Guide for Nonresident Aliens with No U.S.-Source Income

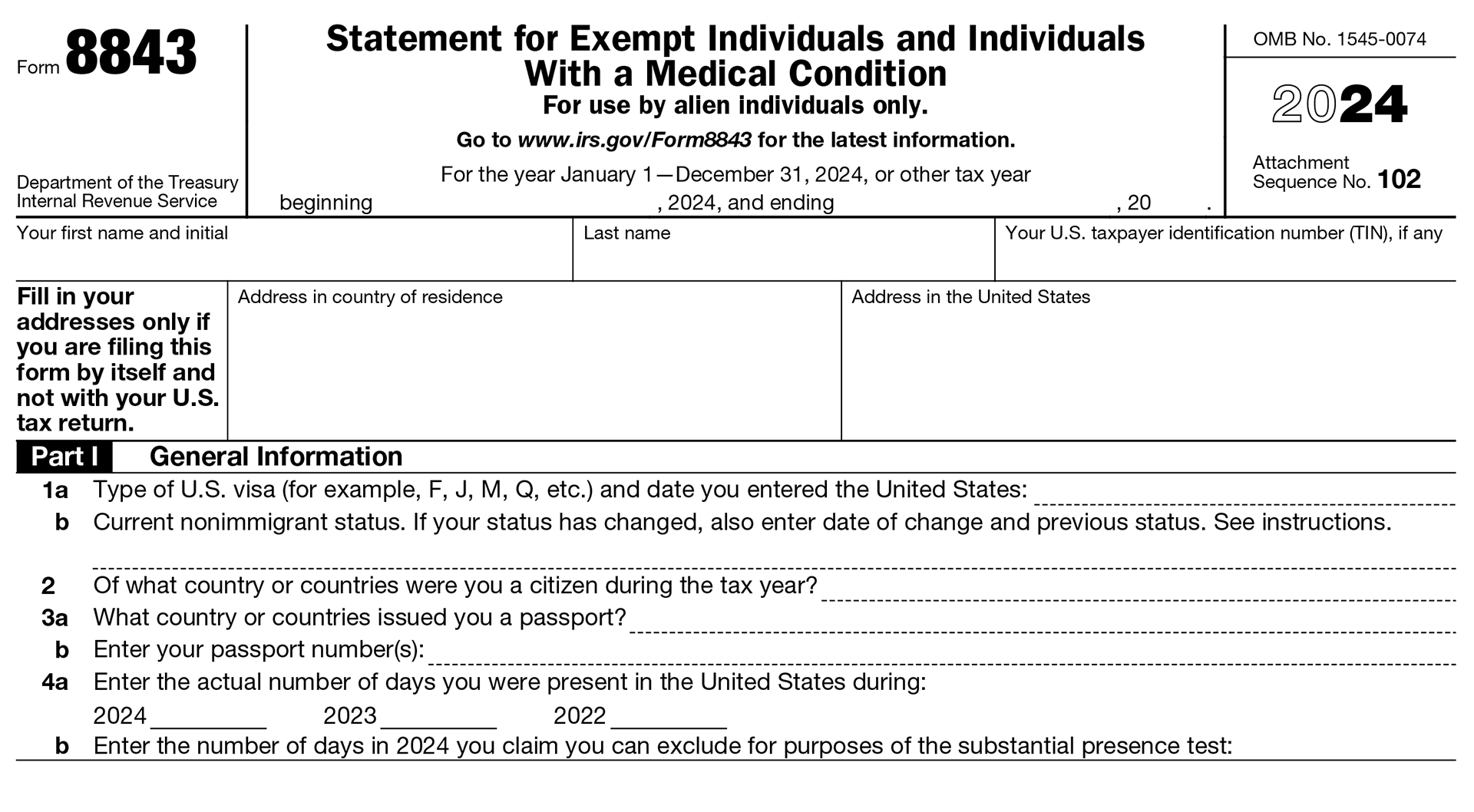

Are you a Nonresident Alien with no U.S.-Source income? If so, your tax situation is very simple. You need to only file a single form, called Form 8843, Statement for Exempt Individuals and Individuals with a Medical Condition. This form states that you are an Exempt Individual for the purpose of the Substantial Presence Test.

Who this Guide is For

Here are some common situations where this guide will apply. If you are at all uncertain, make sure to first read the Start Here Guide to determine if this page applies to you.

- Are you an undergraduate student on a F-1 Visa who had no work-study, no on-campus job, and earned absolutely no money in the United States?

- Are you a J-1 Exchange Visitor who came on a research trip that was entirely funded by your home institution outside the U.S.?

- In any case, if you have absolutely no U.S.-Sourced income whatsoever, then this is the guide for you.

The Reason You Must File

You might be wondering, “If I’m only in the U.S. temporarily and I didn’t earn any money, why do I need to file a tax form?” The reason is simple: you need to officially declare that you are an exempt individual to be considered a nonresident alien for tax purposes.

The phrase "exempt individual" in Form 8843 does not mean you are exempt from tax. It specifically means exempt individual under the context of the Substantial Presence Test, which is used to determine whether you are a resident alien or not. The reason you are not paying any taxes, is because you did not earn any money (in the U.S.).

In the U.S., resident aliens (like U.S. citizens) are taxed on their worldwide income—including any earnings from jobs, businesses, or investments abroad. If you don’t file, you risk being classified as a resident alien, which could mean paying taxes on income you earned outside the U.S., even if you never brought that money here. Filing this simple form ensures you stay exempt for the purpose of the Substantial Presence Test, and that the days you spend in the U.S. does not accrue towards the threshold.

As a student on an F-1 visa, you are considered an exempt individual for up to 5 years of study - but you must file a Form 8843 every year in order to declare your exempt status. The instructions for Form 8843 states clearly that:

Penalty for Not Filing Form 8843

If you don’t file Form 8843 on time, you may not exclude the days you were

present in the United States as a professional athlete or because of a medical condition or medical problem that arose while you were in the United States. Failure to exclude days of presence in the United States could result in your being considered a U.S. resident under the substantial presence test.

As an international student, your journey in the U.S. is just beginning. You might complete your four years of study and simply return home, or stay for additional years – whether on OPT, or attend graduate school, or get sponsored for an H-1B. You want to make sure to declare your exempt status from the start, so your tax situation doesn't blow up and become a mess in the future. So you must file your taxes.

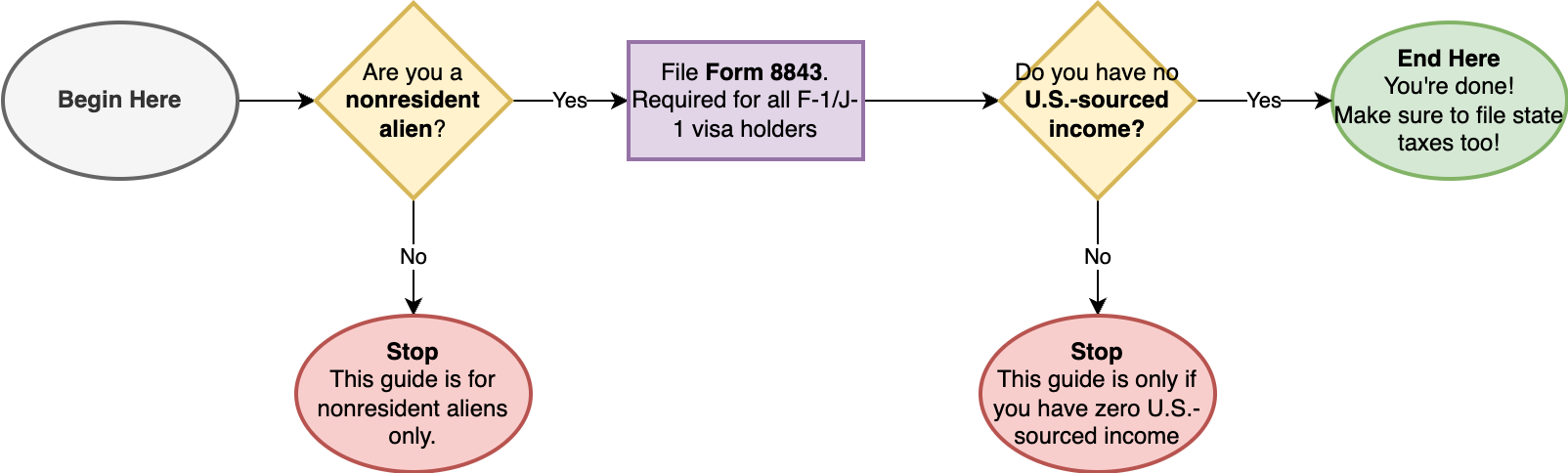

The Flowchart

But don't worry. Since you haven't earned any income, the process of filing is very simple. Every one of my guides have a flowchart. Some flowcharts can be quite long. This guide isn't one of those cases. All you need to do is to file one form. And I'm going to walk you through the process, step by step.

Walk-through of Form 8843

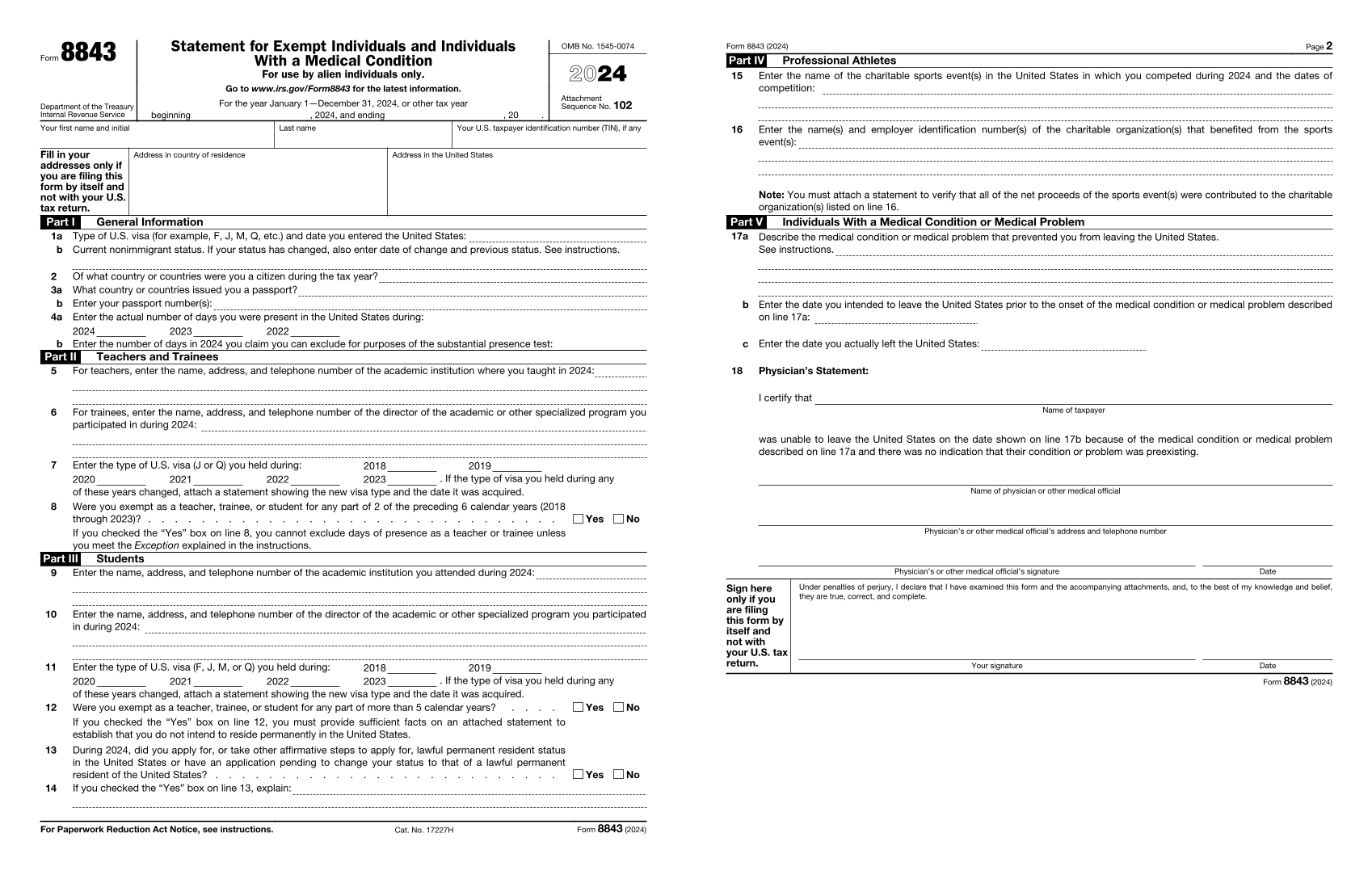

Form 8843 Statement for Exempt Individuals and Individuals with a Medical Condition

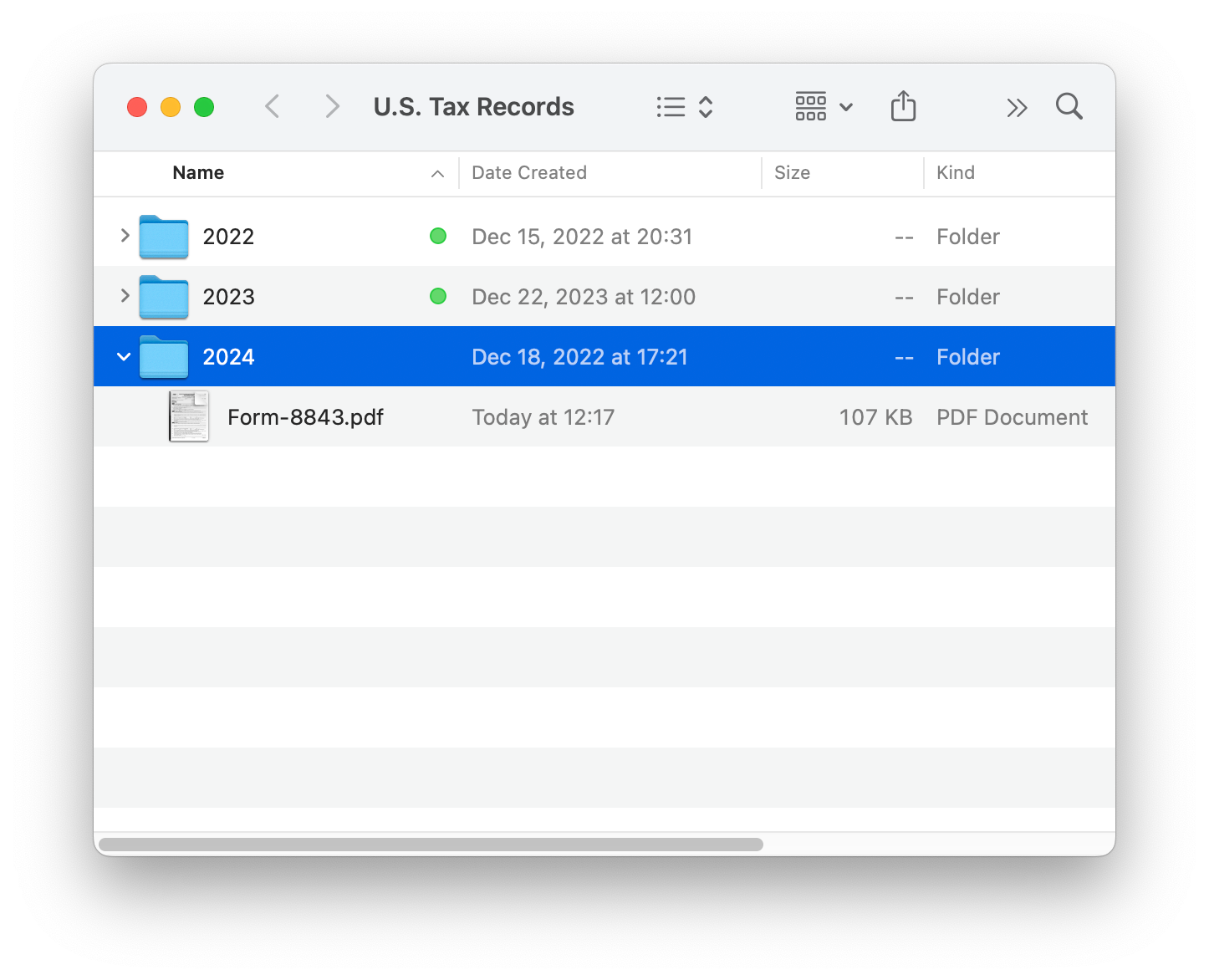

Download the PDF version of Form 8843 from the IRS website. The link is in the info-box above. Make sure to save it somewhere safe, because we will be filling it out electronically. I like creating a folder called "U.S. Tax Records," where I organize my files by year:

Open it. Let's take a look, together.

First, take a deep breath. Don't panic. You will not have to fill out all those lines. Filing a Form 8843 requires only three things:

- Part I: General Information

You need to fill out your basic details, such as your address, your passport data, and your visa status. - Part III: Students

Here you fill in details about your school. - Signature and Date

A tax return is only valid if it has your signature. Remember to write the date in the American format, which ismonth/day/year!

That's it. The rest of the sections do not apply to you. (Unless you are J-1 Teacher or Trainee, in which case fill out Part II instead of Part III). Are you ready? Let's go through it together.

Part I: General Information

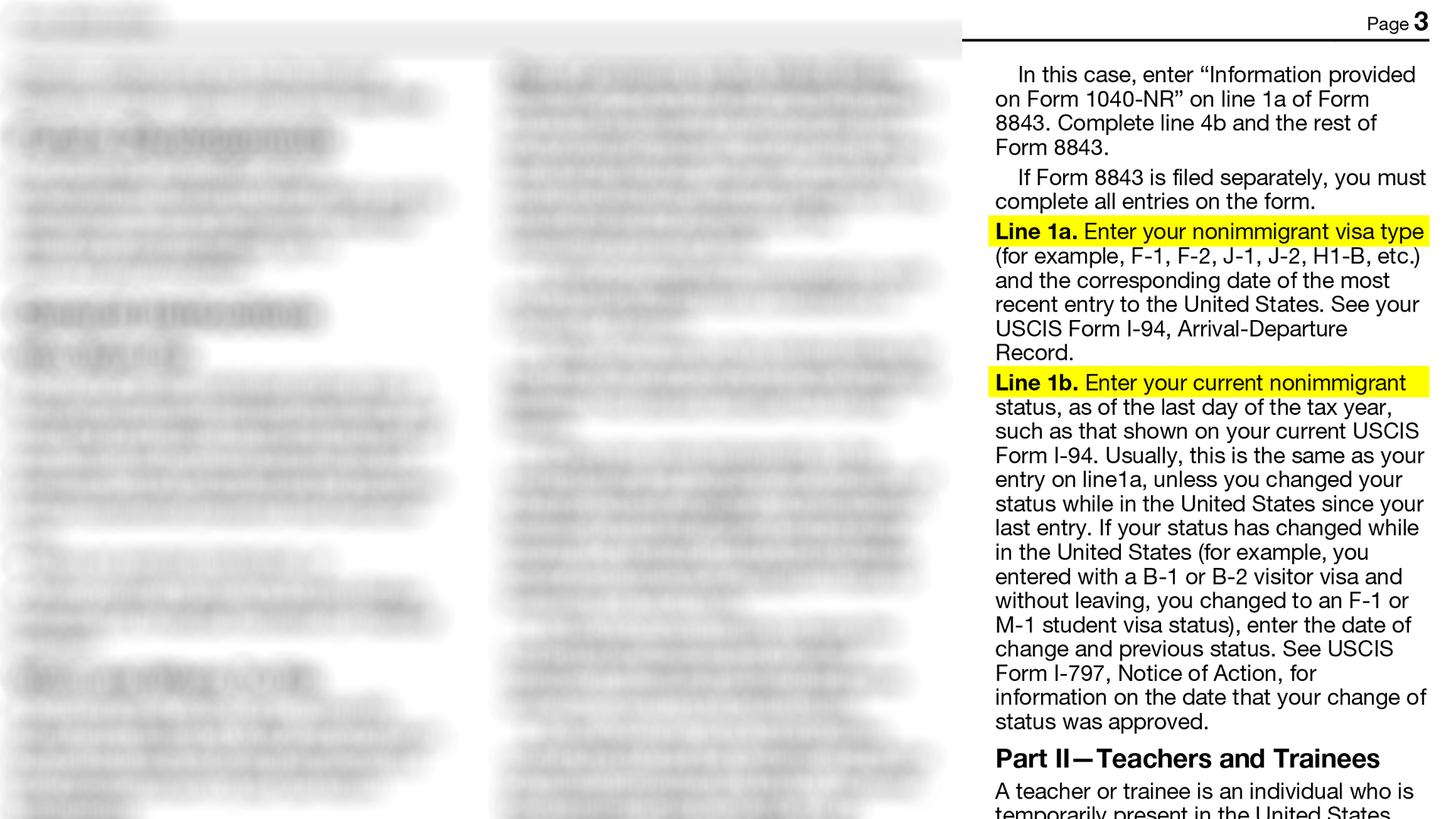

This section is relatively self-explanatory. If you are new to filing IRS Tax Forms, the first thing that you should know is that every IRS Form has comprehensive line-by-line instructions at the back. For example, the instructions for Line 1a and 1b can be found on page 3. So be sure to check them out:

Helpful Way to Find Number of Days Present for Line 4a

If you're an undergraduate student, you’ll likely need to fill out Form 8843 for up to five years, and keeping track of all your days in the U.S. can get tricky. Here’s a pro tip: the easiest way to get an official record of your travel history is through the I-94 website from U.S. Customs and Border Protection.

Your Form I-94 is your official arrival/departure record, generated from airport entry data—it’s as reliable as the entry stamp in your passport. On the I-94 website, click "View Travel History" and enter your passport number. This will pull up a list of all your U.S. entry and exit dates.

To calculate the number of days you were present, simply enter your arrival and departure dates into an online date duration calculator (I personally use this one), and you'll get the total number of days. I also put my dates in an Excel spreadsheet, but then again – I'm the sort of nerd who writes a whole blog on U.S. tax filing, so that might be just me.

Line 4b: Number of Days to Exclude for Substantial Presence Test

Finally, you'll want to enter the number of days to exclude, for the purpose of the Substantial Presence Test (STP). If you want more information on what that means, feel free to revisit the section on the STP in the Start Here Guide. But essentially, as a student on an F-1 visa, you can exclude 5 calendar years. For an undergraduate student that is visiting the U.S. for the first time, line 4b will basically be all the days of the tax year that you're filing for.

Are you a visiting teacher or professor on a J-1 visa? The number of exempt years for the Substantial Presence Test will be different for you. You see see the IRS Article Exempt Individuals: Teachers and Trainees for guidance.

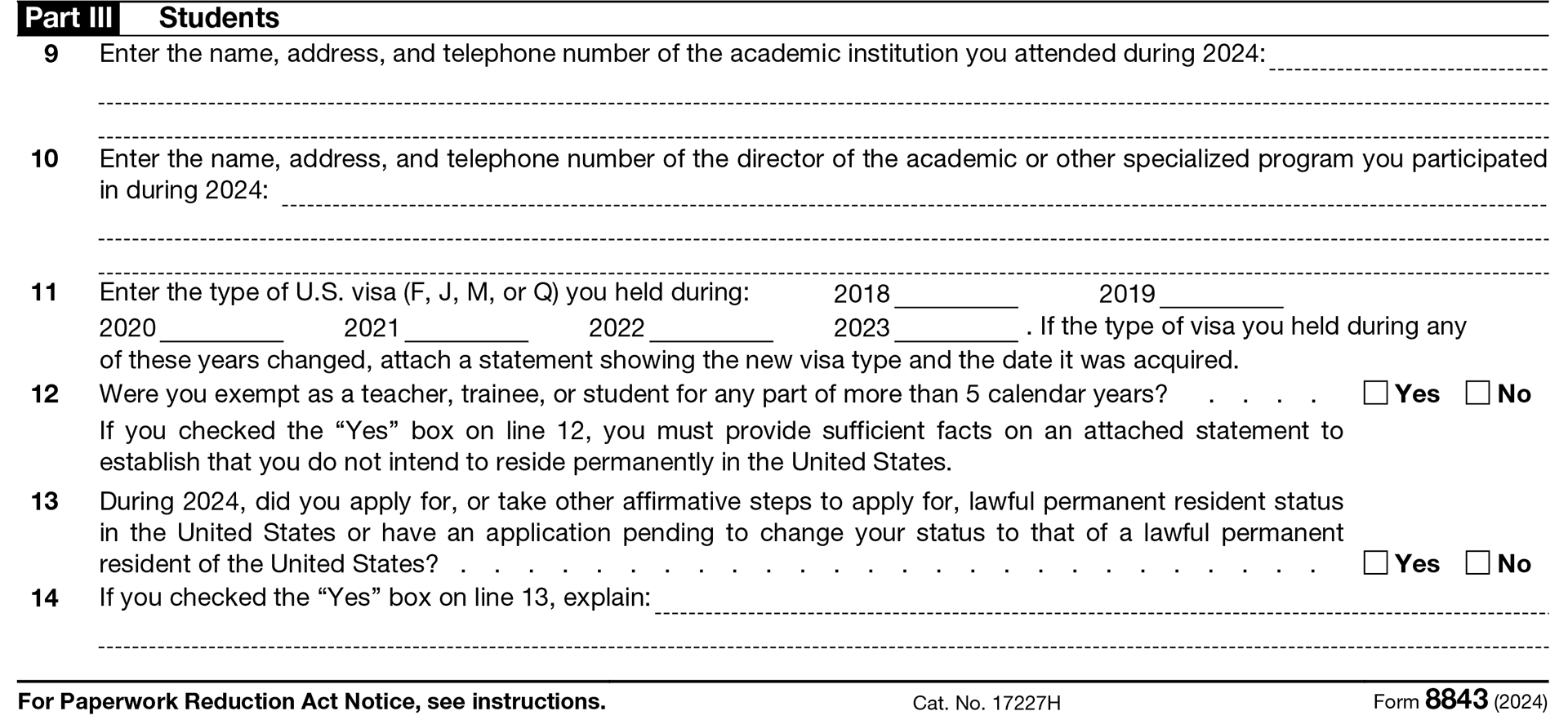

Part III: Students

You're almost done. Complete Part III with your university's information. It is quite self-explanatory as well.

For Line 9 and 10, I generally put in the contact information from my Form I-20 (which is issued by your university) but you can also simply go to the website of your university and look up their contact details as well.

Signature

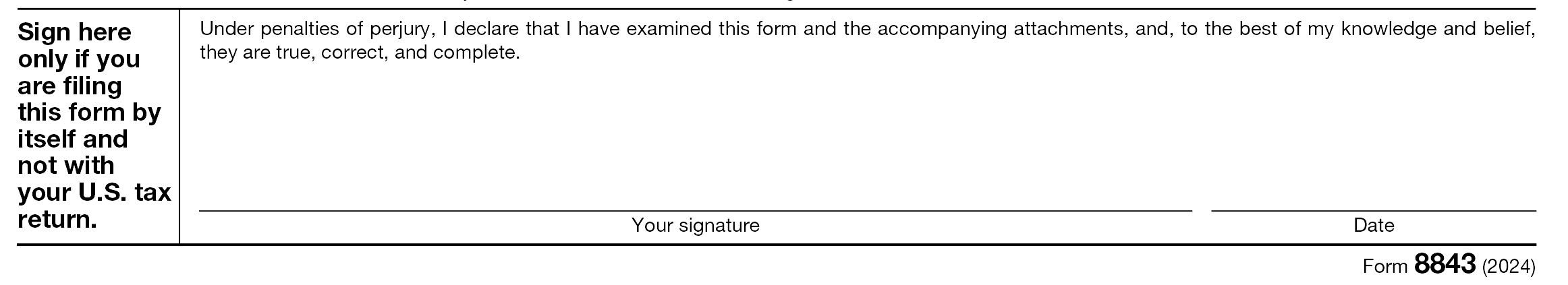

Now, flip to the last page and go straight to the bottom. You can skip Part IV—it’s only for professional athletes. You also don’t need a doctor’s note for Part V. This section exists because one reason someone might qualify as an exempt individual is if they planned to leave the U.S. but were unable to due to a serious illness. That’s why it’s there—but it doesn’t apply to most students.

Simply sign and date the form. Remember to use the American format for dates, it is mm/dd/yyyy. If you are filling the form electronically, all you need to do is to print it.

Congratulations. You're done!

Please share collegetaxguide.org with your friends! This guide is a passion project, and I want to help out as many international students as possible. Share this post with your friends, or your campus group-chat!

How to Send Form 8843 to the IRS

Now, here’s the tricky part. The U.S. tax system is outdated, and there’s no simple way to electronically file (or e-file) Form 8843 directly with the IRS. Most Americans can only e-file through paid tax software or by hiring a tax preparer. In fact, tax software companies have lobbied hard to keep things this way because they profit from acting as middlemen.

Things are slowly improving—the IRS recently introduced Direct File, a free e-filing program currently available in 25 states. Unfortunately, it doesn’t yet support Form 8843. Even many commercial tax programs don’t work with the forms international students need to file. The situation is quite unfair, and indeed one of the reasons I created collegetaxguide.org is to help us avoid expensive intermediaries.

So, for now, we’ll do it the old-fashioned way: by mailing Form 8843.

How to Send a Physical Letter in the Mail

Now, call me a Zoomer, but I've actually never used the post before coming to the United States. And because I'm a mid-wit, every year I forget how to address an envelope, and I have to look it up. So to save us both the shameful annual Google-search, here's a hastily made mock-up of how to address an envelope, by Yours Truly. I know for sure that this time next year, I'd be going back to my own post just to figure it out again...

You'll need to make sure to look for the address on the back of Form 8843. The address changes every year, so I cannot write it here, as it may become out of date in the future.

Pro-tip: don't know where to get an envelope? Every year, I ask the kind secretary at my University's Student Services office for an envelope, and they were always happy to give me one for free.

Make sure to add a stamp to it (you only need one, if you are sending only Form 8843), and drop it off in the nearest USPS mailbox. You're done. Congratulations on filing your taxes!

A Word of Thanks

If you’ve ever searched “How do I file a Form 1040-NR?”, you’ve probably come across websites from tax firms or software companies that offer vague, low-quality information—only to end with a pitch like, "Taxes are complicated. Hire us!"

The College Tax Guide is not one of those websites.

I firmly believe that with patience and the right information, anyone can prepare their own taxes. And as international students, we should empower each other with knowledge— living away from home is hard enough as it is. So if you found this guide helpful, please share it with your fellow students, researchers, and scholars (whether international or not!)

So instead of a sales pitch, here’s a word of thanks—to you, the international student, researcher, or scholar. Thank you for reading my guide. Thank you for your time and attention.

Taxes can be complicated. But you are capable. You are resourceful. You’ve got this.