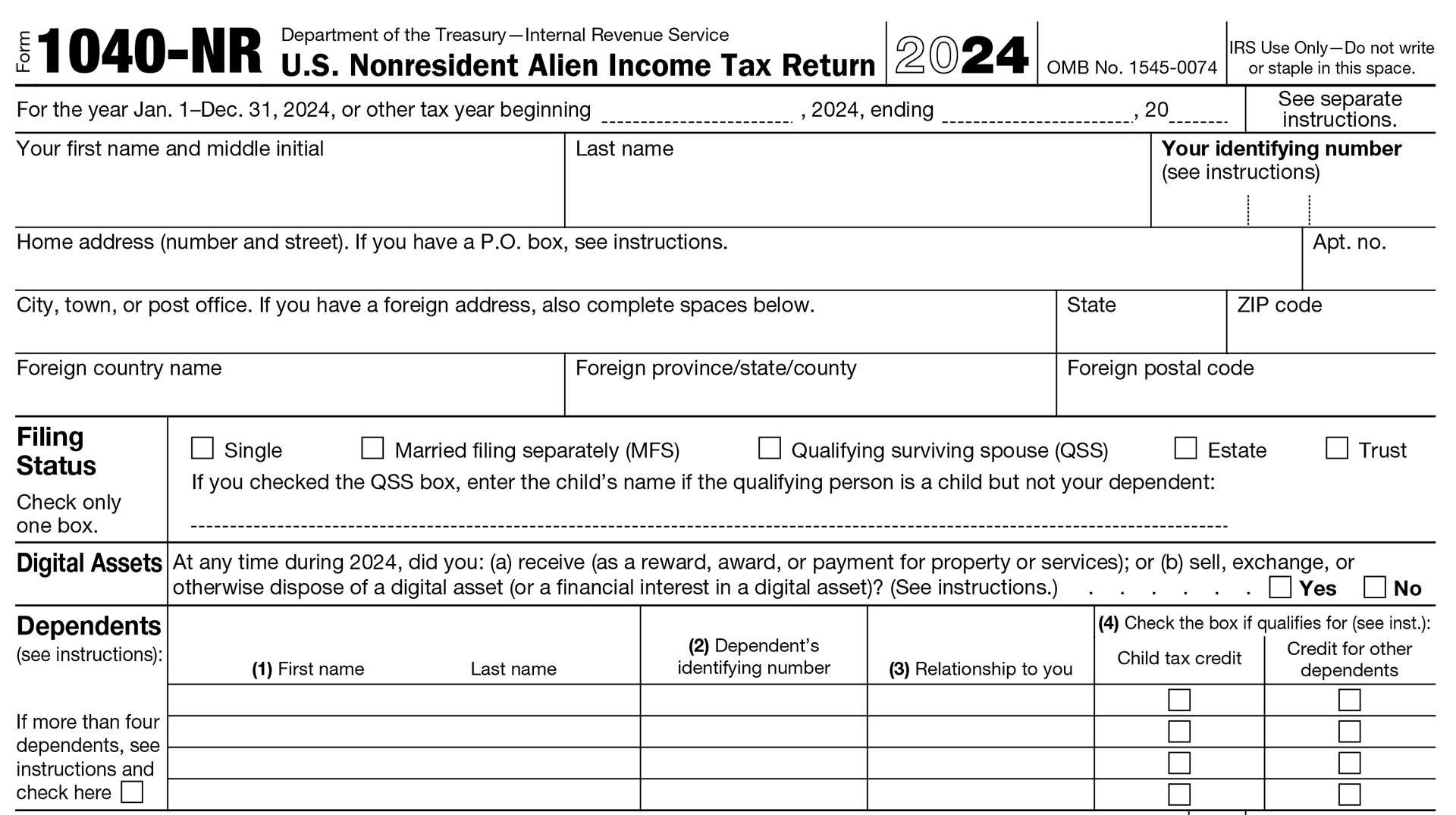

Form 1040-NR: Name, Filing Status, and Dependent Info

Instructions for Form 1040-NR

Every IRS Form comes with a comprehensive set of instructions. These instructions are either available on the IRS Website (linked above), or included with the form itself. Open the instructions in another tab, and keep it handy. This way you can refer to it, if you ever need help.

The first half of Form 1040-NR is mainly autobiographical. There are only two pieces of advice that are relevant for international students.

- Filing Status: If you're married, you must choose "Married Filing Separately." Nonresident aliens can't use the "Married Filing Jointly" status, which offers joint tax benefits. So, even if you're married, your tax status will be treated like "Single."

- Digital Assets: Yeah... they're worried about crypto. If you didn't do anything with cryptocurrencies, NFTs, or stablecoins of any kind, just check "No" and continue onward. However, if you do have any relationship with crypto, read the following content box for additional instructions:

Digital Assets: If you mined, traded, or were paid in crypto

If you have any relationship with crypto, you must read the section on Digital Assets on the Instructions for Form 1040 (without the NR) very carefully. You do not need to check the digital assets box if you simply purchased cryptocurrencies (like with real money), and kept them.

However, if you received crypto as a payment, through mining, or sold crypto in any way, then you must declare it. Since you are a Nonresident Alien, any proceeds from cryptocurrencies will be considered Not Effectively Connected Income (NEC). This means it's income that was not connected with the purpose of your F-1 visa, i.e. your on-campus job.

In most cases, NEC income is taxed at a punitive rate of 30%, (see IRS Publication 519, Tax Guide for Aliens, Section FAQ) and you must declare it on Form 1040-NR Schedule NEC.

You'll need to follow the instructions the section on Investment Income that is coming up in this guide in order to learn how to fill out a Form 1040-NR Schedule NEC.

Once you have filled out the start, we will proceed to the next section: Income Effectively Connected with U.S. Trade or Business.

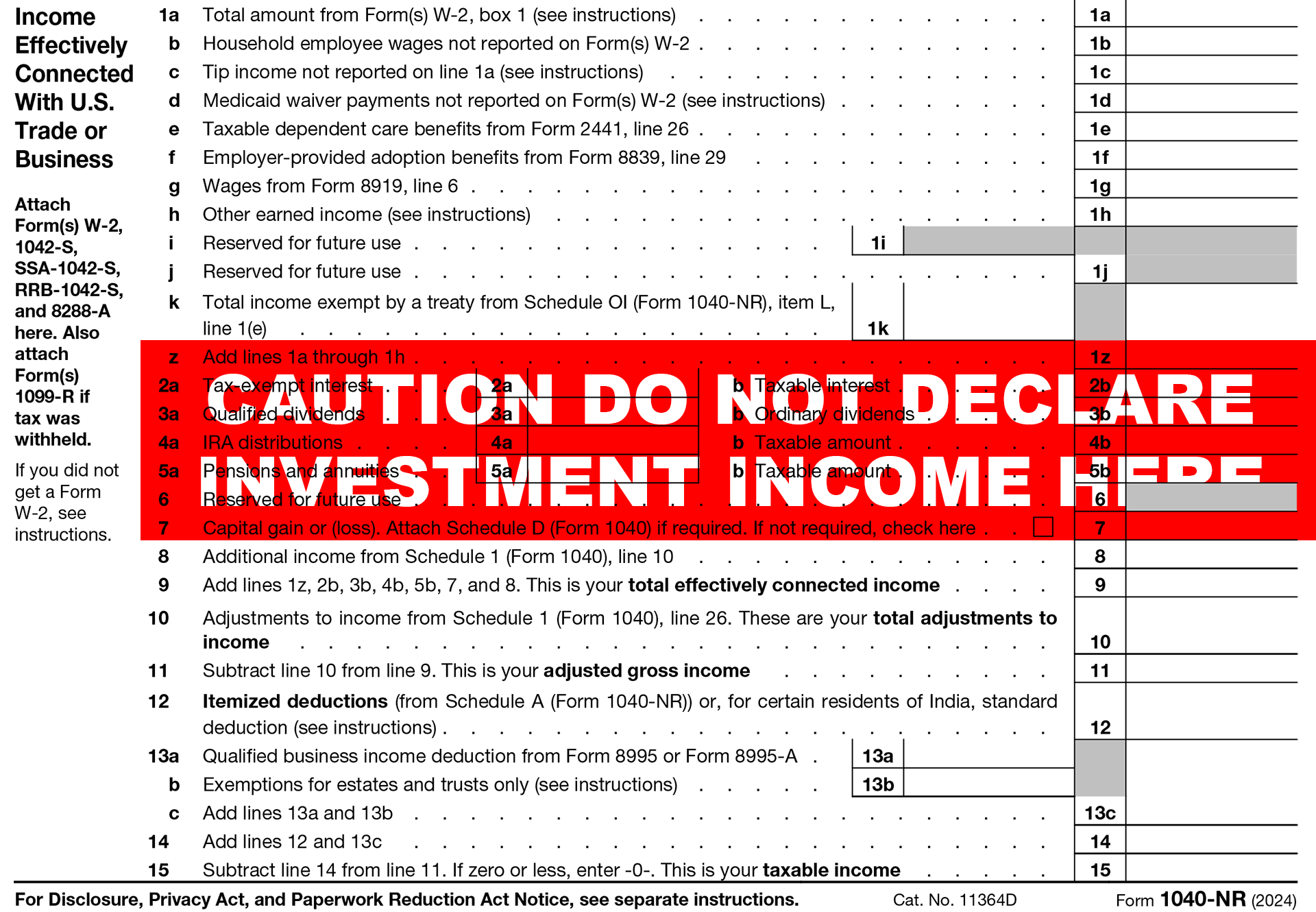

Income Effectively Connected with U.S.

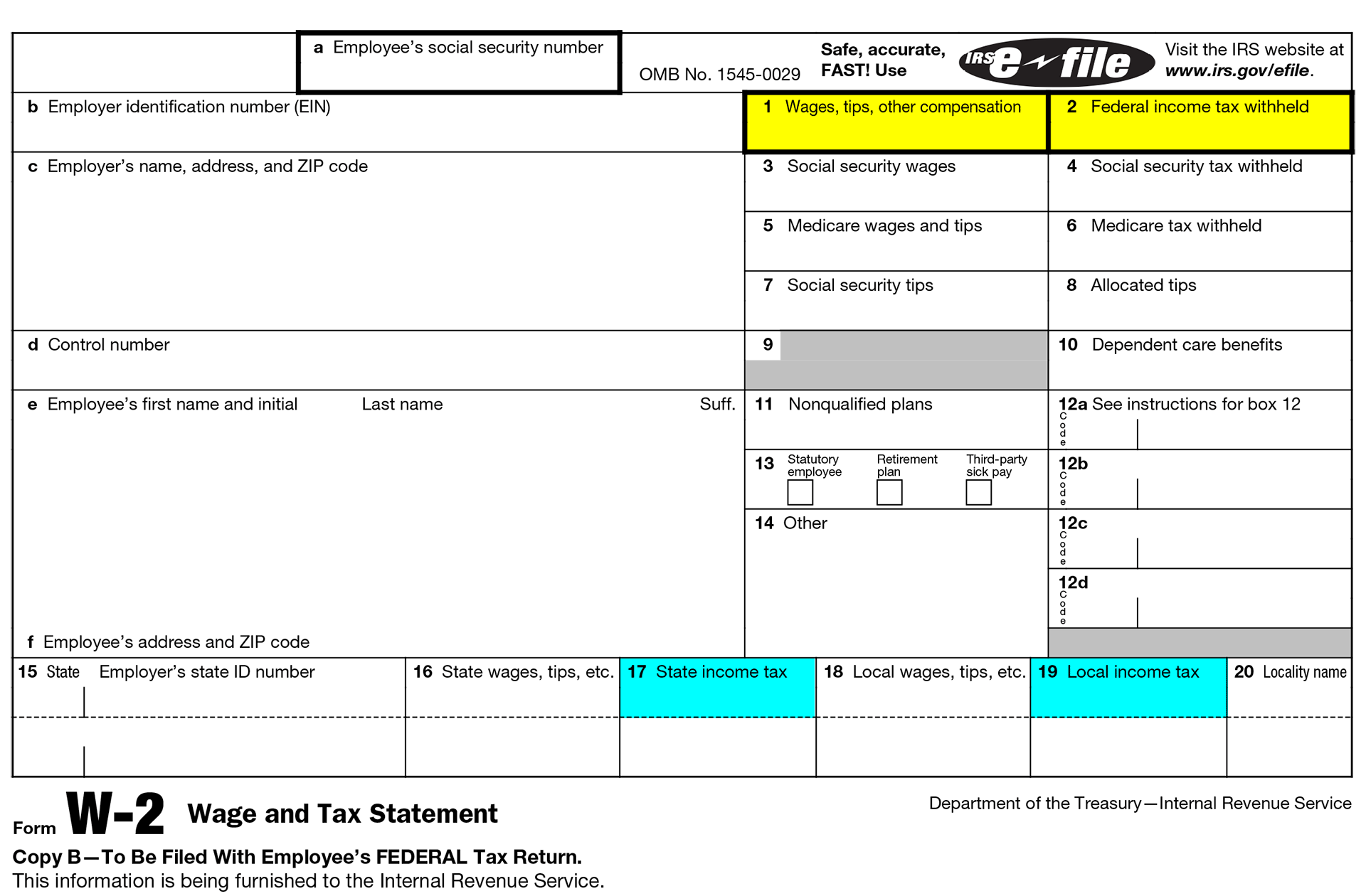

This is the section where we report our income. Don't let it intimidate you: most of the lines simply do not apply to us. I've gone ahead and highlighted in yellow all the lines necessary for a "typical" tax return. The lines in cyan will only be used if we declare a tax treaty benefit, or have itemized deductions. All the other lines will almost never apply.

As international students, we are not allowed to work off-campus, so we will not have any sort of income other than what is on our Form W-2.

Enter the amount from Wages, tips, other compensation (line 1 of your Form W-2) into line 1a of Form 1040-NR. That’s it! If you’re claiming a tax treaty benefit or itemizing deductions, we’ll revisit this section later (see the cyan-highlighted lines), but for now, that's all you need to do. Follow the instructions on each line (they tell you to add different sections up), until you arrive at the number on line 15: that is your taxable income.

Do Not Declare Investment Income in Lines 2a – 7

If you earned any money from investment activity, such as interest (from bonds or treasury securities), dividends (from stocks), or capital gains (from trading), do not declare them in lines 2a – 7. Investment income is not effectively connected income (NEC), and must be declared in Form 1040-NR Schedule NEC.

What is Effectively Connected Income (ECI) and NEC?

In the U.S., Nonresident Aliens are only taxed at ordinary income tax rates on Effectively Connected Income (ECI)—which includes wages from a job or business activity in the U.S. As international students, we are not allowed to run a business, so our only ECI typically comes from on-campus jobs or Optional Practical Training (OPT).

Investment income—whether passive (e.g., interest, dividends) or active (e.g., stock trading)—is not part of our authorized work and is considered Not Effectively Connected (NEC) income. Because of this, it should not be reported in lines 2a–7 of Form 1040-NR. Instead, it must be reported separately on Schedule NEC of Form 1040-NR. There are specific nuances at play here (such as the 183-day rule for capital assets), which I will elaborate in the later section.

Lines 2a–7 mostly apply to Nonresident Aliens who are not students. For example, an H-1B visa holder who is a professional day trader can declare stock trading income there because trading is their authorized business activity. NEC income is taxed at a rate of 30%, unless there is a specific treaty benefit which lowers it.

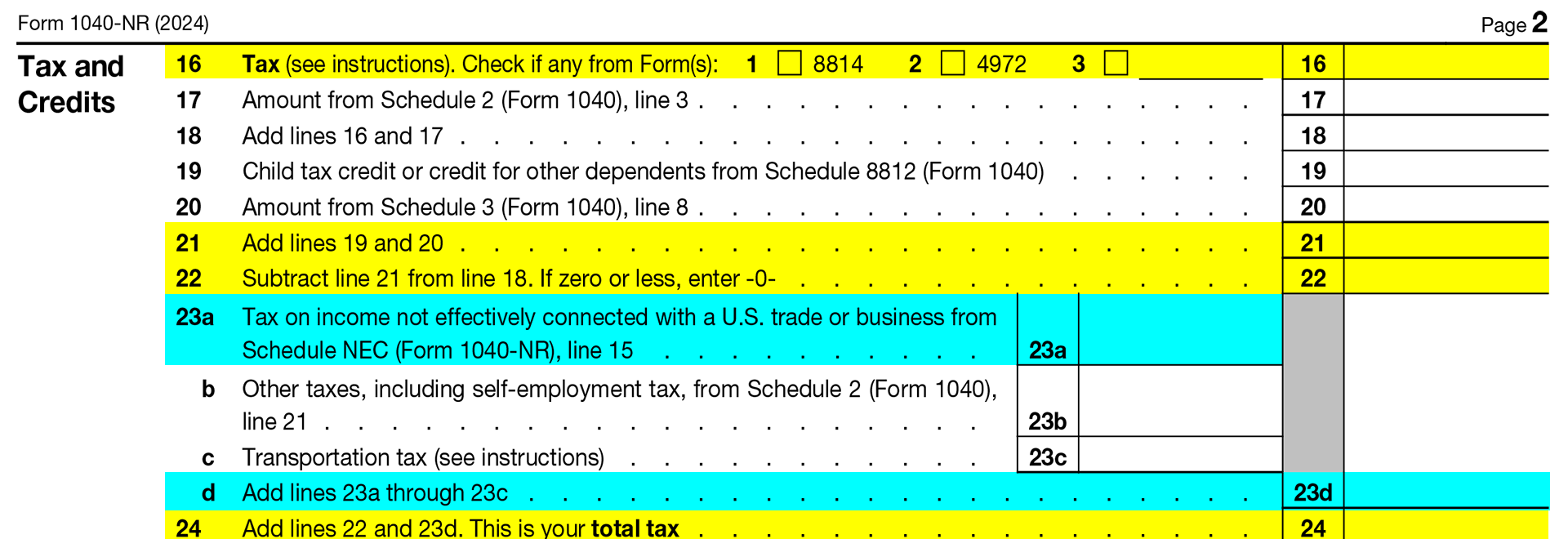

Tax and Credits

You are almost done! Using the number from Line 15: Taxable Income, all we need to do now is to figure out your tax using the instructions for Form 1040-NR. Let's see what the instructions say. They state:

Line 16—Tax

See Line 16—Tax in the Instructions for Form 1040 for details on taxes includible on this line, and for whether you must use the Tax Table or the Tax Computation Worksheet in those instructions to figure your tax.

Okay. That wasn't helpful at all. The IRS is basically telling us to go look for the instructions for Line 16 from Form 1040 (without the -NR). This is because the version of the form for Nonresident Aliens is substantially similar to the version for U.S. Citizens and Resident Aliens. No worries, I'll link it here.

Instructions for Form 1040

These are instructions for the regular, U.S. Citizen & Resident Alien version of the Income Tax Form. We'll need it to look up our taxes using the instruction for Line 16. The line numbers are mostly the same between Form 1040-NR and Form 1040.

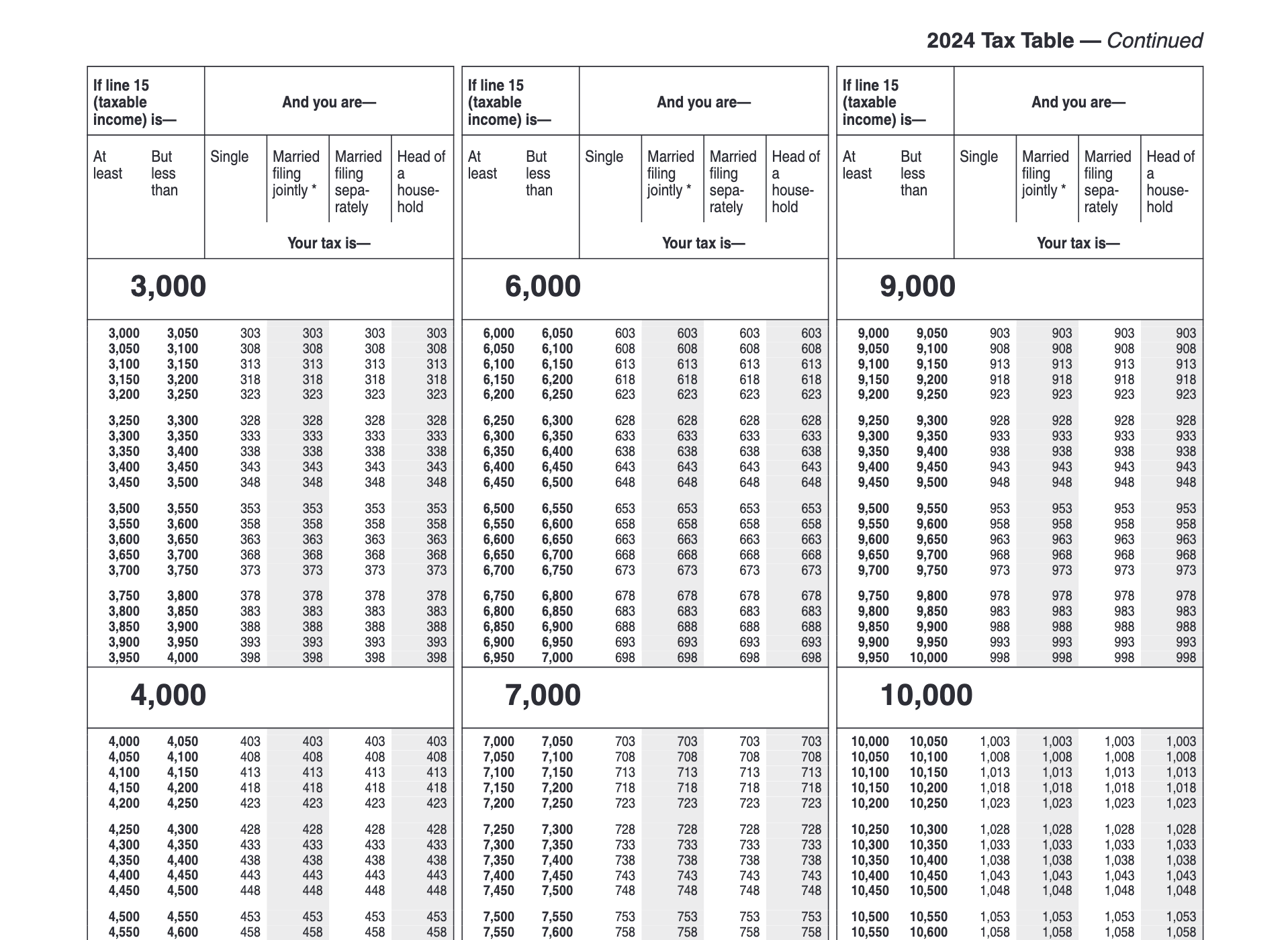

The instructions for Line 16 on Form 1040 (without the -NR) are quite long, but most of it does not apply to international students. The only thing we need to do is to look up our tax using the Tax Table:

Tax Table or Tax Computation Worksheet.

If your taxable income is less than $100,000, you must use the Tax Table, later in these instructions, to figure your tax. Be sure you use the correct column. If your taxable income is $100,000 or more, use the Tax Computation Worksheet right after the Tax Table.

Here is the direct link to the web version Tax Table. Unfortunately, the formatting is quite poor, so the table is very difficult to read. Here's a pro-tip: use the PDF version of the Tax Table instead, the formatting is much more comprehensible.

Instructions for Form 1040, PDF Version

You will want to use this to look up your tax on the tax table, because the formatting on the web version is very difficult to read. The tax table is located on page 64

Once you have found your tax, write it on Line 24. This is your total tax. We will now proceed to the subsequent section where you balance it against the amount withheld from your pay.

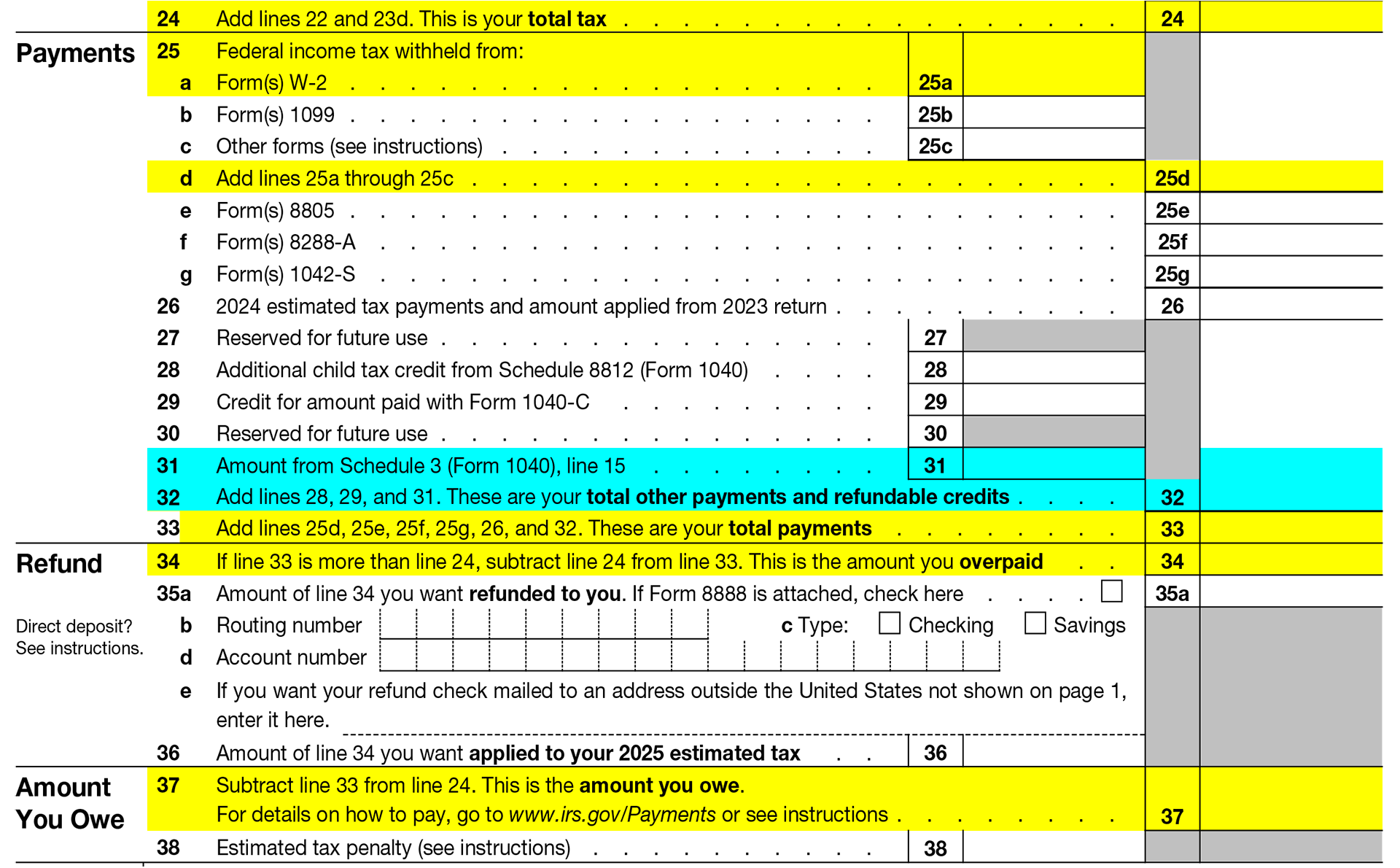

Payments, Refund, and What You Owe

You're almost done. Now fill in the number from your W-2 Federal Income Tax Withheld into Line 25 of Form 1040-NR. Now follow the instructions on each line, in order to compute the balance between your total tax (line 23) and your withholding (line 25).

Finally, you will find either the amount you owe, or the amount you'll be refunded. Hurrah! You just successfully filled out Form 1040-NR!

Completing the Minimal Tax Return

Congratulations! You just completed the most important part of your tax return, your Form 1040-NR Nonresident Tax Return. Now, as long as you do not have any investment income, the only other document you need to complete is Form 8843 Statement for Exempt Individuals. That form is very simple, and I have a detailed step-by-step walk-through in my other guide. Once you complete Form 8843, all you need is to submit that along with your Form W-2 to the IRS, and you are done.

However, I highly recommend you to continue reading. As an international student, you are almost certainly eligible for treaty benefits. If you file an additional appendix (called a "Schedule" in the IRS jargon), then you can potentially save hundreds of dollars, and get a larger tax refund. Likewise, if you choose to itemize deductions, you can potentially save more money too. So if you're not too exhausted, I recommend continuing on the guide!

Please share collegetaxguide.org with your friends! This guide is a passion project, and I want to help out as many international students as possible. Share this post with your friends, or your campus group-chat!

Additional Schedules and Forms

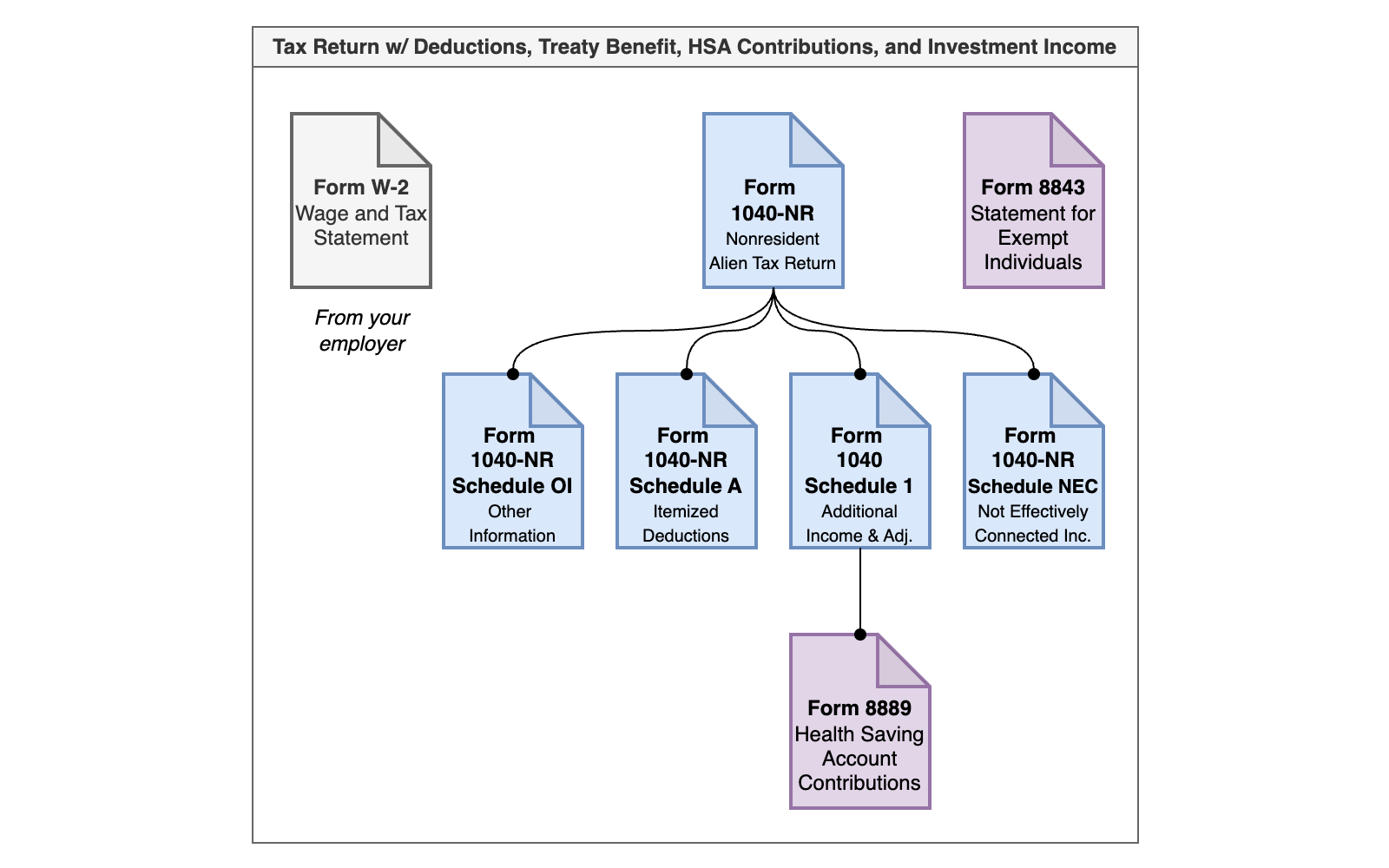

Here's the flowchart from earlier, to help you get oriented. You are now at the second diamond on the left: "Are you eligible for tax treaty benefits?" We'll be following the flowchart for the rest of this section.

Are You Eligible for Treaty Benefits?

For this section, you will need

United States Income Tax Treaties: A – Z

Use this to find if your country has a tax treaty with the U.S.

Form 1040-NR Schedule OI, Other Information

You need to click on the dropdown titled "Schedule OI (Form 1040 OI), Other Information" to access the PDF of Schedule OI. This is the Schedule that we file in order to claim the tax treaty benefit.

Most countries have tax treaties with the U.S. that offer generous tax exemptions for students, researchers, professors, or trainees. In this section of the guide, I will show you how to find a tax treaty, and walk you through the process of claiming it by filing a Schedule OI for your Form 1040-NR.

How to Find Your Treaty Benefit

India's Tax Treaty with the United States contains a rare and exceptionally good treaty benefit. Article 21 states: "a student or business apprentice ... [shall] be entitled during such education or training to the same exemptions, reliefs or reductions in respect of taxes available to residents of the [United States]."

This means that Indian students are are able to claim the standard deduction, just like U.S. citizens and Permanent Residents. The standard deduction for 2024 is $14,600 dollars, meaning the first $14,600 dollars an Indian student earns is completely tax-exempt.

This is the strongest tax treaty benefit in the world, and no other country has anything like it. It is truly a testament to the dignity and statesmanship of Indian diplomacy, that such a benefit was negotiated for her students.

Hence, if you are an Indian student, make sure to claim the treaty benefit by following the instructions here. Skip the section on itemizing deductions, because it is inferior in every way.

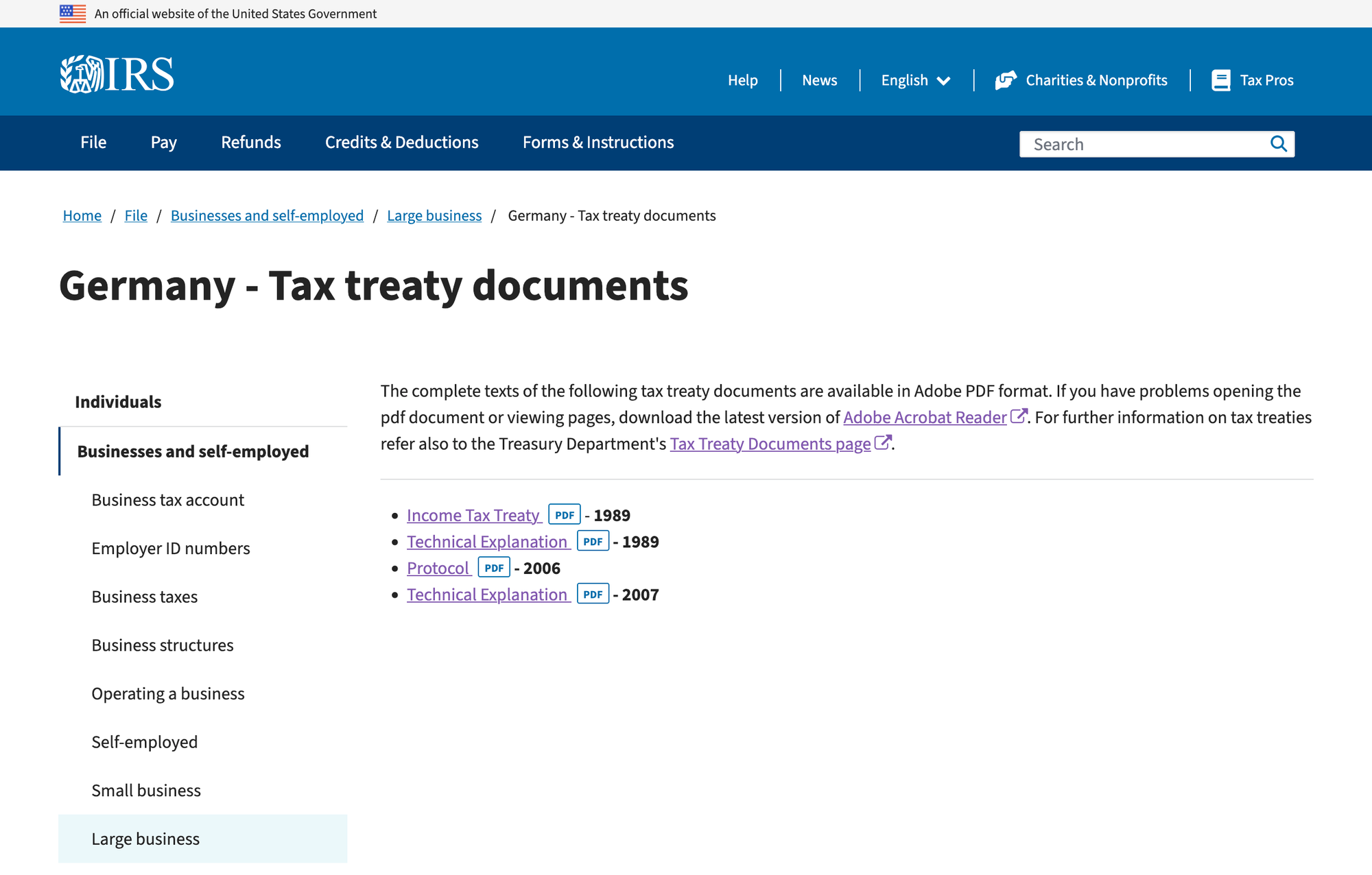

To begin, you need to find the treaty benefit of your country. To do so, navigate to the official IRS Tax Treaties page (linked above), and click on the link associated with your country. I am choosing Germany as an example for the purpose of this walk-through (I am not actually German), but these steps will apply for any country.

For your country's page, you should see the following PDF files:

- Income Tax Treaty: This is the original text of the treaty. If there are no other documents, this will be the authoritative text of the treaty.

- Technical Explanation: These are official explanations of the tax treaty, published by the IRS. They follow the same structure as the treaty (e.g. "Article 1, Article 2, ...") but explain the articles in greater detail.

- Protocol(s):

A protocol is simply an edit or update to the original treaty. They literally state things like "Remove paragraph (b) from Article 2, and replace with: ..."

Some countries might not have a technical explanation for their tax treaty, and that's okay too. Some countries might not have any protocols, or have more than one protocol.

To find your tax treaty benefit, you simply follow this process:

- In the Income Tax Treaty, find and read the Article that contains the treaty benefit that you are seeking. The Article is usually called "Students and Trainees" or "Teachers and Researchers"

- Next, check the Technical Explanation for the same Article. The Technical Explanation will elaborate and explain the Article and how it works.

- Finally, check Protocol(s) for any updates or modifications to the original Article.

For this guide, I will walk you through the process of finding a treaty benefit for an international student from Germany. However, you should be able to do this for the country that you are from.

Example: Finding a Treaty Benefit for a German F-1 Student.

Let's say you are an international student from Germany, and you are studying in the United States on a F-1 visa. You're looking to see if there are any treaty benefits for the income you receive from your on-campus job.

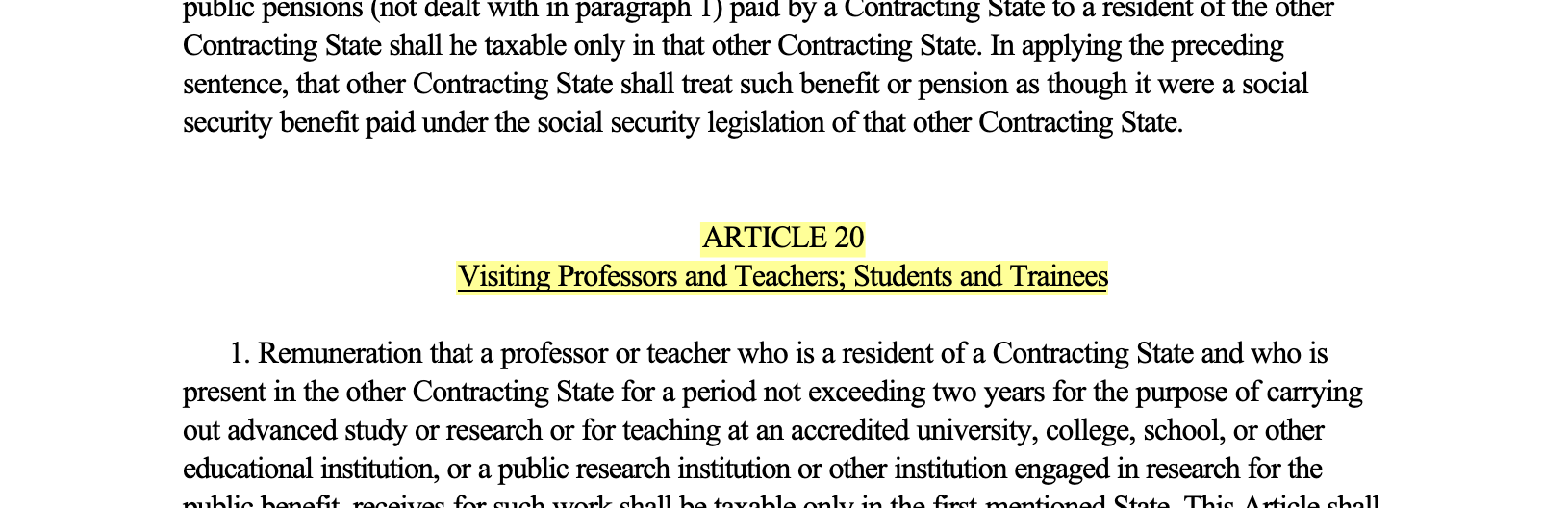

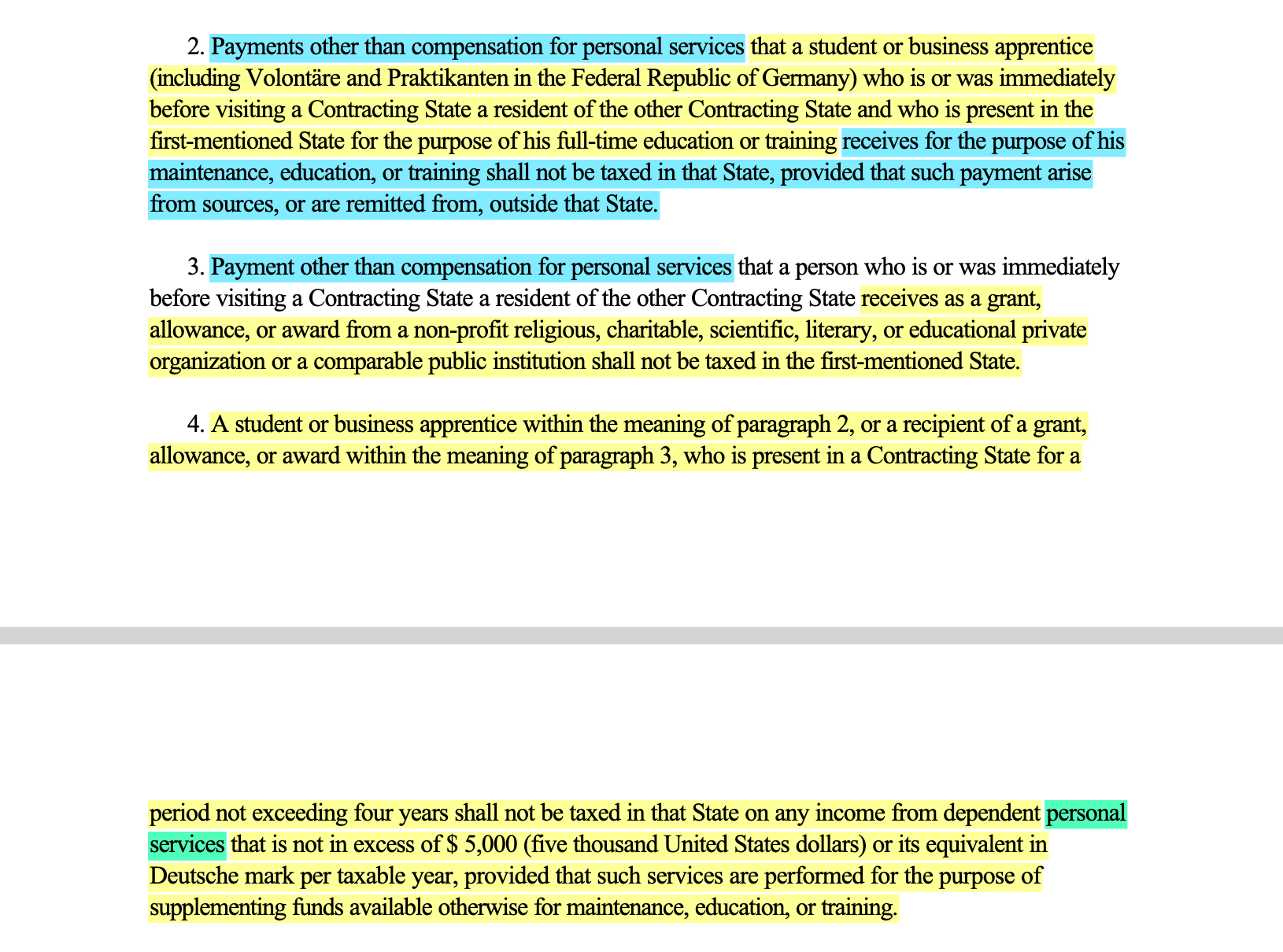

First, we must find the Article that applies to your situation from the German-American Income Tax Treaty. In this example for Germany, it is Article 20:

Next, read the article carefully. It has 5 paragraphs. Paragraph 1 and 5 do not apply to students – they are for professors or business/industrial trainees, so we can skip those altogether. We will look carefully at paragraphs 2, 3, and 4. Let's read it together.

The IRS defines compensation for personal services as anything you receive for a wage. So your W-2 from an on-campus job is considered personal services income. This means Paragraph 2. and Paragraph 3. are specifically tax benefits that exclude wages – they don't apply to the earnings you receive from your on-campus job.

Paragraph 2 contains a tax benefit for payment that you receive from Outside the United States. Specifically, it is saying that any payments you receive "for the purpose of maintenance, education, or training shall not be taxed in that State [i.e. the United States], provided that such payment arise from sources, or are remitted from, outside that State [i.e. from Germany]." This means if you received money from abroad, it is not taxed. For most international students this isn't taxed anyways, so there isn't much point in declaring this.

Paragraph 3 contains a treaty benefit for grants. If you were a researcher and received a grant, then you can declare a treaty benefit to exclude it entirely from taxation. This doesn't really apply for students, but if it applied to you, you would declare it the same way on Schedule OI.

Paragraph 4 contains a treaty benefit for personal services income. This is what we want! It basically states that any students (defined in Paragraph 2), who are in the U.S. for a period not exceeding 4 years, can have up to $5,000 USD of their salary be entirely tax-exempt, per year.

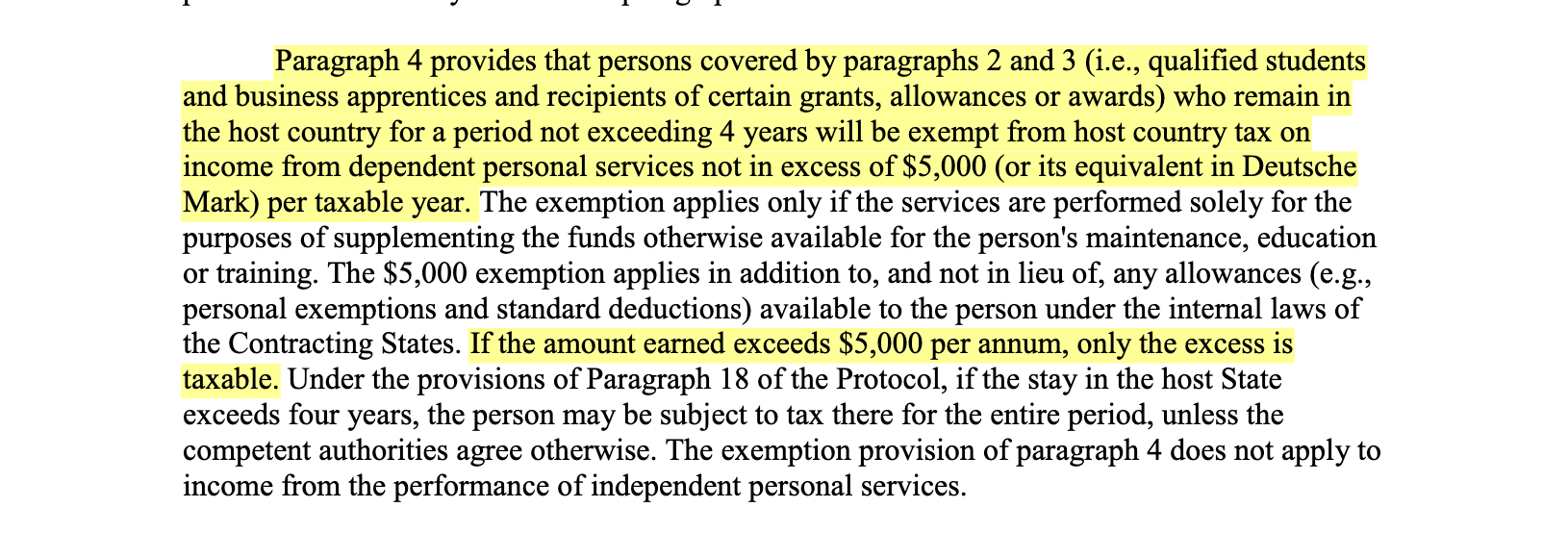

This is exactly the treaty benefit that we are looking for. But before we declare it on our Form 1040-NR Schedule OI, let's check the Technical Explanation for further elaboration.

The Technical Explanation confirms our understanding of the treaty text. It also specifically elaborates that any income earned above that $5,000 USD exemption, will be taxed.

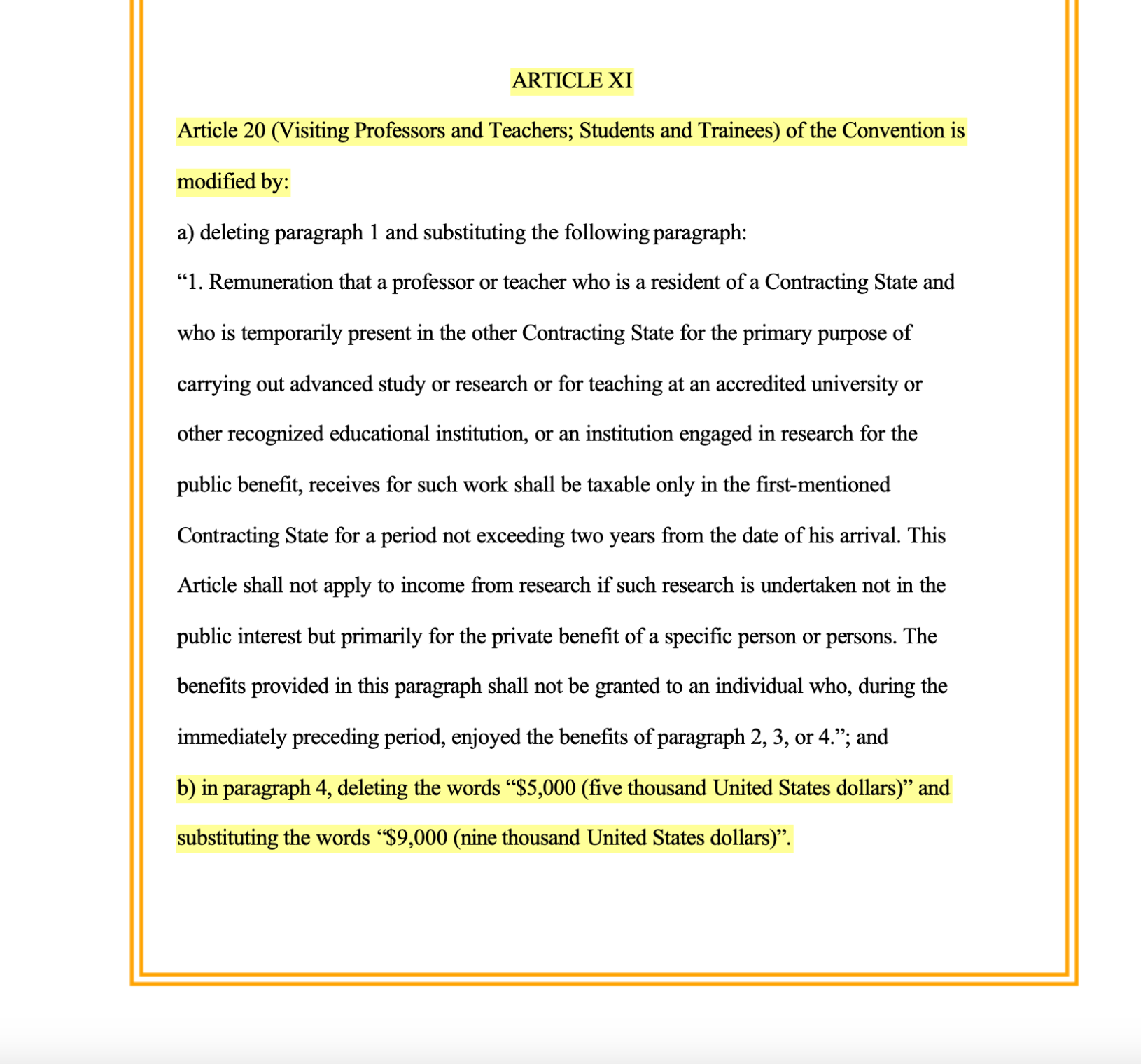

But hold on! This tax treaty was signed in 1989. There was a Protocol published in 2007, which contains updates. We need to check the Protocol to see if any changes occurred to Article 20.

The Protocol has increased the tax exemption from $5,000 to $9,000. Paying attention to these details can really pay off! For a German international student, this means that during their first four years in the U.S., the first $9,000 of their income is completely tax-exempt.

In this example, I walked you through the process of finding a tax treaty benefit from your nation's tax treaties. Now that you found the benefit, write down the Article (and Protocols, if any) and paragraph sections involved. We will be citing these sections in Form 1040-NR Schedule OI in order to claim them.

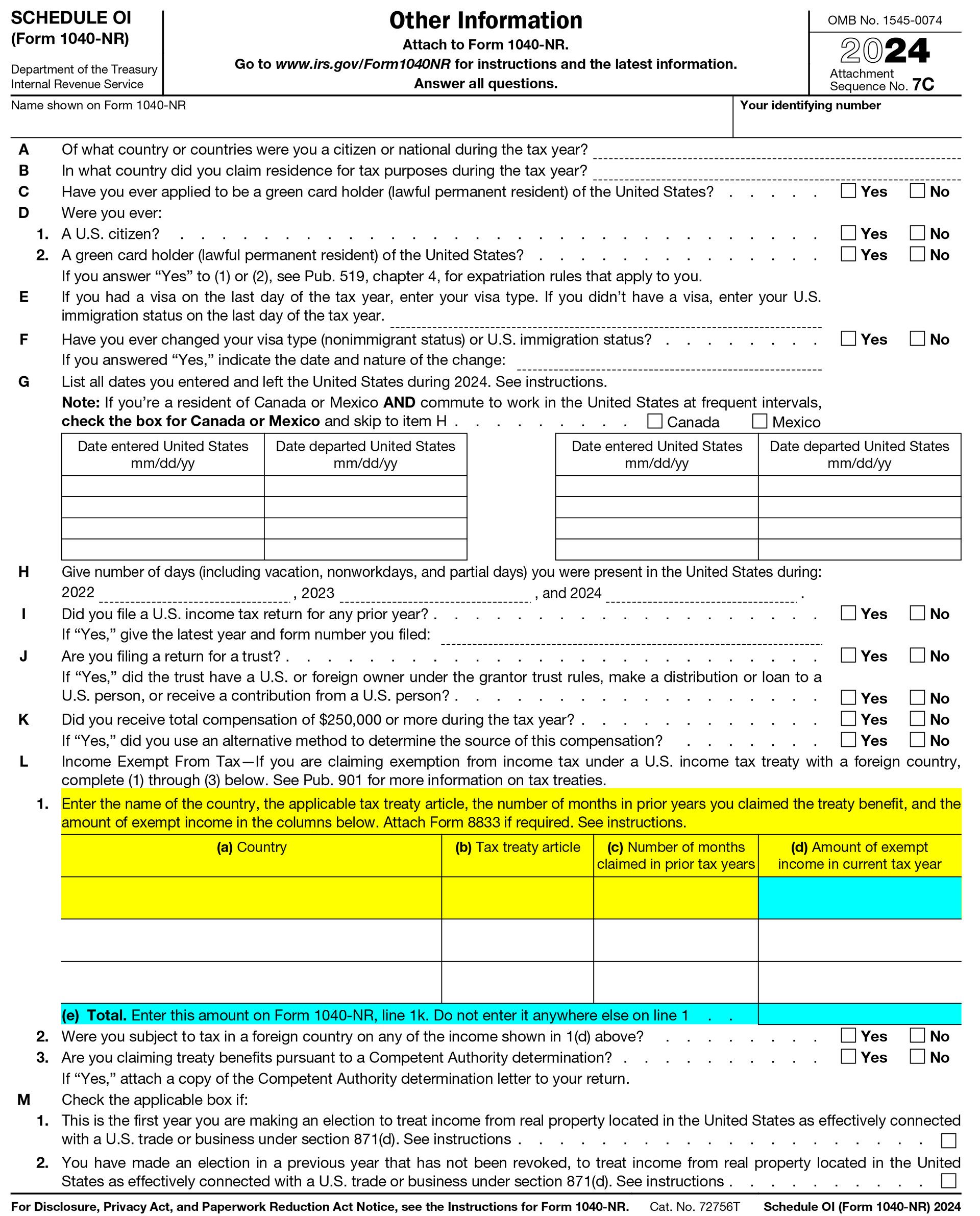

Filling out Form 1040-NR Schedule OI

Form 1040-NR Schedule OI, Other Information

You need to click on the drop-down titled "Schedule OI (Form 1040 OI), Other Information" to access the PDF of Schedule OI. This is the Schedule that we file in order to claim the tax treaty benefit.

Download Form 1040-NR Schedule OI. Save on your computer. Let's open it and declare our treaty benefit. Schedule OI is very simple and only one page long. The instructions for Schedule OI are available on the same page as the instructions for Form-1040-NR, and they are similarly brief. Fill out the autobiographical details by yourself first.

Line 1 is where you declare the treaty benefit that you found earlier. To go with our earlier example, if you were a German international student, you would write "Germany" in the country column, "Article 20, paragraph 4" in the second column, and so on.

Line 1(d) Amount of Exempt Income in the Current Tax Year: Be careful here—this line asks for the amount of income you’re actually exempt from this year, not the maximum exemption listed in the tax treaty. If you earned $5,000, you’ll write $5,000, even if the treaty allows up to $9,000. After all, you cannot exempt income that you didn't earn. On the other hand, if you earned $19,000, you’ll write $9,000, since that’s the highest exemption the treaty allows.

After filling out Schedule OI, we need to go back to Form 1040-NR and make an adjustment. Under the Income Effectively Connected with U.S. section, subtract the exempt portion of your income from your total earnings in Line 1a. Then, report the exempt amount separately in Line 1k (I’ve highlighted it in cyan in the picture).

For example, if you're a German international student and earned $19,000, you’ll write $10,000 in Line 1a on Form 1040-NR, since that’s the taxable portion of your income. The remaining $9,000, which is exempt under the treaty, goes in Line 1k. This means you’ll only be taxed on the $10,000 reported in Line 1a.

There you go. You're done! Now you have successfully declared a treaty benefit and claimed it. Congratulations on your tax savings! If you want to stop here, all you need to do is to file a Form 8843 (here's my guide), and then you're done.

But most international students can achieve greater savings, by itemizing deductions. So if you don't mind filling out one more Form, continue reading onwards!

Do You Want to Itemize Deductions?

In my opinion, international students should always itemize deductions, if they made more money than their treaty benefit exemption.

India's Tax Treaty with the United States contains a rare and exceptionally good treaty benefit. Article 21 states: "a student or business apprentice ... [shall] be entitled during such education or training to the same exemptions, reliefs or reductions in respect of taxes available to residents of the [United States]."

This means that Indian students are are able to claim the standard deduction, just like U.S. citizens and Permanent Residents. The standard deduction for 2024 is $14,600 dollars, meaning the first $14,600 dollars an Indian student earns is completely tax-exempt.

This is the strongest tax treaty benefit in the world, and no other country has anything like it. It is truly a testament to the dignity and statesmanship of Indian diplomacy, that such a benefit was negotiated for her students.

Hence, if you are an Indian student, make sure to claim the treaty benefit by following the instructions in the earlier section. Skip the section on itemizing deductions, because it is inferior in every way.

Introduction to Tax Deductions

What are deductions, and why should we itemize them? A tax deduction is simply an amount subtracted from your taxable income, usually representing an expense. In the U.S, taxpayers have two options:

- They can either take the standard deduction, which is a flat amount of $14,600 (for a single filers).

- Or they can choose to itemize deductions, by counting and adding up all deductible expenses.

The vast majority of American citizens simply take the standard deduction. This means that if you were an American student and you earned $16,000 USD, you would only pay taxes on $1,400 USD, which is your taxable income after deductions.

Unfortunately, Nonresident Aliens are NOT allowed to take the standard deduction.

So by default, international students like ourselves just end up paying more tax. However, if we choose to itemize deductions, you'll get to deduct some expenses from your taxable income, and pay less tax – even though you might not be able to deduct as much as $14,600.

And here's the big deal: you do not need to have made any charitable contributions, or kept meticulous receipts, in order to have a reasonable deduction. The IRS allows taxpayers to deduct State, City, and Local taxes:

You may deduct as an itemized deduction, state and local income taxes withheld from your wages during the year (as reported on your Form W-2, Wage and Tax Statement) and estimated state and local income taxes and prior years' state and local income taxes paid during the year. Alternatively, you can elect to deduct state and local general sales taxes.

On your Form W-2, you can see that you have already paid State, City, and local tax – which was withheld from your paycheck.

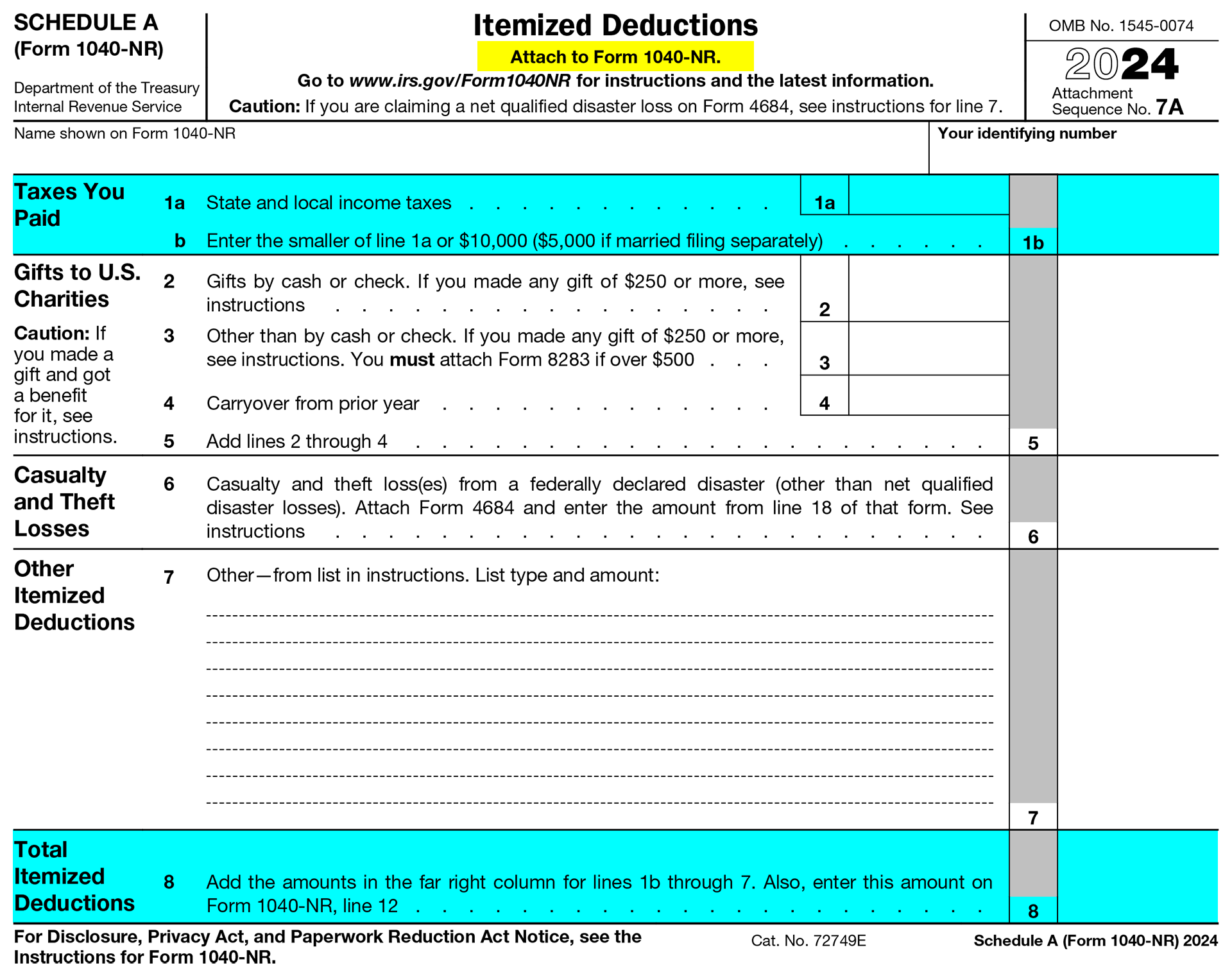

By filing a Form 1040-NR Schedule A, you'll be able to deduct the hundreds of dollars of state, city, and local tax that you paid. This can potentially lower your federal income taxes quite significantly, especially if you made more money than your treaty benefit exempts. Of course if your entire income was already tax-exempt due to a treaty benefit, then you won't have to itemize deductions, because you already pay no income tax.

How to File Form 1040-NR Schedule A

Form 1040-NR Schedule A, Itemized Deductions

You need to click on the drop-down titled "Schedule A" to access the PDF of Schedule A.

The instructions for Schedule A are located at the same place as the instructions for Form 1040-NR

List of Additional Deductions

Feel free to browse through this list of additional deductible expenses, but the vast majority of students are not eligible for them.

By now, you're a pro at filing out IRS Forms. And Schedule A is fairly simple. The only part you have to keep in mind, is to make sure that you found the Schedule A for Form 1040-NR, and not the one for U.S. Citizens and Residents. Make sure that the Form states "Attach to Form 1040-NR," as per the yellow highlight:

The IRS allows us to deduct up to 10,000 dollars of State and Local income tax. Simply fill in the values from your Form W-2 into line 1a, and follow the instructions.

The IRS also allows deductions for donations to tax-exempt charities, which you may declare here. However, you must keep receipts of your tax-deductible donations, if you choose to deduct them. In general, I would be very cautious of this section, and I would not try to deduct any "donations" that are not completely legitimate.

Finally, on Line 8 on Schedule A you take the sum of your deductible expenses, and then write back on Form 1040-NR, Line 12:

Now go back to your Form 1040-NR and re-calculate your taxable income (line 15), and use that to find your taxes again. Congratulations, you just successfully itemized your deductions!

At this point, most international students can probably stop, and submit their tax returns. If you wish to do so, make sure to fill out a Form 8843, by following the walk-through in my other guide, and then you'll be able to print out all 5 documents and mail them to the IRS (instructions here). However, if you have any IRA or HSA contributions, then you should continue reading.

Unfortunately, if you have any investment income or crypto activity, you must file a Form 1040-NR Schedule NEC, and cannot stop here. This is because investment income is considered not-effectively connected income, and is subject to a punitive 30% tax rate (see IRS Publication 519, U.S. Tax Guide for Aliens, Chapter 4, Section The 30% Tax.

Do You Have any IRA or HSA Contributions?

IRS Publication 590-A, Contributions to Individual Retirement Arrangements

IRS Publication 969, Health Saving Accounts & Other Tax-Favored Health Plans

These are the authoritative documents on IRA and HSA accounts. All the information in this section was sourced from these publications. Please review them for further details.

So what is an IRA or HSA?

An IRA stands for a Individual Retirement Account. It's a special, tax-deferred investment account used by many Americans to save for retirement. Tax-deferred means you do not pay tax on the money you put into a IRA account (called contributions). And once the your contributions are inside the IRA account, they can grow tax-free (in the form of investments). Only when you remove your money (called a distribution) do you get taxed.

Likewise, an HSA is a Health Savings Account, and it works in the same way as an IRA. Contributions to a HSA account are tax-deferred – you don't pay tax on them. And contributions can grow tax-free, if you invest the content of your HSA. And you're allowed to spend money from your HSA entirely tax-free, as long as it's on qualified medical expenses.

It is uncommon for international students to have IRA accounts. It is very rare for international students to have HSA accounts.

However, if you do have an IRA account or a HSA account, you must deduct your contributions to them when you file your taxes. This way, you are not taxed on them. After all, that's the entire purpose of having an IRA or HSA in the first place. In order to deduct IRA or HSA contributions, you must file a Form 1040, Schedule 1. Yes, I wrote correctly: Form 1040 (without the -NR).

Should you open an IRA account, as an international student?

It really depends. IRA accounts are meant for retirement savings, so typically you can only acquire a distribution from an IRA after reaching 59 and a half years old. If you withdraw money early, it is called an early distribution (this is a bad thing) and subject to a 10% penalty tax, on top of being taxed at your regular income level. To quote IRS Publication 590-A

"You can withdraw or use your traditional IRA assets at any time. However, a 10% additional tax generally applies if you withdraw or use IRA assets before you reach age 59½. This is explained under Age 59½ Rule under Early Distributions in Pub. 590-B."

Whether or not you should open an IRA account is outside the scope of this guide. Generally, if you are just in the U.S. to study, you should not open an IRA account. However, if you foresee yourself spending a long time in the U.S. – perhaps graduating, working on a STEM OTP for 3 years, applying for a H-1b and staying on-wards for 6 years, and eventually becoming a Permanent Resident (Green Card), then it might make sense to open an IRA, because it is a powerful way to invest in your retirement.

Additionally, if you really want to invest in the stock market, the safest way to do so from a tax perspective to do so is through a tax-advantaged retirement account, like a IRA (or HSA). This is because earnings from an IRA are not taxed. Hence, any dividends, interest, or capital gains within the IRA will not be subject to the 30% tax on Non Effectively Connected (NEC) income. Money from within an IRA is only taxed at the time of distribution. And the hope is that, by the time you are withdrawing money at 59 and a half years old, you are already a Permanent Resident or U.S. citizen, and you wouldn't have to worry about this anymore.

I personally have an IRA account. But ultimately, you'll need to do more research yourself.

Should you open an HSA account as an international student?

No. The answer is almost always no.

You are only allowed to open an HSA account if you have what's called a High-Deductible Health Plan (HDHP). It's a type of Health Insurance plan that has a high deductible – meaning there is less insurance coverage, and basically in return you get access to a HSA.

If you are a F-1 student – it doesn't matter if you are undergraduate, or graduate – your University Health Insurance Plan is almost certainly not a HDHP. Hence, you are not allowed to open a HSA account. And if you do open one, your contributions will be considered non-qualified contributions, and they are subject to a penalty tax. Opening a HSA as a F-1 student is an easy way to blow-up your tax situation very badly.

Please do not open an HSA account if you don't know what you are doing.

The rare instances where an F-1 student could open a HSA account, is if they work for an employer and are not on their University Health Insurance, but rather insured through their workplace. Their workplace would specifically state that the insurance plan is a HDHP. Since F-1 students are only allowed on-campus jobs, this situation is quite uncommon. The only instance that I can imagine this happening, is if you were on your OTP year, entirely done with your studies, and working full-time at a real company (i.e. not your university).

If you think that applies to you, you'll have to do more research on your own. Proceed carefully.

How to File Form 1040 (without the -NR), Schedule 1

Form 1040 Schedule 1, Additional Income & Adjustments to Income

Remember, this is Form 1040 Schedule 1, without the -NR. Hence, we must find it on the Form 1040 page. Click on the drop-down menu labeled Schedule 1. It's instructions are located on the same page as the instructions for Form 1040 (without the -NR)

Download the form. Save it in a safe place. Let's open it and take a look, together.

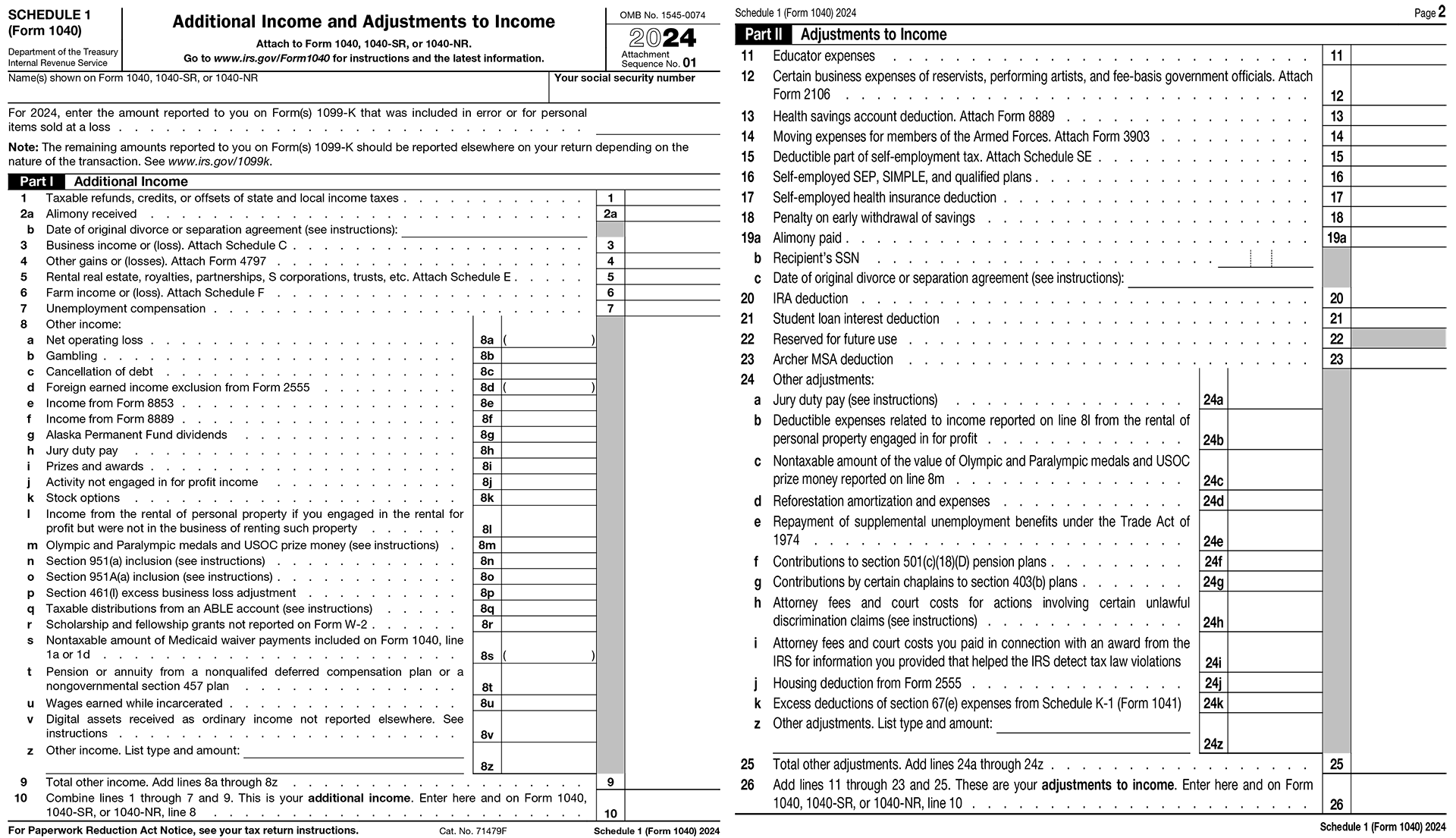

Form 1040 Schedule 1, Additional Income and Adjustments to Income is basically the form that is used to make all manners of miscellaneous adjustments to the Income section of your Form 1040-NR. The Form has two parts:

- Part I: Additional Income

This is the section where you declare extra income that you received. - Part II: Adjustments to Income

This is the section where we declare deductions to our income. Basically, the sum of the values in Part II of Schedule A, Form 1040 will be subtracted from your Form 1040-NR, reducing your taxable income.

For the purpose of deducting IRA and HSA contributions, we will focus on Part II. Part I rarely applies to international students. The only situation where an international student will be using Part I, is if you needed to declare gambling winnings. And I'm afraid I don't know how to guide you, because I've only ever lost at Poker.

Deducting IRA Contributions using Form 1040 Schedule 1

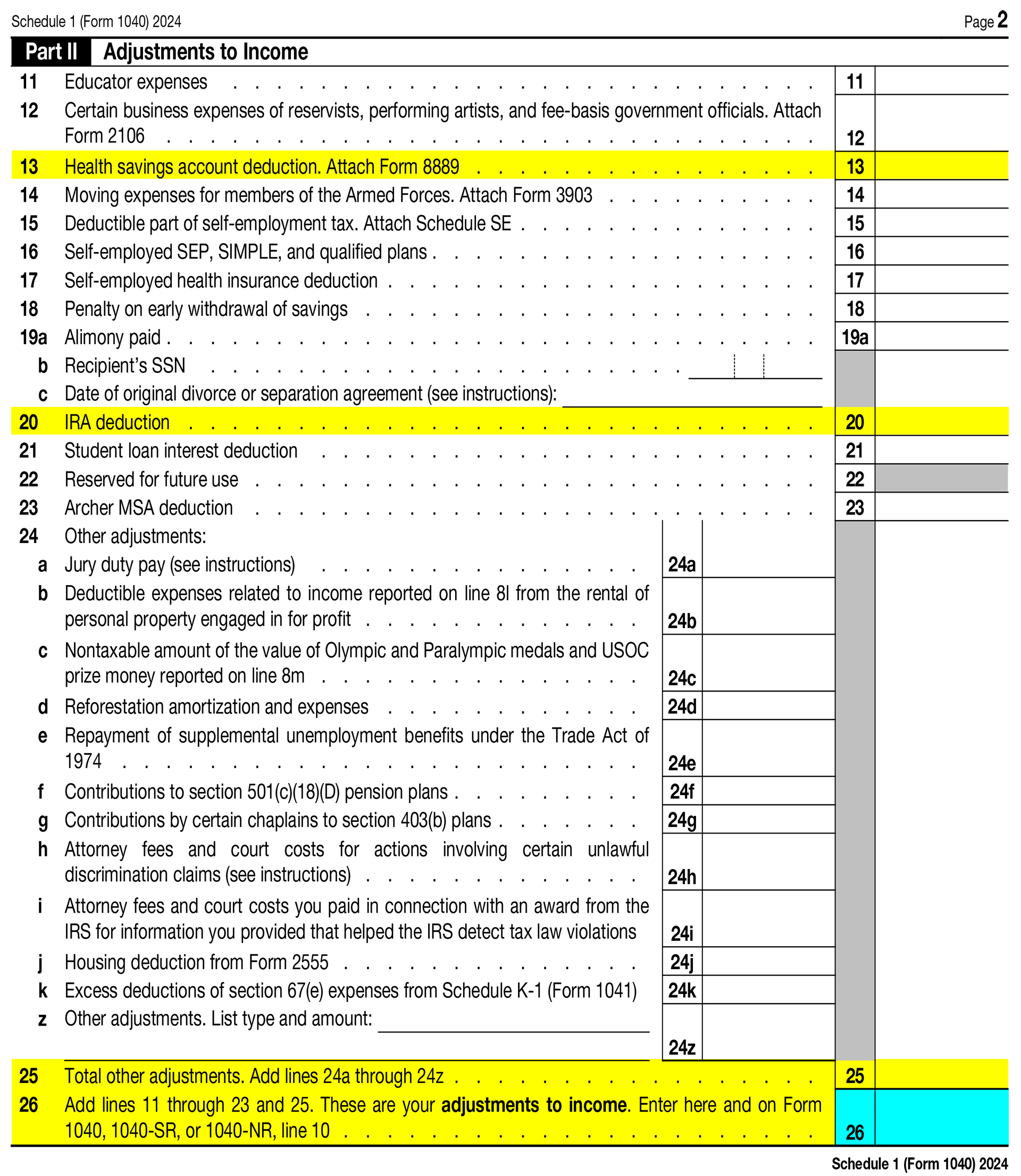

In order to file for a deduction, the only lines we need to focus on are line 13, for HSA contributions, and line 20, for IRA contributions.

Only contributions to Traditional IRAs are tax-deductible. Contributions to Roth IRAs are not tax-deductible.

If you only have IRA contributions, then fill out the value of your contributions on line 20, and complete the form. You will then take the total adjustments to income (Line 26), highlighted in cyan – and write that number in your Form 1040- NR, Line 10.

On Form 1040-NR, make sure to adjust your income on Line 1a so that the value of your contributions are deducted. This way, you won't be taxed on them. Re-do the rest of your Form 1040-NR to find your new taxable income, and find your new tax.

Congratulations, you just successfully deducted your IRA contributions, by filing a Form 1040 Schedule A! Your tax return now contains six documents:

Deducting HSA Contributions Using Form 1040 Schedule 1 and Form 8889

Form 8889, Health Saving Accounts

You only need to file this form if you are deducting HSA contributions.

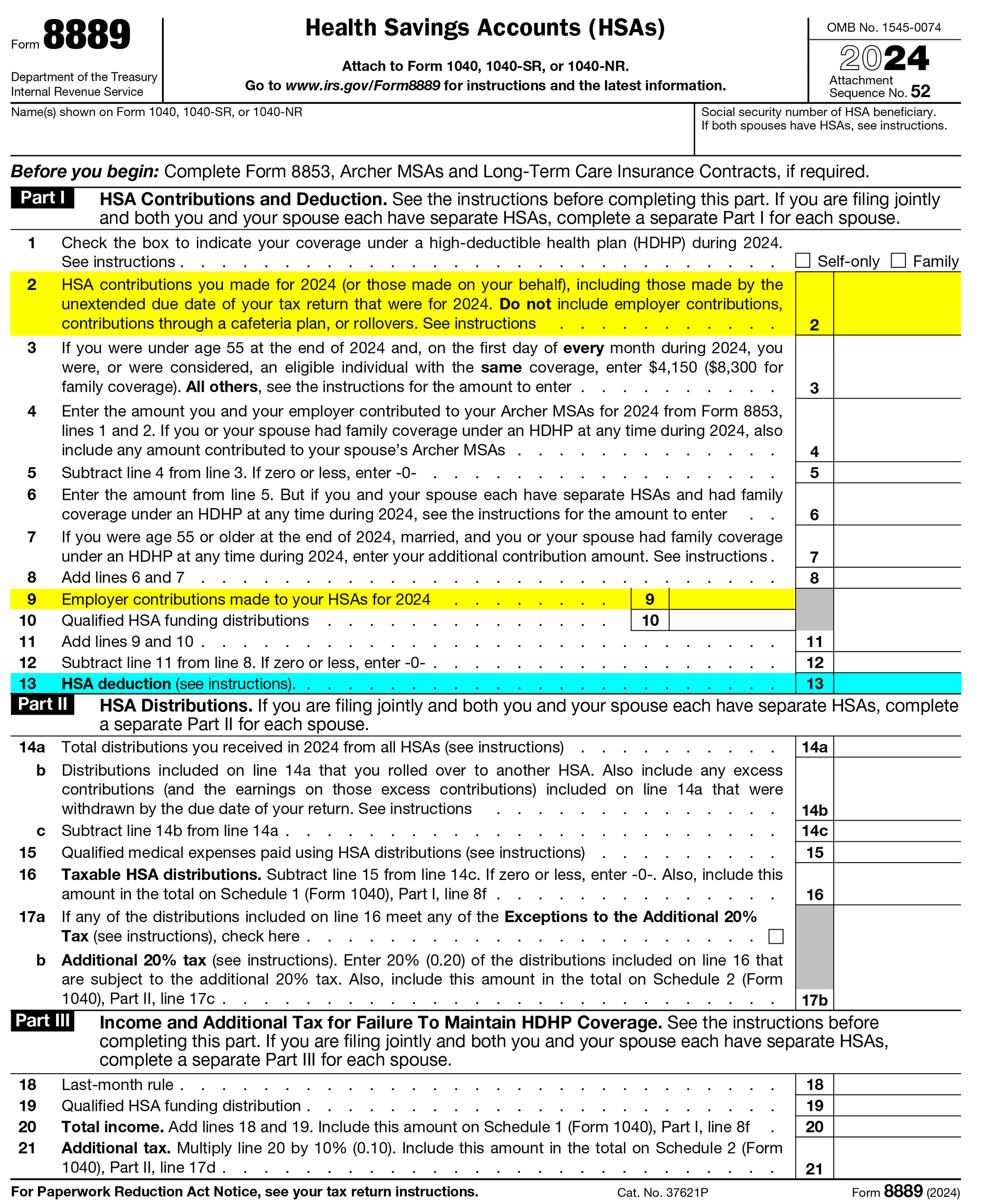

This section only applies to you, if you have any HSA contributions. It is very rare for international students to have an HSA. In order to deduct HSA contributions, you need to fill out one additional form. This is Form 8889, Health Savings Accounts.

You should follow the instructions for Form 8889 when filling this out. Generally, if you only had contributions to a HSA, you only need to fill out Part I. If you had any distributions, you must fill out Part II. If you spent your distributions on qualified medical expenses, then the sum of Part II will balance out to zero, meaning you won't owe any additional tax.

The only piece of advise I have, is to make sure to understand that employer contributions to a HSA are not tax deductible. For example, if your employer contributes 200 dollars to your HSA each year, and you contributed 800 dollars, you could only deduct 800.

Once you have filled out Form 8889, go back and declare the value of the contributions on Line 13 of your Schedule A. Then update your Form 1040-NR and re-calculate your taxes. Congratulations. Your tax return is now complete!

Do You Have Any Investment Income?

You must always declare investment income. If you traded in stocks, bonds, or cryptocurrencies, you have investment income. Investment income is considered Not Effectively Connected (NEC) income, and is taxed at a punitive rate of 30%, unless there exists a lower tax treaty rate.

Does the word "leverage" sound familiar to you? Does the phrase "margin call" give you a thrill? If you made it big trading options on Robinhood, or Bitcoin on a crypto exchange, then I have some very sober news to share with you. In the United States, any investment income earned by a Nonresident Alien is considered Not Effectively Connected income. Investment income includes dividends, interest, and capital gains. And NEC is taxed at a 30% tax rate, unless there are specific tax treaty benefits which lower it.

Tax Treatment of Investment Income

IRS Publication 519, U.S. Tax Guide for Aliens. Section on The 30% Tax

IRS Publication 544, Sales and Other Dispositions of Assets, Section On Capital Assets

The information from this portion of the guide is taken entirely from the above two, authoritative publications. For the definition of Capital Asset, see Publication 544. For the tax treatment of NEC income, and investment income, see Publication 519.

Investment income for nonresident aliens is treated in the following manner. For international students, all investment income is considered Non-Effectively connected income. Furthermore, for each type of investment income:

- Interest Income: Taxed at a flat 30% rate

- Dividend Income: Taxed at a flat 30% rate

- Capital Gains Income: Slightly more complex. The tax treatment of capital gains income (i.e. from selling stock at a profit) is decided by the 183 Day Rule for Capital Gains

The 183 Day Rule for Capital Gains Income

IRS Publication 519 states:

183-day rule:

If you were in the United States for 183 days or more during the tax year, your net gain from sales or exchanges of capital assets is taxed at a 30% (or lower treaty) rate. For purposes of the 30% (or lower treaty) rate, net gain is the excess of your capital gains from U.S. sources over your capital losses from U.S. sources. This rule applies even if any of the transactions occurred while you were not in the United States.

...

If you were in the United States for less than 183 days during the tax year, capital gains (other than gains listed earlier) are tax exempt unless they are effectively connected with a trade or business in the United States during your tax year.

So what does this mean? If you are in the United States for more than 183 days in the tax year, Capital Gains Income is also taxed at the 30% NEC rate. It doesn't matter even if the sales occurred when you were outside the U.S.

Help! Is interest from my bank account or certificate of deposit, considered investment income?

Thankfully, the answer is No. For Nonresident Aliens, the IRS specifically excludes the following sources of interest from taxation:

- A U.S. bank (this includes certificates of deposits!)

- A U.S. savings and loan association

- A U.S. credit union

- A U.S. insurance company

- Portfolio Interest

This is according to IRS Publication 519, U.S. Tax Guide for Aliens, Section on Interest Income. The IRS provides more detail and clarification on their page on Nonresident Aliens – Exclusion from Income, which I've also linked for your reference.

Specifically, interest from the above sources are excluded from income. This means you do not even have to include it in your Form 1040-NR. So the bottom line is that, if you're earning interest from your bank account or High-Yield Savings Account, or have a Certificate of Deposit with your Credit Union, you do not have investment income, and you are not taxed on that income, and you do not have to file it anywhere. Indeed, if you only had interest from these sources and no other U.S. source income, you don't even need to file a tax return.

This section on investment income is mostly for situations where an international student bought stocks on a U.S. stock exchange, and other advanced cases.

I’ve had personal experience dealing with NEC income, and unfortunately, the only reasonable way for international students to invest in the U.S. stock market, tax-wise, is either to become a resident alien or to invest solely within a tax-advantaged IRA. There is no way around it. So let's hope you've set aside 30% of your investment earnings, because in this section of the guide, we will learn how to give it to the IRS.

For a more detailed treatment of investment income for nonresident aliens, please see my article:

https://collegetaxguide.org/taxation-of-investment-income/

It contains a longer discussion with further citations to IRS sources.

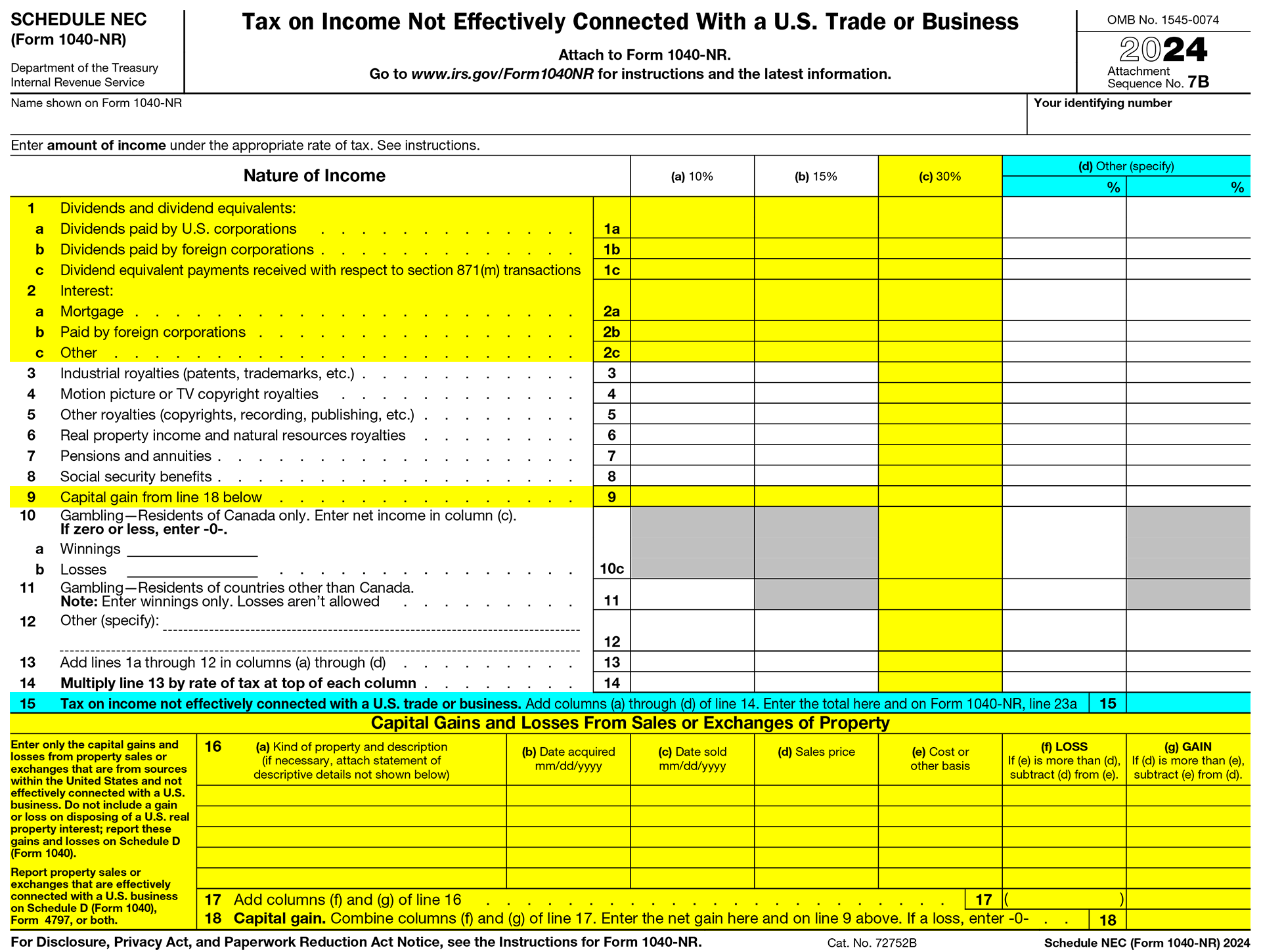

How to File Form 1040-NR Schedule NEC

Form 1040-NR Schedule NEC, Tax on Income Not Effectively Connected With a U.S. Trade or Business

You find this Form on the same page as Form 1040-NR. Click the dropdown menu with the title "Schedule NEC" to access the PDF. The instructions for Schedule NEC are located on the same page as the instructions for Form 1040-NR (direct link here)

Don't worry, you've a pro at this. Save the PDF in a safe place, and let's open it up together.

This is the form that you'll use to declare any kind of NEC income. As you can see, it includes sections for gambling income, real property (i.e. rentals), and an "Other," section. For this guide, we will only focus on declaring investment income, and I've highlighted those sections in yellow.

First, in order to begin, you need to make sure you have your tax forms from your stock brokerage ready. Your broker (e.g. Charles Schwab, Fidelity, or Robinhood) should have sent you the following tax forms:

- Form 1099-DIV: This contains a statement of your dividend income.

- Form 1099-INT: This contains a statement of your interest income.

- Form 1099-B: This contains a statement of your capital gains income

Your brokerage is legally required to send two copies of these forms: one to you, and one to the IRS. Hence, we must take care to report investment income accurately, because a discrepancy may trigger an IRS tax audit.

Interest and Dividend Income

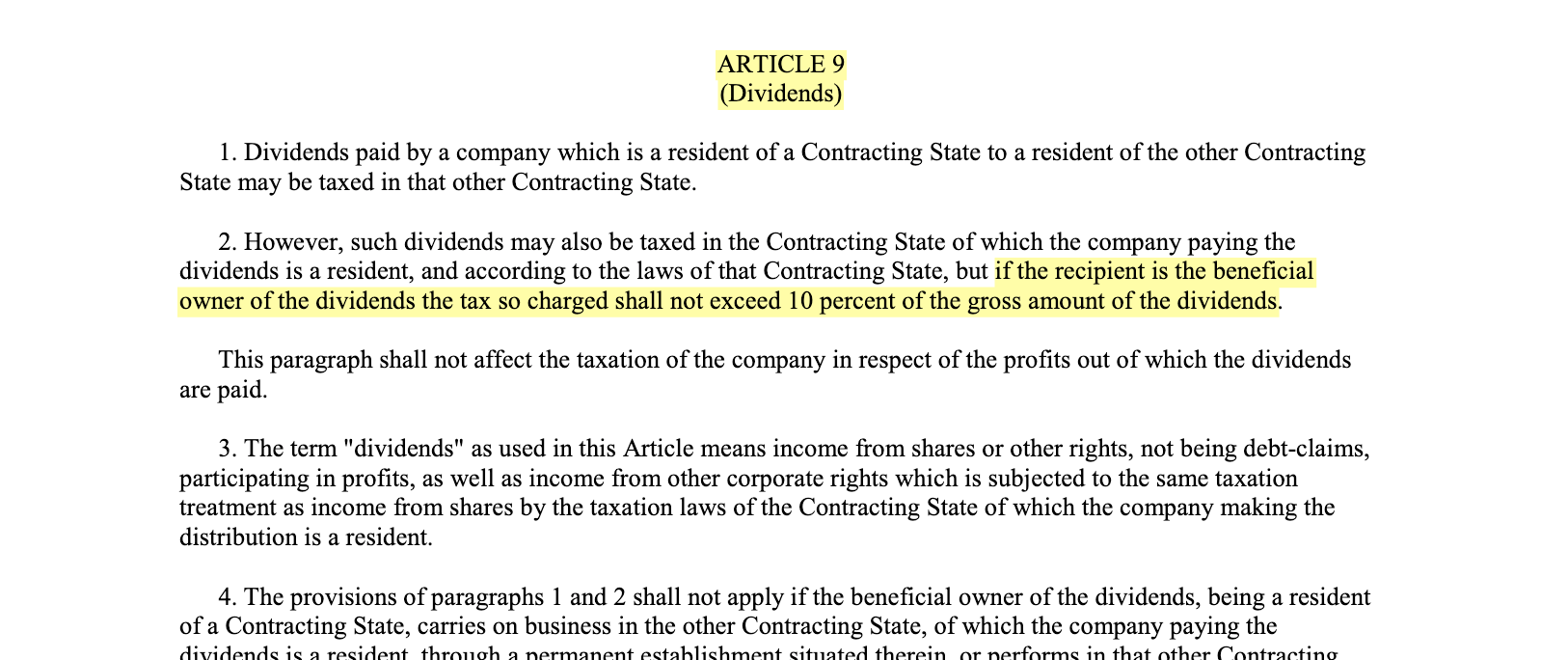

First, fill in the numbers from Form 1099-DIV and Form 1099-INT. These go in Line 1(a,b,c) and Line 2(a,b,c) on your Schedule NEC. By default, you must put the numbers under the 30% column, unless there exists a lower treaty tax rate.

This is now a good time to go back to the tax treaty, and check to see if you qualify for a lower treaty rate. For example, according to the U.S.-China Tax Treaty, Chinese nationals qualify for a lower treaty rate of 10% for dividend income:

If you qualify for any treaty benefits, declare them on your Form 1040-OI.

Capital Gains Income

Now, open your Form 1099-B. This is a statement from your stock brokerage, containing your stock purchases and sales. You must report the information from your Form 1099-B in the Capital Gains section of your Schedule NEC. If you do not have enough room on your Schedule NEC to report all your capital gains, you must attach a statement including the rest. For this statement, simply create it in Microsoft Word, and use the same format as the table in Schedule NEC, with your columns clearly labeled. Make sure your name and Social Security Number are present on the statement, and send it in with the rest of your Schedule NEC.

Phew! Congratulations. You just properly declared your investment income!

Are You Able To Claim Any Tax Credits?

This is the final section. Once you finish it, you are done. Gosh, I can't believe I wrote 10,000 words on federal income tax. Please share this website with your friends, if it was helpful. I really need to finish this and go and do my statistics homework.

What are tax credits?

A tax credit is different from a tax deduction. While deductions lower your taxable income, a tax credit is applied directly against the amount of tax you owe. Tax credits are very powerful, because they can substantially lower your taxes.

Unfortunately, the vast majority of international students do not qualify for any tax credits.

This is because we are nonresident aliens, and nonresident aliens qualify for very few tax credits. I encourage you to check out the tax credit section of IRS Publication 519, to see if you are eligible for anything, but don't get your hopes up.

IRS Publication 519, U.S. Tax Guide for Aliens. Chapter on Nonresident Aliens, Tax Credits

In general, as a nonresident alien:

- You do not qualify for educational tax credits.

- You do not qualify for the earned income credit.

We do qualify for a few tax credits, but they are very obscure and do not apply for the vast majority of international students (like the child care credit, or the adoption credit), so I won't really talk about them here.

There is one tax credit that you should keep an eye out for, though. As students we do not generally qualify for it, but keep it in mind for your OTP year.

Credits for Nonresident Aliens

Retirement Savings Contributions CreditYou may qualify for this credit (also known as the saver’s credit) if you made eligible contributions to an employer-sponsored retirement plan or to an IRA in 2024. You cannot claim this credit if:

- You were born after January 1, 2007;

- You were a full-time student;

- You were claimed as a dependent on someone else's 2024 tax return; or

- Your adjusted gross income is more than $38,250.

As you can see, only Nonresident Aliens who are not a full-time student are eligible to claim the Saver's Credit.

How To Send Your Tax Return to the IRS

Congratulations! You just completed your tax return!

First, remember to sign and date your tax return. Remember to use the American format for dates, it is mm/dd/yyyy.

No Simple Way to e-File

Now, here’s the tricky part. The U.S. tax system is outdated, and there’s no simple way to electronically file (or e-file) a Nonresident Alien tax return (i.e. Form 1040-NR) directly with the IRS. Most Americans can only e-file through paid tax software or by hiring a tax preparer. In fact, tax software companies have lobbied hard to keep things this way because they profit from acting as middlemen.

Things are slowly improving—the IRS recently introduced Direct File, a free e-filing program currently available in 25 states. Unfortunately, it doesn’t yet support Form 1040-NR, which is the tax return used by Nonresident Aliens. In fact, even many commercial tax programs don’t work with the forms international students need to file. The situation is quite unfair, and indeed one of the reasons I created collegetaxguide.org is to help us avoid expensive intermediaries.

So, for now, we’ll do it the old-fashioned way: by mailing your tax return!

How to Send a Physical Letter in the Mail

Now, call me a Zoomer, but I've actually never used the post before coming to the United States. And because I'm a mid-wit, every year I forget how to address an envelope, and I have to look it up. So to save us both the shameful annual Google-search, here's a hastily made mock-up of how to address an envelope, by Yours Truly. I know for sure that this time next year, I'd be going back to my own post just to figure it out again...

The address where you must mail your tax return is different depending on the state you are filing from, as well as whether you are including a tax payment or not. You must look up the address on the IRS website:

Now, once you have prepared your tax return packet, make sure to put enough stamps on it. I suggest going to your local USPS office and having them weigh the envelope, to be on the safe side. Then send it, and you're done!

A Word of Thanks

If you’ve ever searched “How do I file a Form 1040-NR?”, you’ve probably come across websites from tax firms or software companies that offer vague, low-quality information—only to end with a pitch like, "Taxes are complicated. Hire us!"

The College Tax Guide is not one of those websites.

I firmly believe that with patience and the right information, anyone can prepare their own taxes. And as international students, we should empower each other with knowledge— living away from home is hard enough as it is. So if you found this guide helpful, please share it with your fellow students, researchers, and scholars (whether international or not!)

So instead of a sales pitch, here’s a word of thanks—to you, the international student, researcher, or scholar. Thank you for reading my guide. Thank you for your time and attention.

Taxes can be complicated. But you are capable. You are resourceful. You’ve got this.